I recently realised, to my horror, that pension fund and retirement annuity providers are winning at consumer education. With my first job came an onslaught of pension fund providers vying to communicate with my broke ass. I didn’t know how to budget, how to manage my debt, how to navigate myself out of a brown paper bag, but did I know who to call about retirement.

Unfortunately, in the process of educating consumers to sell retirement annuities, providers fail to connect retirement savings with other aspects of financial life. The tax implications can be especially worrisome. Understanding taxes in relation to retirement savings is an important piece of the asset allocation puzzle in a broader portfolio.

This week we received two excellent questions about retirement savings and taxes. Organisations like Gradidge-Mahura Investments are devoted to helping people figure out how to navigate this tricky terrain as part of a larger wealth management strategy. We asked co-founder Craig Gradidge to answer two questions.

Firstly, what is the most tax efficient way to treat your retirement savings when you change jobs? Secondly, what does it mean to get a 27.5% tax rebate on retirement savings? Craig drops knowledge bombs all over this episode.

Thanks to Petrus Booysens and Tim Milner for your excellent questions. Remember, The Fat Wallet Show is about learning. If you have a question about money or investments, no matter how simple, send it to us at ask@justonelap.com.

Finally, at the beginning of the episode I allow myself a little indulgence by talking about one of my favourite Johannesburg hangouts, The Orbit. You can find out more about that here.

Erik Thiart sent a question that I’ve subconsciously been avoiding on this podcast. He wanted to know what the deal is with my debt story. I talk about paying back my debt often, but I’ve never really gone into how I got into debt in the first place. If I’m perfectly honest, it’s because it serves as a reminder of what a total moron I can be. It makes me look bad and I don’t want people to know about it.

This week I come clean. I explain how I got to owing R100 000 on a R10 500 salary in the blink of an eye. After unburdening myself, we discuss possible scenarios where debt could be helpful. We discuss how store accounts are trying to lure you in, how credit cards allow you to arbitrage the bank, buying a car and (oh goodness, why?) home loans.

I mention Jason Pieterse’s fantastic email in this episode. I published that mail here.

If you love us, please go tell iTunes here. It helps other people find us.

If you have questions or comments, feel free to send them to ask@justonelap.com.

When I finally paid off my debt three years ago, I was in the perfect position to start building wealth. It took two stark years to get out of a very dark place of my own making. No salon visits, no new clothes and a helluva lot of peanut butter later had me looking a little furry, but I felt good about myself.

Paying back all that debt made saving easier. I was already used to running a tight ship and sending my money to financial instruments. Six months after paying back the last of my debt I had saved enough for an emergency fund and my first lump sum investment.

