When you’re just starting out on your investment journey, dividends seem like much ado about nothing. That’s because dividends get paid per share. If you don’t have many of those, dividend amounts can be laughably small. It’s hard to get excited about R25.

When you’re just starting out on your investment journey, dividends seem like much ado about nothing. That’s because dividends get paid per share. If you don’t have many of those, dividend amounts can be laughably small. It’s hard to get excited about R25.

However, long-time rich-ass shareholders will tell you dividends become way more fun the longer you invest. It’s a good idea to have your dividend strategy in place while you’re only getting a R25 twice a year. In this episode, we share some options for your dividends.

Sheldon from Twitter

When looking to invest in equity with the aim of receiving dividends. How much should the price action influence your decision? I.e. if price action is bearish/flat but the equity pays decent dividends, how does one ensure they don't lose money.

Morore from The Fat Wallet Community

What is the best strategy for reinvesting dividends within a TFSA? Do you reinvest in the ETF that paid out? Do you use the dividends to buy the cheapest ETF at the time within your portfolio? To keep the "right" balance, do you reinvest them in terms of your predetermined allocation strategy?

Caroline

I was using the strategies above, but then I decided to reinvest the dividends back into the ETFs that earned them to get a better idea of the ETFs overall performance.

Win of the week: Gerard has a tip on avoiding the huge spreads on EasyEquities.

On the Buy screen where you fill in the amount you want to buy, click on "What's been happening to STX40 in the market".

This will show you a graph, and three prices - Last Price, Selling At, Buying At. You want to make sure your Last Price and Buying At price are close together. If Buying At is much more expensive than Last Price, then odds are the Market Maker is offline, and you should rather come back later and try again.

EasyEquities is not a perfect system, but it is cheaper than most... just don't get burnt with this annoying thing.

Tash

I had an opportunity to work in Germany and have been here since 2012 on a temporary residence permit.

I'm on the compulsory pension system and have an RA to squeeze the tax man back. I plan to be here for the long run, but home is where the heart is and I would want to spend lots of time in South Africa when I retire.

I’ve opened a TFSA with EasyEquities in 2018, because we don't have such a wow savings initiative in Germany. Here the tax man does his best to grab deep into your wallet at every opportunity.

That said I want to have a long-term savings plan in South Africa. German interest rates are laughable and the savings plans are even worse. I listened to Simon's recent lecture at the JSE and one of the first things he explained about the TFSA is that you have to be a South African resident. The term “South African resident” is coming under scrutiny with the new emigration laws.

Will my TFSA be valid and inviolable if I remain a South African citizen, with a residential address ?

I maxed out my 2018 contribution and plan to do the same till I hit the R500,000 limit.

What implications are there for a TFSA if you spend most of your time outside South Africa and your main income is earned in Germany?

The Bank’s Cash Cow

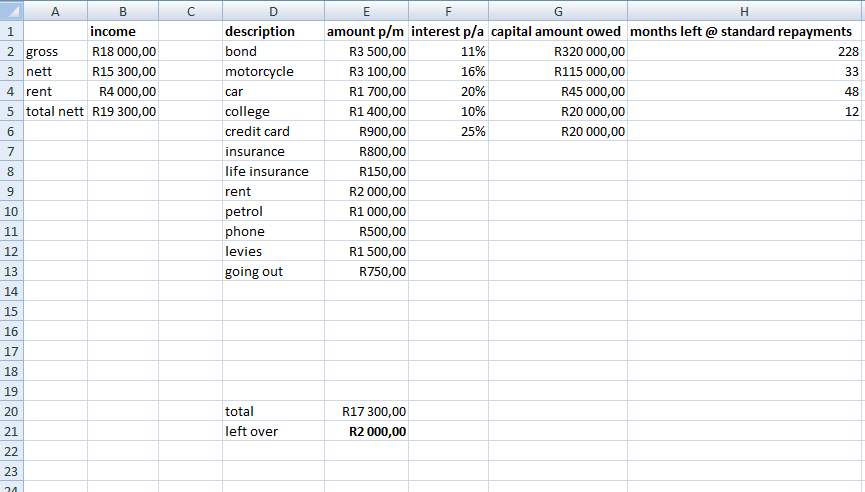

I’ve gotten myself into a debt hole, and it’s completely my own fault.

