Your first investment will scare you half to death. Don’t let anyone tell you different. We’ve all felt that terror (some of us more than once). We all came out the other end secure in the knowledge that we are now among the select few who Invest in the Market.

Hannes, a Just One Lap user, has been following Simon since before Just One Lap existed. He’s paid for a share trading account every month for the better part of a decade, and yet never managed to pull the trigger on that first investment.

In this episode we discuss the things we’re afraid of when we start investing and how to overcome those fears. Like Lesigisha pointed out last week, effective compounding depends more on time than money. This excellent Stealthy Wealth article illustrates that point very effectively.

Links

Frank was perplexed by this quote from a Moneyweb article, “Taxpayers may even include any capital gains that they are liable for in a particular year of assessment as part of the 27.5% tax deduction."

In this episode we explain how that works.

Chris is concerned about spreads in ETF products. As we explain in this episode, spread is the difference between the price people are willing to pay for a share and the price at which people are willing to sell. ETF prices are determined by market makers, not buyers and sellers like ordinary shares. Why then are the spreads so large?

His email is below.

I was intrigued by the discussions around the Lars Kroijer videos and your post "ETF: The whole world in your portfolio". This got me thinking about implementation of such a strategy and I started looking at TERs and spreads of local top 40 ETFs and the global ETFs as I will most likely opt for the cheapest products.

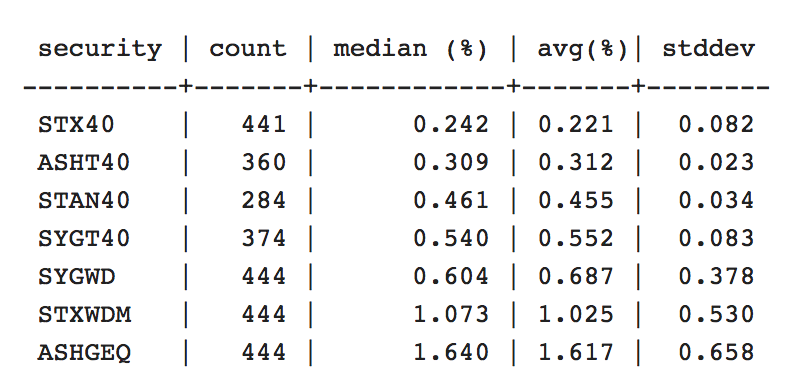

TERs are easily available and published by the product providers and some third party sites such as etfSA.co.za. But nobody ever talks about the spreads. I wrote a script to poll bid/ask prices every 5 minutes throughout the trading day and computed some statistics on them:

The count column is the number of samples taken, median is the median of unfiltered data, avg is the arithmetic mean after filtering for outliers and stddev is the standard deviation from the mean.

Because ETFs trade fairly infrequently compared to normal stocks, I think it is safe to assume the market makers participate in the majority of orders. Thus, the figures above should be a fairly accurate view of the spreads the market makers maintain.

Now I understand the spread is a once off "cost" that I pay, but look at those numbers. 1.6% on the Ashburton global and 1% on the Satrix world!

Kristia

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

For many South Africans, saving simply isn’t an option. Either they don’t earn enough to be able to save, or they have too many familial obligations to do so. In this episode we offer some tips on things you can start doing on a very low income to put yourself in a better financial position in the future. We also talk about some common traps high income earners fall into.

If you’re already too scared to listen, here’s what we talk about:

- Why insurance might be a better idea than an emergency fund.

- Why a low income is the best place to start preparing for a bright financial future.

- Why debt is not your friend.

- How cost per use or cost per unit can help you make better financial decisions.

- Why you shouldn’t avoid paying tax.

Our win of the week is Lesegisha, who is foregoing sushi in favour of education. As you’ll hear, his letter blows my mind in this episode. For that reason, I’m republishing it in full here.

I am a pious listener of The Fat Wallet Show and the proud contributor to Lewis dragging down our Fat Wallet Index. When I heard the topic of this week’s show I knew you guys were still sticking to what it says on the label and giving advice to the little guy on the street.

Thank you for that and it’ll pay dividends in future if not cheap wine.

I am a 26-year-old full-time postgraduate student (I’m lucky I know but here me out) living on R6000 a month.

This may sound like a lot for a student but bear in mind I have previously held a full time paying auditing job with plenty of travel perks and whatever bells and whistles that come with the occupation. So I have tasted the fruits of freedom and R6,000 in that context is worse than my life before I knew what sushi tastes like.