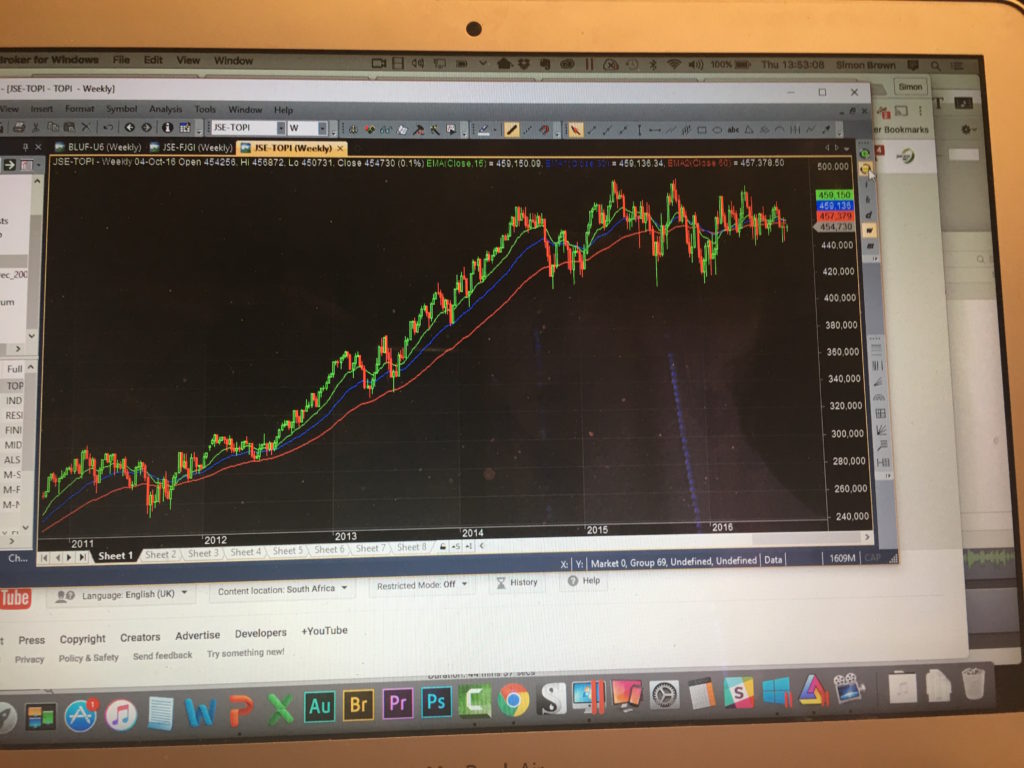

I understood why I had to invest. I understood compounding, wealth creation, setting goals and the 4% rule. What I didn’t anticipate, however, was that my investments would flatline for two-and-a-half years. The drama with Deutsche Bank over the past three weeks gave me pause. Many Just One Lap users have been asking us what to do about their x-trackers. Since my entire tax-free allocation for the past two years has gone into DBXWD, this hits very close to home.

My investment portfolio has never really done much, and that never really bothered me much. However, this week I also got my monthly Capitec interest SMS. Over a one-year period, my emergency fund has earned me nearly R5 000 in interest, while my investment portfolio is actually worth less. Over a two-year period, I would have been better off sitting on a hunk of cash.

- How not to time the market. What the JSE Top 40 has done since I started investing.

In this episode of The Fat Wallet Show I turn to Simon for a much-needed pep talk. Yes, I understand the principles of investing. Yes, I know historically speaking the market always recovers. However, the market hasn’t really been kind to me. I want it to show me the money, not take the money.

I’m not planning on doing anything differently for the moment, but I’m ready to see some upside. Pronto, please.

I’m a big believer in having an emergency fund that will cover my expenses for at least three months. I don’t want too much cash sitting around doing nothing, but I also want to avoid cashing out investments to cover emergencies.

My emergency fund creates an interesting dynamic in my personal finances. Because I have cash available, I think differently about warranties and insurance products. My 2008 Huyndai Atos, for example, is currently insured for R25 000. I have that amount available in cash. At what point does it become uneconomical to pay insurance? If something happens to my car, having access to the additional R25 000 probably wouldn’t hurt. Would it be better and would I be able to save that much before I need it?

Quinton Hoffman is facing a similar problem. He sent us this question:

Should I bother with extended warranties and service plans or should I use a emergency savings account? Which method gives me better value?

In this episode of The Fat Wallet Show, Simon and I talk about how to work out when a financial protection product becomes unviable.

Home calculator

The calculator I mention in the podcast can be found on rollingalpha.com. It’s a great toy!

I’ve been memed! Our friend Stealthy Wealth was on point with this one.

At a recent @JustOneLap podcast... pic.twitter.com/mv32ubuQb7

Prepaid and contract

Ourmoney.co.za wrote a great article about finding the most economical airtime solution. Check it out here.

Shoes!

My irresponsible behaviour inspired The Disruptors to write an article about shoes. I’m flattered and honoured. Speaking of disruptors: I get so many emails from guys, but I hardly ever hear from women. Where my girls at? Drop me your questions at ask@justonelap.com.

This podcast forces me to do an annoying amount of personal growth. This week I had to work out what I disliked more: being wrong or being irrational.

My early 20s was a haze of red wine and shopping on credit. In three short years I managed to rack up debt ten times my monthly income. If you’ve ever had debt you couldn’t honour, you know how terrifying that is. When I finally worked up the courage to tackle my debt, I developed a strong aversion to big corporations taking my money.

Cancelling my cell phone contract was one of the first things I did. Getting a new phone every two years was part of my consumer mindset. Naturally I didn’t want a manky-ass entry level phone either. Top of the range, baby, or nothing. What a moron I was.

Cancelling the contract saved me a huge amount of money. At the time I kept my airtime to a minimum and I started holding on to my phones and replacing them with second hand phones when needed. It was an important part of developing the financial discipline I needed to get out of debt.