I'm trying to figure out which one I should pay off first, and if i should consider debt rescue.

I thought I should pay off credit card, then motorcycle, then college, then car.

Gerard

I watched a lot of Simon's trading videos in 2016. I wasn't planning on trading, just thought I might learn some stuff. Using Simon's Lazy System, I back-tested some of the things I hold, and the signals there are pretty clear for when to sell. It probably would've have meant that 2018 would've been a positive year for my TFSA.

In one or two of the videos Simon states that when he hits 100K in his TFSA, he will start trading in the Tax free account.

I'm now interested in starting to trade my TFSA, but there is an alarm bell going off in my head:

Why does Simon, who is an experienced trader, not trading his TFSA and recommending that it's probably better not to ?

Sarah

If you want to sell some of your shares, to the precise degree that you can get R40,000 of capital gains in a year, and no more: How do you know how many shares to sell?

The online platforms will give you a form AFTER 28 Feb telling you how much capital gains you had on that year’s sales, but that is too late to inform your selling decision.

In Cape Town, rental prices on average increase by 10% per year. House prices (excluding the Atlantic seaboard) increase at more like 6%. What does this mean for rental prices 10 or 20 years from now? Does it mean that renting will become inhibitive at some point? Do you think the market will balance itself?

You mention that moving in a bit early and paying occupational rent before the transfer goes through. Can you explain a bit more why that would be a beneficial thing to do? My guess is that if you move in a month or so before the transfer goes through and you discover things like leaks, cockroaches, etc. it will be too late to change the terms of sale at that point anyway, due to the ‘voetstoots’ understanding.

The tax-free investment case is so appealing, it’s almost always a good idea to do your tax-free investing before anything else. Even fancy algorithms like this one finds that. Sadly, life happens to our money and a full tax-free allocation isn’t always possible.

The tax-free investment case is so appealing, it’s almost always a good idea to do your tax-free investing before anything else. Even fancy algorithms like this one finds that. Sadly, life happens to our money and a full tax-free allocation isn’t always possible.

This week, we help a father of four figure out how to balance his educational priorities with his tax-free allocations. The good news is there’s no one right answer. You have many options, including pausing your tax-free contributions and taking it up again later, as Njabulo pointed out in this podcast. The bad news is sometimes two options have more or less the same benefits and shortcomings. In that case, it’s time for the soft sciences.

I always talk about the importance of knowing what you want your money to do. Since Tinus chose to have four children, we can assume his family and children are his top priority. His finances should reflect that. Secondly, a great education will empower his children and offer them a greater likelihood of being financially secure themselves. Tax-free is important, but it’s not the be all and end all.

Tinus

I try to max the contributions for myself, my wife and my four kids every year, even if it means I need to sell from my existing portfolio to get the required cash.

I hope that I’ll be able to teach my children enough about finances that they’ll handle their TFSAs with care once they turn 18.

My initial idea was that they would pay for their own studies from the TFSA, but it would probably not be very smart to start withdrawing from the TFSA as the real opportunity of compound growth is just massive if they can keep the investment going.

Projecting the value of a maximum annual contribution up to the R500,000 level and 8% annual return, the account at age of 18 would sit at around R1.2m. This R1.2m becomes R31m by the age of 60, which should allow them a comfortable retirement from the TFSA alone.

Surely this “asset” in the child’s balance sheet would make getting a study loan much easier if required, especially if the TFSA is then moved to a provider that also give study loans (type of a soft security).

How do you balance the contributions made to your child’s TFSA and provide for their studies? I’m leaning towards maxing out the TFSA and face the music to pay for studies when the time comes.

I have always believed in choosing stocks with good momentum. For this reason, I initially chose the Satrix Momentum Unit Trust for two of my children’s TFSAs and I’ve been contributing to them all along with TFSAs at Satrix directly.

