When I finally paid off my debt three years ago, I was in the perfect position to start building wealth. It took two stark years to get out of a very dark place of my own making. No salon visits, no new clothes and a helluva lot of peanut butter later had me looking a little furry, but I felt good about myself.

Paying back all that debt made saving easier. I was already used to running a tight ship and sending my money to financial instruments. Six months after paying back the last of my debt I had saved enough for an emergency fund and my first lump sum investment.

I understood why I had to invest. I understood compounding, wealth creation, setting goals and the 4% rule. What I didn’t anticipate, however, was that my investments would flatline for two-and-a-half years. The drama with Deutsche Bank over the past three weeks gave me pause. Many Just One Lap users have been asking us what to do about their x-trackers. Since my entire tax-free allocation for the past two years has gone into DBXWD, this hits very close to home.

My investment portfolio has never really done much, and that never really bothered me much. However, this week I also got my monthly Capitec interest SMS. Over a one-year period, my emergency fund has earned me nearly R5 000 in interest, while my investment portfolio is actually worth less. Over a two-year period, I would have been better off sitting on a hunk of cash.

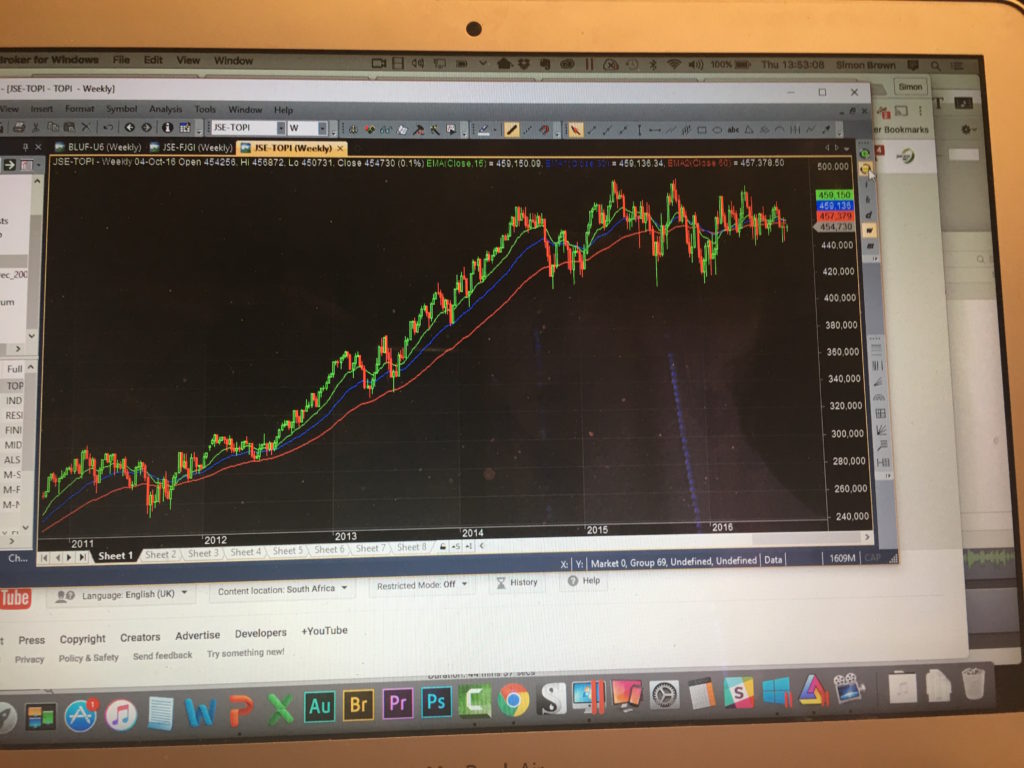

- How not to time the market. What the JSE Top 40 has done since I started investing.

In this episode of The Fat Wallet Show I turn to Simon for a much-needed pep talk. Yes, I understand the principles of investing. Yes, I know historically speaking the market always recovers. However, the market hasn’t really been kind to me. I want it to show me the money, not take the money.

I’m not planning on doing anything differently for the moment, but I’m ready to see some upside. Pronto, please.