It’s been three years since I settled my final debt. I stayed on prepaid, when along came Petrus Booyens, who apparently thought it was a good idea to ruin my life.* His calculations indicated it was more cost effective to get a contract to buy a new phone. “Surely not,” I thought right away. “If this is true, I’ve been wrong for a very long time, and that totes doesn’t sound like me.” Ha!

This podcast is me eating a huge serving of humble pie. Here are some of the incorrect assumptions I made about being on prepaid:

- While I only budget R300 a month on airtime, in reality I spend on average R553 per month.

- I remember the cost per minute being much lower on prepaid than contract when I researched this long ago. That either was never true, or it stopped being true since then.

Over a two-year period, I spend R29 178 on my phone. The three Vodacom contracts I looked at worked out to R27 816, R29 256 and R21 096 respectively. Only one contract is more expensive by R87, and that contract has 700 minutes of talk time, vs the roughly 200 I get in a month. Dogdarnit, Petrus. What did you do?

I hope I made a mistake somewhere and I’m wrong about being wrong about this. If I am, let me know at ask@justonelap.com.

Please also let me know what you think would happen if all the world suddenly paid off its debt. I’ve been obsessing over that question for nearly two weeks now. Drop some knowledge!

*I’m being hyperbolic for dramatic effect, Petrus. I’m actually very grateful that you wrote us.

WARNING: This episode contains some insipid moralising. Vomiting might ensue.

Please allow me a moment to be a little philosophical. It’s my birthday week. This can be your gift to me. Last week I featured the NewFunds NewSA ETF. It’s an ETF that invests in companies based on their empowerment ratings. As our bestie Nerina Visser points out in the article, the ETF has a few glitches. It’s over exposed to the local market, because locally-listed international companies aren’t required to be BBBEE compliant. The weighting methodology leads to problematic exposures. All things considered, it’s not the best investment choice.

However, it gives me the feels. I want to live in a country where the workforce reflects the demographics. It means 51% of the workforce would be women. You can guess why I care about that one. Black South Africans would make up 80% of every team. This really matters to me. Should my investments reflect that, even if it’s not the most rational financial choice?

I’d love your thoughts on this. Are you an ethical investor? Tell us at ask@justonelap.com.

Then, finally, we get to some questions we received after our retirement podcast. We consider two questions in this episode:

- If you only had R30 000 per year, should you put it in a tax-free account or a retirement annuity?

- Should you consider in-house products that don’t offer a tax benefit if the fees are really low?

If you love us, please tell iTunes.

Fat Wallet listener Kennith Brand asked us to unpack the advantages and disadvantages of endowments. In this podcast, Simon and I try to wrap our heads around what these products are, why they’re offered by insurance companies and whether you should be putting your money in them. Regular listeners will be unsurprised to find that we end up in ETF territory without trying very hard.

I can see a world where endowments would be useful. If you struggle to keep your hands off your savings or investments, endowments could become a savings vehicle. However, opting for an expensive product with little transparency might not be the best way to address this issue.

I am a firm believer that your financial house should be in order before you start investing. You can’t grow your capital if you still have debt. You should have a financial fail-safe in place in case you become injured or disabled. You should have an emergency fund so you don’t have to sell your ETFs when you need money. Putting all of these things in place should help you develop the financial discipline you need to save towards a goal and to invest without needing to sell your investments.

Simon totally stole my thunder by doing a presentation on the basics of wealth creation like a boss, which is good, because he is my boss. I highly recommend you spend the hour.

It’s really great to be part of a community - especially when it’s a community of excellent individuals. While many didn’t love what we had to say in our homeownership podcast, almost all of the feedback was of the intelligent allow-me-to-disagree variety. There wasn’t even a light shanking. I am grateful. We should all hang out.

In this episode we go through all the counter-arguments and feedback. We also answer questions about shorter payback periods and cash purchases. The biggest criticism was failing to account for rental escalation and the inclusion of structural insurance in levies. Many people also pointed out that the situation would look very different if you paid your bond off over a shorter period. These are all excellent points, which I concede.

For all the comments and calculations go here.

Kristia

Until now, most episodes of The Fat Wallet dealt with investment concepts. When it comes to money, however, smaller personal finance choices can arguably have a much more profound impact on your financial well-being. We address this often when we talk about keeping your lifestyle costs in check.