I noticed that there is now a Satrix Momentum ETF, that seems to be exactly the same as the unit trust, just lower cost. ABSA NewFunds also have a momentum-based ETF. I am considering moving these two kids TFSAs over to EasyEquities for easier admin and future flexibility, but would like to stick to a momentum type fund for now. How do these options compare (the methodologies are not the same as is evident from the current holdings in each fund).

For my two youngest children I chose the Sygnia 4th industrial fund (mainly because it sounded cool and I thought choosing technology for my 0 and two-year-old can’t be a bad idea).

Their investments have done very well (just lucky timing to be honest). From your recent podcast I could pick up that you are not a massive fan of this fund (it invests in guns etc) and I know that there are performance fees as well. What would be other options in the technology space, just a simple Nasdaq ETF?

Find our house view on tech ETFs here.

Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Win of the week is Hannes for sharing a great car financing tip.

For anyone interested in calculating car affordability (because some of us love cars and it’s also our hobby, not just a means of transport), Dave Ramsey has a cool rule stating that you can afford the car ONLY if you can tick off all three of the following:

- You are able to pay a minimum of 20% deposit on the car.

- You are able to finance it for a maximum of four years (48 months).

- The monthly repayment (after 20% deposit and a max four-year term) is less than or equal to 10% of your gross monthly salary.

I've done the math like this and it removes a lot of the thinking involved in buying a car, especially if you're a petrolhead. Use it / don't use it. :)

Alistair

I received my very first dividend from my Ashburton 1200 in my TFSA today (yay), but I was quite shocked to see I paid 26.76% tax.

That seems like an extremely high price to pay for a tax free account - I was under the impression it would be much lower. I do know we are subject to foreign dividend tax, but considering this is how much tax one is paying... is it even efficient to put ETFs like the Ashburton 1200 in a TFSA? Surely (if your finances allowed it) it would be significantly better to fill your tax free with local ETFs and all foreign ones outside of it? Or is the advantage of not having to pay capital gains tax so great that it completely out-shadows the tax on dividends (and the growth that taxed amount would have had)?

I'm curious what difference this tax would make over a period of 40 years, conservatively assuming the growth of the Ashburton 1200 was the same as that of the Satrix 40 (and assuming dividends are reinvested).

Anne

I have an offshore investment with Allan Gray. The money split between Orbis Sicav global balanced fund and Nedgroup Investments Core Global fund.

I wanted to make an additional contribution, and had a relook at the fees. TER 1.08 and admin fee of 0.5%.

It the investment worth the fees? Should I rather stick to ETF in EasyEquities?

Ned inherited R2m.

With such a large amount of money, the fear of investing is damn real. My biggest fear is that I find myself fiddling around with my money until I find myself in a “ah fuck” situation. As a result, I have over R1.9m just sitting in cash. I realise this is a bad thing and I plan to move it all to EasyEquities, minus the emergency fund.

The real fear comes in with my discretionary investments.

I’m 29 and a major career improvement is imminent if all goes well. This will bring with it a MASSIVE change in salary. The plan is to continue dumping all my excess salary into tax free and thereafter discretionary investments. I’m not too sure about an RA at this stage as this is something else I’ve been putting off.

The only real investments I have outside of the tax free are about R18k in Ashburton 1200, top 40 and mid cap ETFs through FNB which I’ve been contributing to since about 2014/15.

Investment fear is a very real, very scary thing. It just gets worse when there’s more money. I realise now how important it is to start early and when you don’t have so much money to stress over. I wish more people would realise that investing isn’t only for rich people. It’s the best thing you can do for yourself.

John

In SA we have the Top 40, so an equal weight equates to 2.5% per share. Our biggest share is Naspers which is about 22.5% of the index, so Naspers is 9 times bigger than the equal weight. (22.5 divided by 2.5)

In the USA they have the S&P500 so an equal weight is 0.2% per share. The biggest share is Apple which is about 3.6% of the index, so Apple is 18 times bigger than the equal weight. On a relative basis Apple is twice as concentrated as compared to Naspers in our market.

Now I am guessing but I believe most of the data to validate the equal weight model has come from the USA and not from SA. This could mean the the equal weight model is not effective in SA.

