- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

We spend so much time talking about bad financial products. Is there such a thing as a good financial product? If so, where would you find them?

Listener Bronwyn got badly burned with financial products in the past. She’s been paying 15% fees on an Old Mutual education policy and took out a Discovery retirement annuity that hasn’t returned anything above her contributions for the past six years. Now her financial advisor wants her to invest in Body Corporate Bridging Solutions, which apparently guarantee a return of 17.5%.

In this episode, we provide a checklist for buying financial products. When comparing similar financial products, think of the following:

- Fees

Let this be your point of departure. As winner of books and life, Ronel, explained last week, “If I get 10% growth, and inflation is 6%, there is only 4% left for growth and compounding. If I pay 3% or 4% in fees, I will only get back what I put in, adjusted for inflation.”

- Guaranteed returns far above retail bond rates

As Simon points out, the government is the only party that can realistically guarantee returns, because the government owns the printing press. You can check government retail bond rates website here.

- Counter-party risk

Investments are for the long-haul. As winner of books and real life, Lesigisha, pointed out, the principles of compounding relies on time, not money. If there’s not much information available about the company taking your money, be very careful. Counter-party risk should be considered alongside fees, though, in the case of older, bigger corporations who probably won’t go bust but happily pocket your investment returns.

- Active or passive

Simon and I spend a bit of time discussing this point. The SPIVA report indicates that actively-managed funds underperform the market year after year. However, if an actively-managed fund makes you feel more comfortable, don’t forego it just because we say so. It’s your money, after all.

Win of the week: Sean worked out if you’ll be better off at Absa or EasyEquities. He also worked out how many years it would take him to make back the penalty.

ABSA’s new inactivity cost is essentially R40.25 per every two months, but only charged five times as there would be a trade in the beginning of the year,

This adds up to R201.25 per year for the next 14 years (R2 817.50 excluding compounding or about R6 780.98 at 15% growth adjusted back with 6% inflation).

After that the fee is R241.50 per year until you remove the money, which assuming my daughter is financially savvy will be a long time as she is only 18 months old today.

Anyway before getting myself worked up about ABSA essentially stealing a month’s income from my daughter, I decided to objectively look at the numbers (boring Excel attached to check calcs) and do a comparison between EasyEquities and ABSA

For my family it’s cheaper to use the EE platform by quite a bit,

We will pay off the moving of the two ETFs in just under two years.

For someone using a monthly deposit it may be better to pay into ABSA until the TFSA allowance is maxed out and then only move to EasyEquities.

Hope this helps some peeps.

Click on the link below to download the spreadsheet.

Shout-out to Lean, who recently started listening and seems to be going through the episodes front to back. They wrote about tax on whisky, from many moons ago.

Claire wrote to say my newsletter editorial really hit her in the feels.

Your "editorial" this morning really struck a chord with me... Of course that's how they make their money. And the same goes for any of the other things we buy, oh so complicated: wine, perfume, cars, homes blah blah ~ have a great week!

Chas wants to know if we have transcripts.

I have listened to most of #96, then I was interrupted by a phone call so I lost the thread.

I am 78 and a bit deaf so I battle to keep up with your rapid delivery. Do you provide a transcript that I can study in my own time or is there a way I can pause to digest what you just said and then go on again?

I always want to learn more about investing.

Thanks for a lively intelligent show.

Transcripts are for one day when we grow up. It is our highest priority in terms of this show.

Thinus has a question about structuring his pay cheque.

When allocating your salary to different "pockets", should you use gross or nett salary?

Alexander sent this great email about selling his house.

When selling a primary residence does one pay CGT for the amount above R40,000 regardless of what you have spent on the house?

We sold our house for R50,000 less than we bought it for about four years ago.

We paid more than R500,000 towards our loan (which was mostly interest of course)

We spent about R100,000 on renovations before we moved in.

After the sale we end up with R70,000 in our pocket.

Of the R500,000 (paid into the bond) R120,000 went to the principal amount.