A concept as simple as “value for money” can be immensely complex, as we discover in this episode. When you have all the information to quantify value in terms of price per unit or use, you can make an informed decision pretty easily. The trouble is, when it comes to consumer goods there’s a huge incentive not to make all the information available. Add to that the amount of options available to consumers and you soon find yourself paralysed by indecision in a straightener isle on voting day. I know this pain.

In this episode I rally the forces. Simon Brown, Petri Redelinghuys and Dineo Tsamela all pitch in to help me figure out how to quantify value when you don’t have all the information. While all of us have excellent ideas, I’m afraid there’s once again no tidy answer. This is probably the most frustrating thing about money - tidy answers are few and far between.

That, by the way, is also why we don’t check our language in this show. Money is a bastard. It ruins lives, it causes divorce, it drives people to do crazy things. Corporates have to gloss over the very messy, dangerous underbelly of money to sell you products that make you feel safe. As consumers of those products, we feel everything but safe and comfortable in the world of money. We hope having frank, messy conversations about money helps you to do the same.

Kris

We spend a lot of time at listening to debates on whether low-cost index investing is better than paying someone to manage your money. During these debates, there’s invariably a chart that compares the performance of a fund against an index. The problem is that fund returns aren’t always represented in the same way. Sometimes the reported returns are annualised, sometimes since fund inception. Sometimes costs and performance fees are deducted, sometimes not.

Interpreting fund returns is as important for investors considering a fund as it is for index investors looking to gloat over how little their investments are costing them. In this episode of The Fat Wallet Show, Simon and I try our best to park our predilection for index investing and throw a bone to our friends in the active space. I pick Simon’s brain to find the best way to interpret active management fact sheets. Unsurprisingly we both end up gushing over index investments. We tried, though.

Kris

Are share buybacks an indication that a company is trading on the cheap, or a sure sign that management has run out of good business ideas?

In this episode of The Fat Wallet Show, I try to figure out how share buybacks affect investors. From time to time, a company will buy and destroy some of its own shares. While the reduction in shares theoretically reduces the amount of claims on dividends, is this type of corporate action really in the best interest of shareholders?

I’m surprised to learn that share buybacks happen on the open market at market value. Doesn’t that indicate that a company is trading below its net asset value? Wouldn’t that be my cue to jump in and grab shares at a reduced price? Simon isn’t convinced.

I think it comes down to a bigger question: Why did I buy this share to begin with? If I hold a share because I understand the business, believe in its ability to make money in the future and think the management team know what they’re about, the buyback might be an opportunity for me to pick up some more. If I hold the share as part of a momentum portfolio, on the other hand, I might see the buyback as an uninspired use of free cash. The moral: know thy companies.

Given our political history, it’s hardly surprising that South Africans take homeownership very seriously. Many young South Africans will be the first homeowners in their family. Like so many financial decisions, homeownership is emotionally charged. However, once you start running the numbers it’s difficult to make a financial case for buying a home.

In this episode of The Fat Wallet Show Simon and I open ourselves up to a world of outrage by doing the maths. We are unsurprised to find that owning a home is an exercise that has more to do with the feels than economics.

It is, of course, perfectly acceptable to buy a home for emotional reasons. If it makes you feel safe and happy to own your place, why shouldn’t you? We do encourage you to go through a similar process we went through in this episode before you commit to buying, though. Understanding the full financial impact of your decisions is a really big part of responsible adulting.

Below is a list of the factors we included in the price of buying a home. I assumed structural insurance is always part of the deal, but Simon pointed out that it might be included in levies. The insurance number was a thumb-suck based on what Simon, the homeowner, currently pays, with allowances made for smaller excess amounts. Before you start this calculation, phone your current insurer for a quote to get a more accurate number and confirm whether structural insurance is included in your levy.

- Home price

- Initiation fee: The fee your bank charges just to open a home loan account

- Interest rate

- Pay-off period

- Levies

- Rates and taxes

- Maintenance: Either 1% rule, or R1 per square metre, which seems very low.

- Insurance

- Transfer duty

- Conveyance cost

You are welcome to send your abuse or follow-up questions to ask@justonelap.com.