When the expects say "over the long term shares have outperformed the other asset classes" I guess that they use the the overall index to validate their statement. I guess they are not referring to some bespoke index with smart beta components. To me any "smart or not so smart beta" is moving away from passive investing towards active investing even if the costs are lower. Passive investing should be no more complicated than reproducing the index.

Is it cheaper for CoreShares to change the methodology of an ETF compared to launching a brand new ETF with a different methodology? My guess is that it is.

I believe that CoreShares must stick with their model or front up and tell the market their model is broken.

Martin

I am a 26-year-old Mountain Guide living in Somerset West. I have a wife and a one 1.5 year old little girl dinosaur. My wife doesn’t work.

I am busy studying and I hate traffic so I leave home at 04:30 most mornings to avoid traffic to Cape Town where I then have 1.5 hours to listen to your shows and do other studies while I wait for my clients to arrive. I finish work at 11:00 and can spend most of the rest of the day with my wife and daughter.

Recently I started my own business and make a reasonable income during the summer months and then eat only putu in winter.

I save a fair amount of my income, mostly because we live very basic with no debt.

Anyway my questions are the following:

I don’t plan on living in South Africa for very long, another four years, at most. What impact will this have on my TFSA? Will I be able to keep it growing and fill it while we travel? I don’t plan on emigrating anywhere, so my bank accounts should stay in SA for the moment.

Would it be smart to start investing in a RA if I’m not going to be in SA. Can I transfer my RA across borders later in life?

I know you did that blog post on the global property ETF, but I was wondering if that is a good investment into my TFSA? I thought I will only get tax exemption on local property like the satrix property ETF. Will I get dividends on those two global ETFs? What Property ETFs should I be looking at?

This is not the first time I’ve heard people buying insurance products to leave money to loved ones who aren’t financially dependent. In cases of premature death, it’s genius (aside from the dying). However, insurance companies are money printing machines because they understand how to harness probability.

This is not the first time I’ve heard people buying insurance products to leave money to loved ones who aren’t financially dependent. In cases of premature death, it’s genius (aside from the dying). However, insurance companies are money printing machines because they understand how to harness probability.

When you take out a life insurance policy, the insurance company works out how many years of contributions they’re likely to get from you before you hop off your mortal coil. They do with your money what you should be doing with it - they invest it. They understand money today is worth more than money tomorrow. If this didn’t work, the insurance industry would not exist.

Lady Kabelo is thinking about life insurance.

It would only be to give my folks, my sister and my partner a nice lump sum when I die, not because they depend on me financially.

I just feel tired of black people dying poor, leaving relatives to scrounge to bury us. I want to leave them with money to bury me and then mourn with bubbles or, if they listen to me, put the lump sum in a retirement fund for future comfort.

You could argue that I should invest that money and they will inherit that. But if I die next year, it wouldn't have grown to a considerable amount. Life insurance would pay out a nice amount between the four of them.

Is my thought process as crazy as I think it sounds, or would this fall into the category of making your money align to your values? I love my people and if I can put some money aside now so they get some money when I die, why not?

Win of the week: Cheryl from The Fat Wallet Community.

Nedbank offers a Greenbacks shop card which allows you to draw your Greenback value in cash from any Nedbank ATM. You could then use this cash to buy your bubbles. I draw mine once a year in December and use this money towards Christmas. I try to get Christmas for free - using Dischem, PnPay points and greenbacks to pay for gifts and christmas lunch shopping. Not 100% achieved but getting closer every year.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Jacob

I have a debt problem that I need to address, but my wife is not helping. She is also in debt and her business is not making enough money. How do I convince her to start a financial plan so that we can address our debt problem in order to be able to buy a house?

Gerhard

Just listened to Simon’s JSE direct around the changes in CSEW40.

The question I was waiting for but that never came, is what will the impact be on the TER of the ETF if they make the change.

It doesn’t help they smooth the ride, but in the end you lose because of fees.

Bella

I had been investing R500 per month with Discovery Retirement Optimiser Endowment policy for the past 10 years. It grew by 13% in that time.

To say disappointed is an understatement, seeing that I’m just 10 years away from retirement age.

I’ve decided to take the plunge and invest in ETFs with the proceeds from my unit trusts and endowment policy.