I've been studying the topic of investing, business and leadership since I was 15, reading Rich Dad Poor Dad and can say the easiest and biggest investments that one can make on a small paycheque is in their financial literacy.

The concept of pay yourself first cannot be overemphasised.

In my budget the first R300 goes towards everything finance and investing related. I split it R120 for my active share portfolio, R120 for my tax-free savings portfolio and R80 into a rolling emergency fund which I draw down to R80 after three months to invest the excess in my active portfolio and my tax-free savings. I’ve been with EasyEquities from the very beginning.

“Lost money” that I find in my jeans, birthday presents etc I take in cash or direct my friends and relatives to make deposits to these accounts.

I make sure that at least once a year the R300 buys me a decent book that can help me stay on course. My Best Buy and read so far was Fooled by Randomness by Nicolas Taleb and Security Analysis by Ben Graham (which costs the equivalent of six months' investing capital).

The reason I do this is to entrench the habits of having my money work for me while it’s in triple digits so that when I eventually break my glass ceiling the pressure isn’t there to learn habits that I had the opportunity to learn before lifestyle creep.

My biggest belief is that the size of my return will be materially disproportionate to my input not because I’m gambling, but because I take the time to learn as much as I can about the basics of money that you guys mention. I always look to put my money hard at work where it’ll earn me the biggest most predictable returns.

The law of compounding interest says, start early not start big.

The rest of the R5700 I survive on with the piece of mind of knowing that I have used the best part well and that there will always be someone who is surviving on waaaay less and not complaining.

But my key takeaway is that on a small paycheque education is your biggest investment and then pay your future self first. The rest is survival as we know it.

Kristia

For a moment there I got excited. I blame Peter Hood, who dangled the capital gains avoidance carrot dangerously close. Peter’s theory is elegant:

Use your capital gains allowance each year to offload your cheap ETF units at a profit and then buy them back at a higher price. Your cost per unit goes up over time, allowing you to pay less capital gains tax when you eventually cash in for real.

Unfortunately, traders ruin it for everyone. Regular (read, annual or more) transactions in your trading account lands your squarely in the investing-for-income category. Income, as in “income tax.” Yeah.

You may be able to hack it by having three different ETFs that you sell and rebuy on a rolling three-year period. That sounds like a lot of admin, but the tax saving might just make it worth it. I’m not often grateful that I have a growing portfolio (I was going to say “small”, but I like the more hopeful term), but this time it works in my favour. Unless my portfolio doubles twice over, I’m not even close to the profit exemption. I have time to figure this out.*

Links

Thanks to Christoff and Mukhtaar for sharing this link to the financial independence calculator. This tool will help you work out the most tax efficient way to invest your money. They sent this following the discussion we had about tax on a retirement annuity. Play around and share your insights with us.

Francois Louw shared this ShareNet article on Top 40 offshore earnings. It’s an awesome tool. ShareNet will publish an updated version this Thursday - this data is about a year old. Keep an eye out for that.

When we had the discussion on renting vs owning last year, many of you shared this Rolling Alpha calculator. Johan Uys discovered it last week and shared it with us. I’d forgotten how much fun it is.

Lastly, next week we’re doing an episode for people who earn very little. If you consider yourself a low income earner, send your concerns to ask@justonelap.com.

*Unless my ship comes in. I expect it any day now.

Following last week’s investment crisis episode, indices seem to be on everyone’s mind. We decided to dedicate this episode to all things index. Navi wanted to know which ETFs we’ll be investing in this year. The Ashburton 1200 looks very appealing for us both. Nobody saw this coming - least of all us.

Frank Denys made a case for ETNs that practically had us throwing our money at him. It’s a product I intend to learn more about. In the meantime, I strongly suggest you direct your ETN questions to our friend Nerina Visser from etfSA.co.za.

Tim is so into ETFs he’s been reading SENS announcements. He realised that he doesn’t know how the delisting and listing of additional securities work with ETF providers. He was worried that it might be an ominous sign, but we reassure him.

What is the best thing to do with your tax-free account when you are already retired? Jim is 76 and not sure if he should be keeping his allocation in cash or ETFs. We help him think through his decision.

Fernando thought he found a workaround for our single ETF strategy by investing in a passively-managed unit trust. We have some bad news for him that might land us in trouble.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.