Ten whole episodes, and not a single rock thrown at us! I’m surprised and delighted. This week we kick off with quite a bit of feedback on previous endeavours. Thanks for taking the time to write us. I’m even grateful to George, who came to Magnus’ defence after last week’s episode. There’s enough space on The Fat Wallet Show for all views*.

If you’re wondering why we’re talking bonds again, it’s because we recently fell into the trap of People Who Know Things. When I’m around Simon, there’s often a very good case to be made for I’m with stupid t-shirts. Because he knows so much more than I do, I’m forever reaching for new levels of understanding. In a previous episode on bonds, I forgot to mention where I’m reaching from. I already had some information and I assumed everyone knew what I was talking about. The intent always was to talk about what bonds are and how they work, but I got excited and ended up doing exactly what The Fat Wallet tries to combat.

@kristiavh I still dont understand bonds. Never even heard of corporate bonds. What difference between that and a share?

— Charmaine (@charmaine59) July 21, 2016

Thankfully I had our friend Charmaine to keep me honest. Her tweet made me realise that I missed the mark on the bonds episode, so I’m having another go at it in this one. Charmaine, I apologise for being an

If you’re wondering why we’re talking bonds again, it’s because we recently fell into the trap of People Who Know Things. When I’m around Simon, there’s often a very good case to be made for I’m with stupid t-shirts. Because he knows so much more than I do, I’m forever reaching for new levels of understanding. In a previous episode on bonds, I forgot to mention where I’m reaching from. I already had some information and I assumed everyone knew what I was talking about. The intent always was to talk about what bonds are and how they work, but I got excited and ended up doing exactly what The Fat Wallet tries to combat.

@kristiavh I still dont understand bonds. Never even heard of corporate bonds. What difference between that and a share?

— Charmaine (@charmaine59) July 21, 2016

Thankfully I had our friend Charmaine to keep me honest. Her tweet made me realise that I missed the mark on the bonds episode, so I’m having another go at it in this one. Charmaine, I apologise for being an arrogant asshat who assumes people know things by magic. I hope this episode clears the whole thing up. I will continue to count on you to remind me what this is all about - access to information everybody can understand.

This is a gentle reminder that anything worth doing is also worth swearing about. If you are offended by swearing, The Fat Wallet Show might not be for you.

*Unless the views are racist, sexist, bigoted, full of logical fallacies or generally stupid, which George’s was not.

who assumes people know things by magic. I hope this episode clears the whole thing up. I will continue to count on you to remind me what this is all about - access to information everybody can understand.

This is a gentle reminder that anything worth doing is also worth swearing about. If you are offended by swearing, The Fat Wallet Show might not be for you.

*Unless the views are racist, sexist, bigoted, full of logical fallacies or generally stupid, which George’s was not.

Let’s start this week with a slow clap for Magnus Heystek. In a single article, he managed to troll an entire industry. Well done, sir. You got me.

I’m a huge ETF nerd. I love thinking and writing about and investing in them. I love them, because I understand them. That is not something I can say for many financial products. I believe ETFs are the easiest, safest, cheapest way for me to grow my capital. Once I got over my initial outrage, however, I remembered the point is exactly to grow capital. If there’s a chance that ETFs aren’t the best way to do that, I want to know sooner rather than later.

Stephen King advises writers to kill their babies. If your witticism doesn’t fit anywhere, the only solution is to throw it out. That approach, I believe, is a very healthy (albeit uncomfortable) way to live. Am I holding on to an idea too tightly? Am I becoming inflexible and closed off to alternatives? I’m grateful to opposing points of view, because getting angry and uncomfortable is a good indication that I need to check my ego at the door and revisit the facts.

In this episode, I try to kill ETFs. I have to keep reminding myself that I am not a crusader for a particular style of investing. If ETFs turn out not to be the best option, fuck ‘em. I’m here to grow capital so I can retire early, move to a beach and dance the salsa all day. Whatever gets me there is what I’m going to do.

Kristia

The Fat Wallet Show is a weekly humble pie eating contest (on iTunes, for all the world to witness, as of this week).

For about the first six months after joining Just One Lap, I left every meeting with a list of things to Google. Half a year in, I finally knew enough to start asking questions. However, nobody around me ever asked a question. I realised that either the expert-to-novice ratio was skewed and I was literally the only person who didn’t know what was going on, or someone was bullshitting.