I’ve recently transferred my RA to etfSA and also opened a tax-free account. I’m contributing R1500 p.m towards Coreshares Global Dividend Aristocrat, Coreshares S&P 500, Satrix Emerging Market, Ashburton Global 1200.

Should I open up a discretionary account (with EasyEquities perhaps)? I’m looking at offshore ETFs but unsure on what that spread of the funds should look like.

I also have an investment property but my tenant has lost his job and is paying a lot less than the amount I’m asking for, and I’m not sure for how long he will even be able to keep this up for.

Should I just consider selling and investing these proceeds as well?

Martinus

My 14-year old car said its final goodbye and had to get a new car sooner than I expected. I only had 50% of the cash on hand to purchase the new car, then I had to to either take out a loan for the reminder, or take money out of my TFSA or a paid up RA. I figured the wiser choice was the loan since drawing from the capital of a TFSA so early hamstrings your future growth.

Considering a high interest car loan, would it be wiser over the long term (20+ years) to put that R2750 pm that would go to a TFSA to paying down the loan and then miss out on the TFSA allotment for a year?

My math shows that if I pay an additional R2500 a month on my car loan I'd pay it off 21 months early, saving me R24150 in interest and R1449 in fees.

I'm leaning towards paying off the loan, because it’s the first time in my life I have debt and I really don't like it.

Boitomelo the Diplomat

I am looking at increasing my RA contribution. I started with a low amount 2 years ago. I’ve read that 27.5% is the maximum tax benefit I can get towards my annual RA contribution. Is this 27.5% of my contributions to the RA, or of my taxable income? If it’s based on my taxable income, how does a person in my position determine what my maximum RA contribution would be since I do not pay income tax?

Secondly, given that my contracts will expire in 6.5 years and that I’ll be without formal employment, is increasing an RA a good idea given that I’ll only access it at 55? It leaves me with an 11-year access gap. I will be looking for a job and other alternative sources of creating income, one of which will be to provide editing and French translation services which I can’t currently do.

I know that freelancing is not easy and that one should be sufficiently financially prepared for it. Should I rather keep the RA contribution as is with a 5% annual escalation, and look into alternative investments options for purposes of creating an income for that 11-year gap at the end of my official ‘formal’ working life? If so, what investment vehicles would you recommend?

Tristan

I think you said you use your tax refund for tax-free deposit. What about adding it back to your RA each year? Wouldn't that have a cumulative refund benefit? Going into the tax free account means no more instant rewards, you have to wait a decade.

My half-thought out idea is to try hit 27.5% each year, e.g. dump in and top-up any bonuses. My thinking is that it'll be easier in future years because of maxing out my refunds.

The end result should be the same as if my bonus was deposited directly into my RA rather then losing much to tax.

Survivors of a battle with the Debt Monster already got a nasty introduction to the world of fees. A combination of account fees and interest on debt will leave you poorer every time. This baptism of fire may have been unpleasant, but it’s not a lesson you’re soon to forget.

Survivors of a battle with the Debt Monster already got a nasty introduction to the world of fees. A combination of account fees and interest on debt will leave you poorer every time. This baptism of fire may have been unpleasant, but it’s not a lesson you’re soon to forget.

Those most vulnerable to the wealth-destroying effect of fees are those new to the financial world. When you don’t have much money and a brush with debt hasn’t yet alerted you to the grimy side of the financial system, a 1% fee on a small transaction is unlikely to set off alarm bells. On a R300 investment, a 1% is only R3. What could you possibly buy with that? Beware, dear lambs, this is how they get you.

In this week’s episode of The Fat Wallet Show, we try to show you why you should care about fees very much. We run the gamut - from expensive, ego-stroking bank accounts to total investment costs in ETF products.

You might be disappointed to find that we can’t offer cut and dry solutions to fees. A lack of consistency in reporting among financial institutions makes it almost impossible to do a side-by-side comparison of fees. Instead, we try to steer you in the general direction of clarity.

We reference this document.

Kelly

I’ve just received my first salary and am extremely eager to make my first investments into TFSA ETFs, however the more I started thinking about life expenses the more I realised that there are a couple of other financial planning decisions that I still need to make. I would like your advice relating to the following matters:

Which bank account for day to day activities? Investec approached us first year trainees with the young professionals’ private banking account. It has a monthly fee of R295 with no additional charges. It gives you reward points and access to airport lounges and all sorts of shiny bells and whistles.

In what ratio would you advise me to invest my savings into an emergency fund and TSFA ETFs? Also, in which bank account would you advise me to keep this emergency fund?

I am aware of the extreme importance of saving for retirement, and am unsure of whether I should be contributing to a pension fund as well as TFSA ETFs or if focusing only on TFSA ETFs for now will be sufficient. What is your opinion on this?

As I am young, I would like to focus on high risk, high return (hopefully), equity ETFS. I have considered the Satrix Top 40, as it is a known favourite and I can “catch up” on the time I have lost due to the sideways market with the hope of a more favourable market in the near future. I have also considered the Ashburton Global 1200 and Satrix MSCI World ETFs. The new ABSA low volatility ETFs also caught my attention but I am concerned that the risk on these ETFs are too low? Will you please advise?

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Flipi

Any change in your opinions about 10x as a good RA choice?

Would Stanlib's new TFSA be as good as any other? I have some investments with them and it would be convenient to simply move the money across in the next few days.

Other Gerhard

I opened a TFSA account for each of my daughters and did my first transfer.

I did the instruction on their website and the trade was done 09:15 in the morning.

I bought the Satrix MSCI World ETF and the trade price was R39.16 per share.

From another trading system I use on a personal level I couldn't see this price trade anytime during the day. The highest price traded was R38.65 for the day, which means that over and above the normal small trading fee I paid to EasyEquities I also paid R0.51 or 1.32% of the share price.

I invested R10,000 and the total transaction cost according to their break down was R37.40.

But I got charged R39.16 per share instead of R38.65 (assuming the highest price for the day) and therefore I paid another R130.24 in "transaction charges". The total transaction charges therefore R167.64.

If I did the same size transaction on Investec's trading platform I would have paid R151.72 in charges.

Did I do something wrong here?

Always Abundant

In 2002 we bought into an Executive Redemption bond offered by a UK-based Life Assurance Co via the International arm of a large South African financial institution. This was sold to us by our financial advisor (at the time) as a way to maintain our offshore diversification.

In 2012 we applied for a full withdrawal in order to close the policy. We were able to redeem everything other than 1 of the funds (a UK-based Property fund) which had gone bust. We accepted our losses, which were considerable, and forgot all about it. Recently we received a letter from the International Arm of the local company informing us that the annual fees on the policy had gone up.

I obtained online access to the account and noticed that the Property fund in question had eventually liquidated in 2018. The small amount that was generated from the liquidation had gone towards paying these fixed annual fees. But since the fees were charged continually, there is now in a significant amount owing (1.5K USD).

The policy is worth nothing but the fees continue to accumulate even though we had submitted the withdrawal form years ago. No one has informed us about the fees owing.

What are our rights in this case? Surely there must be some kind of Consumer Protection laws to protect us from being liable for these fees? What should be our course of action, if any?

Win of the week: Phasane

2018/2019 Tax Year has been, surprisingly, a good year for me.

- I finished paying off my car, not planning to buy any car until 2023. The only debt remaining is the bond.

- I discovered the Fat Wallet Podcast and the Just One Lap community in general.

- I listened to all Fat Wallet episodes (the weekly wait is now killing me).

- I moved my RA from Liberty to 10X, a process that started late in October 2018 and about to be wrapped up as I write this mail (waiting for some Trustees what what signature but 10X have kept me informed every step of the way). By the way, I started with my RA contributions to 10X in November and contributed to both Liberty and 10X that month.

- Although I wanted to do more, I contributed 16 600 ZAR to my TFSA (up from the R4 620 that I contributed the previous Tax Year). I am comforted by the fact that I have built my emergency fund to levels I am comfortable, from 0 - 4 months worth of living expenses (in Simon's own words, "that makes me sleep well at night").

2019/2020 goals

- Contribute the max amount to the TFSA, this is important considering TIME in the market.

- Add one more month of living expenses to the emergency fund.