The Fat Wallet Show is a direct result of the process of owning my ignorance. Since I’ve already claimed the Village Idiot title, I’m no longer shy to ask smart people to explain things to me. They already know how little I know. Once I started unabashedly owning my stupidity, the rate at which I learned things increased dramatically. Yes, sometimes I ask stupid questions, but once in a while I ask a really good question, and I’m proud of that.

This week, something really cool happened. I was reading through a report we got at the CoreShares ETF Exchange and noticed something I didn’t understand. This did not shock me. I went through my usual process, which means I asked Simon. He didn’t know. So I asked the three ETF geniuses, Helena, Candice and Nerina (*whistle*). They didn’t know. Then I asked my smartest friend, who drove over to my house so she could draw pictures. Only, she couldn’t figure it out either. It turns out an important piece of data was missing and nobody knew what was going on.

This excites me, because the financial services industry as we know it today came about in a time before fintech and, you know, cars that weren’t attached to horses. Like all new things, it didn’t start out effective and efficient. It remains a work in progress, a living thing that exists for our benefit. A simple question like, “Why is it like this?” naturally leads to, “Is there a better way to do this?” That question, hopefully, leads to improvements that can benefit the human race, not just some dude in a suit.*

Information is such a powerful tool. To get it, though, you have to plant your feet firmly in what you don’t know. This week, I tell this story, which you now have to go through twice. I apologise. Then I talk about bonds. If that’s what you’re here for, skip to the end.

By the way, ETF geniuses, where my retail bond ETF at? Gimme it.

I mention our friend Daniele in the podcast. You can follow him here.

*I’m actually a big fan of dudes in suits. Especially well-made suits that fit just right. Please don’t stop wearing them. You look fantastic.

At Just One Lap, we don’t shy away from financial products. If it exists, odds are you can find it in our archives. We do, however, have an Achilles heel. We don’t like talking about retirement annuities. Personally I have no qualms with them. I wasted the first decade of my earning life getting shafted by credit providers and poor decision-making, so I only started contributing to my RA in my 30s. By that time, 10X existed and I could settle comfortably into that delightfully cheap little nest. Simon wasn’t as lucky.

Retirement annuities are worth talking about. A few product providers are making an effort to contain fees to 1% of assets under management (AUM). While AUM is a bullshit concept, I like that they’re making an effort. 27.5% of my contribution is tax deductible, and can live in a double tax haven in my tax-free savings account. My retirement annuity also keeps the money out of my irrational little paws until I hopefully have some sense.

In this episode, Simon and I start off discussing the merits and limitations of retirement annuities. You can’t really talk about retirement without talking about lifestyle, so our conversation quickly veers into the dangerous realm of personal finances. How much should we be saving? That turns into how we should be living. Odds are you won’t like what we have to say. Perhaps you shouldn’t listen to this episode after all.

This discussion was prompted by a question we received on Facebook. Send your questions to ask@justonelap.com. It’s a judgment-free zone.

A completely risk-free investment is pretty much a unicorn. Even cash in the bank loses value over time as inflation rises. Hedging is a word obnoxious trader types use to describe investment strategies aimed at protecting your portfolio from losing money. Traders mostly hedge using derivative products, but I steer clear of the d-word as much as I can. Does that mean I can’t protect my portfolio from risk?

In this episode of The Fat Wallet Show, Simon and I try to figure out if there’s a space for hedging for a boring long-term index investor like me. Spoiler alert: There is.

Kristia

The more questions I ask about investing, the more questions I have. While talking derivatives last week, Simon mentioned arbitrage. It’s a term smart folks like to use a investment conferences. When they do, I nod and hope people can’t really smell fear.

In this episode I find out arbitrage is a lot like being Batman – all you really need is a ton of money and dead parents. I’m only half kidding. When a share is traded on more than one market, price differences creep in. Arbitrage is when you buy the cheaper share on one market and sell it at the higher price on the other market. I thought this sounded like a pretty awful way to earn a living, but it turns out computers can do it for you while you do things that are fun. Like be Batman.

This is a show about questions. Send yours to ask@justonelap.com.

Kris

PS - we still waiting on iTunes to approve our submission :(

Sometimes it seems like derivatives exist simply to vex me. I know, academically, that the world doesn’t revolve around me, but seriously derivatives: what the hell? In this episode of The Fat Wallet, I reach for that eureka moment. Then I stop reaching because injuries are a real risk.