- My normal RA contributions will continue, this is a top up to the work pension fund.

- Everything else remaining, including change from the F##k it monthly budget, goes to the Bond. I am planning to settle the Bond in 2022 (9 years from the registration date)

Tax rebates, bonuses and inheritances really throw us for a loop. Most of us have every cent of our salary allocated to some higher purpose, but the moment we find ourselves with a big hunk of cash, we get in our own heads. We all know what we should do with the money, except because this is magical unicorn money we don’t.

Tax rebates, bonuses and inheritances really throw us for a loop. Most of us have every cent of our salary allocated to some higher purpose, but the moment we find ourselves with a big hunk of cash, we get in our own heads. We all know what we should do with the money, except because this is magical unicorn money we don’t.

We get questions about lump sum investments so often that we decided it’s time to devote an entire episode to it. In short: the math says invest it all at once as soon as possible. If your emotions tell you to do otherwise, however, you should probably pay attention to them first.

We talk about our friend Hendrik’s blog tigersonagoldenleash.co.za in this episode.

Andrew

I just received 10 months worth of salary as a bonus. I currently have money invested in my portfolio. I’m trying to decide how to go about investing my bonus. Should I chuck the entire amount in now? (Keep in mind my TFSA is maxed out for 2018, and I plan on investing R33 000 on 1 March) or should I average it out over a few months? Also keep in mind that I have no debt.

Win of the week: Nadia

I listened to the show about my question and I just want to say thanks a million! You guys helped a lot with my decision and I have decided not to get involved with Forex trading. I first need to focus on my TFSA and make sure I understand all the ETFs I have chosen to invest in.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

David

Love the show. I have a question for you relating to picking a Global ETF. I have an Easy Equities Account and have access to investing in ETFs listed on the NYSE.

I was looking at the Vanguard Total World Stock ETF on the USD account and comparing it to the Ashburton 1200 on the ZAR account. The TER is significantly cheaper for the Vanguard ETF – 0.1% vs. 0.45%.

The weighting of the constituents of each ETF are quite similar although the Vanguard has over 8,000 stocks where the Ashburton has over 1,200 stocks which makes it attractive to have more exposure globally.

My feeling is that in the long run, it’s probably worth moving all my investment offshore (into USD) into the Vanguard ETF if I follow the concept of one ETF to rule them all because of the low cost of running the ETF.

What risks other than a strengthen Rand or having a Will in place in the USA to transfer the funds in the event of death would you foresee? How would the tax on dividends / Capital Gains be affected?

Hannes

I recently received a severance package. This money is considered "tax free income" because of a SARS tax directive, which seems to be common with severance packages. It’s been lying in a savings account, and I'd like to know what you think is the most tax-efficient way to put that money to work.

I don't have any investments and no emergency fund. The savings referred to above is currently my emergency fund. The only debt I have is car debt, a monthly expense of R2400. No bond either.

The amount is just enough to max out my TFSA for the 2018 tax year ending in February as well as settle my car debt completely, but then I have no more savings / emergency fund left at all. However I can quickly build up an emergency fund, or to rather contribute aggressively to my car debt with a monthly contribution if I decide to not settle.

It seems crazy dropping a huge amount on my car debt to settle it considering the small monthly repayment, but it's also something I want to get rid of ASAP as it allows for more savings, less essential expenses and more cashflow when I'm rid of the repayment. The risk of course is that I will be stuck without savings / emergency fund for a few months until I can build it up again. I do have a credit card.

Not quite sure what the best course of action is. Should I rather leave the debt as is and invest with this "tax free income"?

Minnaar

I would like to understand how a property-based ETF actually distributes the income that it gets from rentals? How does the ETF distribute this to holders of the product? Is it in the form of a dividend?

Can you explain like I am 5 why some people think investing in REIT properties are a good idea in a TFSA?

Dave

I discovered that you can buy REITSs via unit trusts, exchange traded funds or standalones directly from your stockbroker or financial advisor or a site like EasyEquities. I can see a sort of hierarchy here but just don’t get it. Are earnings from REITs rental income or dividends? I can appreciate that if held in a property owning company the earnings would be in divs. But if held by a unit trust how would rental earnings be paid?