I’ve been trying to get at derivatives for about four years. Brilliant Lauren Bodington from 28E Capital once spent what must have been a long, frustrating hour explaining the bare bones. I thought I was pretty smart after that conversation, but every time I add a single new fact, my tower of knowledge crumbles like this metaphor.

Here’s what I know: futures contracts are the easiest derivatives products to understand. They are contracts to buy something at a set price at a future date. Their slightly more nasty cousins are contracts for difference (CFDs). Those are bets on what the price of something is going to be at some future date. Warrants, options and swaps were on the list of things I wanted to talk about, but they are so ugly I didn’t even look at them. They’ll get their own episodes once I muster the energy.

For now, brace for impact.

I like to think about investment fees. A man in a clown suit can lure me into a panelled van with a cheap ETF. Over the last week or so, however, I’ve come to realise that an ETF’s price tag is only one part of a much bigger picture. Yes, Big Bad Industry, I realise this is common knowledge to you, but I’m a retail investor, remember? Until now nobody told me.

Following the now fabled conversations with Roland Rousseau – the unofficial mascot of The Fat Wallet Show – I’ve been paying much more attention to things like sectoral exposure and risk in ETFs. I enthusiastically share my findings on exposure the NewFunds GIVI in this Periscope.

I’m starting to discover cheapness is relative when it comes to ETFs. So far, I’ve been focusing on a combination of total expense ratio (TER) and brokerage fees. However, Roland mentioned churn in ETFs. I knew churn wasn’t part of the TER, but I had a sneaking suspicion that I was paying for it anyway.

In this episode, I talk to Simon about churn, we take a little trip to spread and finally end up at tracking error. I have to go back and back again a few times to wrap my head around it. I’m here to learn, so that’s okay.

I think every question deserves an answer. If you’ve been wondering about personal finance or investment concepts, drop your questions to ask@justonelap.com. I’ll try to help you find the answer.

Fund of funds with Keith Mclachlan

Fund of funds are the Russian nesting dolls of investment. When you strip away all the layers, are you left with fees or profit? In the second episode of The Fat Wallet Show, Simon and I bedevil industry boytjie* and small caps fund manager Keith Mclachlan about these products.

Keith reckons the collective investment scheme tax shuffle, institutional fee efficiency and access to products not ordinarily available to retail investors make funds of funds worthwhile. He has a point, until he starts talking about “fuzzy logic” (which, I’m pretty sure, is a type of washing machine setting) and how you have to trust the fund manager.

Is there a person in the world that I trust enough not to fleece me on fees and to make decisions that will benefit me and not him? Haha! Yeah, right.

There is a moment right in the middle when we all go really quiet to process everything. Not great radio-ing, I know, but sometimes the brain needs a while to catch up to the information. We recorded this episode at the JSE right before Keith did a very enlightening presentation on buying small caps. He talks about the process of selecting a good stock that will be valuable to any investor. It’s worth a watch here.

* I once called him something way worse in a poker game. I know he’ll forgive me.

What's with structured products?

Welcome to The Fat Wallet Show! It’s our maiden voyage, and we’re happy to have you on board. We’re excited to introduce uncertainty, irreverence and the subtle art of asking questions to your portfolio.

Phrases like, “I’m not sure” or, “Let me look that up and get back to you” or, “I don’t know” don’t exist in the financial services industry. If you ever had a financial question you were too embarrassed to ask, you know what we’re talking about. In this business, appearances matter, and nobody wants to seem like they don’t know how things work or what the outlook is for the buchu industry. It’s easy to excuse that little vanity, except that people in the investment industry are meant to service investors - people like you and me who need to figure out what to do with our money.

The Fat Wallet Show is a show about questions. It’s about admitting that we don’t know everything, but that we’re willing to learn. Most of all, it’s about understanding as much as we can to make us all better investors.

In this episode we discuss what structured products are and whether they’re something individual investors should be thinking about. We talk about people who are smarter than us, people who like to pretend they’re smarter than us, tulips and rich people. It’s a lot more fun than structured products have any right to be.

There’s no such thing as a stupid question in this show. If you have unanswered financial questions, this is your opportunity to have them answered in a way that even I can understand. Pop them to us at ask@justonelap.com.