Phil

I love this podcast and this a wonderful public service you're offering to all South Africa.

Even though I'm in the UK and a lot of the advice can't be directly applied the thinking still applies and continues to push my thinking.

I want to share stuff that changed my financial life which was given a wake-up call after I took a massive hit on RA when I financially emigrated and was confronted with just how far behind I was. Painful stuff, and wish I had a podcast like yours to point me in the right direction at the time.

I wanted to share some references I use in the UK that I think would be very useful for reference in your offering to the public as well:

- The go-to reddit (I know, don't take advice from unknown muppets, but it's good) for me is /r/ukpersonalfinance/. In particular I love the UK Personal Finance Flowchart and it's interactive version (which is opensource on github btw...). This flowchart is awesome for visualising where you are on the maturity scale. Super helped my wife with her "O, fok!" moment.

- The second source I love is moneysavingexpert.com. It's a bit of a marketing-hidden-like-advice site, but it's got some gold-level guides on finance basics for people who were never shown how the basics work.

- The more extreme sites are FIRE the based, but drastically shifted my thinking on what retirement means, in particular @firevlondon on twitter is an interesting feed I follow with monevator.com to frame my thinking on passive investment.

Melissa

I already have some investments with Easy Equities, so just decided to move some funds around so that I can put the full R33 000 in for the 2018 tax year.

I am a bit confused about the limit of R33 000 and the fees involved. When I bought my TFSA ETFs the admin/brokerage fees were deducted and my investment amount only shows as R32 877 (R123 admin fee). I know it is a small difference, but I would like to utilise the full R33 000 that I am allowed for the year. Easy equities however does not allow me to invest any more funds into this account.

Do you have any clarity whether this R33k limit includes the administration fees?

André

I heard you say you had to re-open your FNB account because you have and FNB flexi bond.

Not sure what the exact reason is but thought I will share this. You do not need an FNB account to withdraw from your FNB bond. I also have an FNB flexi bond and I nominated an account at a different institution and I have withdrawn from the bond directly into that account.

Fanie

I’m nearly 70 and earn the biggest part of my income from the following ETFs: PREFTX, PTXTEN and STPROP.

You mentioned that because PREFTX consist of many banking pref shares there is a risk should we get downgraded to junk status by all the rating agencies. I understand that a junk grading will affect our total banking system negatively in that interest rates will go up. What do you think will be the effect of a downgrade on my income from PREFTX.

Chris

What stops me from opening a tax free savings account with a overseas fund managers like JP Morgan, Investco, Black Rock etc?

What are the tax implications for me as a non-resident in an international based etf tfsa?

What are the risks and is it something worth investigating?

Conette

I am 55 and work for a big bank group, with lots of good benefits.

My emergency funds sorted out and bond debt almost covered.

I want to open a Tax Free Savings (ETFs) account with Easy Equities .

I please need your assistance in my ETF selection? I intend not to 'touch' the investment in the next 15 to 20 years.

Jo

I am in the process of shifting my RA around and moving away from unit trusts and into ETFs.

I started investing in an RA as soon as I started working, but unfortunately I thought they were very one size fits all and so it's all sitting in unit trusts with fees of around 3.8%.

While digging more into finance I came across a TED talk by a doctor in Australia who pointed out that most people's retirement funds are invested in British American Tobacco (BAT). So I looked up the current funds I am invested in and my current unit trust, my work provident fund and the new ETF I was looking into for my RA all invest more than 1% into BAT.

This is pretty disappointing to me. I can guarantee that a large percentage of the general populace wouldn't invest in tobacco if they had the option. And yet they are unwittingly helping fund the industry.

I have tried to do some googling for green funds in SA but haven't really come across anything. I realize that I could just build my own RA by picking shares but would much rather choose an ETF. I would also not like to pay exorbitant fees just to avoid investing in unethical companies. Maybe I will have to suck it up and offset my investment in BAT with charitable donations to cancer research. ;)

Jon-Luke

Is it possible to transfer ETFs that you already own into your Tax Free Savings without having to sell them first?

Rudolph wants to know if yield rise or fall with quantitative easing.