We sold for R50,000 less than the principal amount.

In my book, it’s a loss of R530,000 (500k + 100k -70k). Or may I only deduct the renovations? Which is still more than the 70k, but in principle can one only deduct physical improvements?

Living there cost us a fuck-ton of money.

Obviously we are getting very little out of this deal, but even if we made R600,000, I would be able to prove that it cost us much more to live there so there is no "gain".

What can I deduct from the money we get from selling a primary residence?

How does this compare to a buy-to-let property?

If you can deduct a bunch more for a buy to let, would it be worth it to buy and let to yourself?

We’ve had a few more emails from people who are upset about Absa’s fee increases. John says this is not the first time.

I bought a small amount of the Absa NewGold ETF years ago and had never done anything else with them.

They sent me a letter (in the POST) about 18 months ago telling me about a new minimum admin fee, payable quarterly. On my pretty small account it amounted to an admin fee of something retarded like 10% a year!

After querying it and getting a shrug of the shoulders, I thought FUCK THEM!! I did some research found EasyEquities, sold my ETF, was below my CGT threshold and reinvested two days later with my newly minted Easy Equities account at a newer, much higher base cost.

With EasyEquities being such a user friendly, reasonably-priced platform, I've subsequently invested multiple times what I originally had with ABSA. Their, EasyEquities’ gain.

We foolishly forgot to pick a winner for Sam Beckbessinger’s book Manage your money like a fucking grownup. Njabulo, who writes for us, snuck in his submission.

Whatever your investment or savings plan is, it is important to consider inflation and fees. If the investment can't outperform inflation after fees, that investment is making you poorer.

Jen was the Win of the Week in episode 90 for figuring out that people who don’t earn a steady income can still structure their savings by doing it by invoice paid instead of by month.

As a self-employed person without a fixed income, I can't structure a pay cheque because I don't get one. But I can apply the same methodology to each amount that I receive.

Since my last email to you about this, it has been going well (although April has been a kak month so it has not been easy).

On the odd occasion when I have been tempted to forget about my system in favour of instant gratification, I just listen to beginning of episode #90 again where you discuss my email. Straight away I am committed all over again, like I would be letting you down if I didn't stick to my guns. I know I should be motivated by how happy future me will be, but sometimes it is hard to think for two people at once.

The second brain wrinkling fact, and this isn't mine but a repeat of what you said, is the idea that our total income over a lifetime is a finite amount. Every time you spend money on something, there is something else you can't spend money on. Has that bit of information affected my spending habits!

You are changing my life and I have turned into a bit of a fanatic about all this. I am constantly annoying the crap out of everyone I know because I am trying to convert them all to The Fat Wallet Show, for their own good.

This, as well as iTunes reviews and mentioning us when you deal with any financial services provider really helps us. Thanks!

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

This is another themed-by-serendipity episode. Last week Edwin mailed with a dilemma: how do you choose between being a good citizen or family member and having money? Whatever you spend on your family, kids or pets or donate to charity is money not going towards your savings goals. Does that mean you should forego those things altogether?

Money and morality are closely linked, but so is money and health, as Christoff pointed out. Having a lot of money but never having any fun is completely pointless. A lot of money at the expense of having children is not going to make you happy (if you want children). Sitting on a mountain of money and never helping anyone else is going to bankrupt you morally. Spending your life trying to get rich but neglecting your health is going to lead to sickness in retirement. What’s the point of that?

We discuss strategies to navigate these questions and completely fail to choose a winner for Sam Beckbessinger’s Manage Your Money Like a F*cking Grownup giveaway. Something to look forward to next week!

Win of the week: Jacques Kasselman. He found us by accident on iTunes and immediately panicked. After reading his mail I realised that he actually didn’t need to panic at all.

Where to start to get on track? I think the best thing would be to get rid of my debt of over R1500 a month, excluding interest on my vehicle loan.

I started paying off my debt by having a liberty investment I had for 6 years (R500/pm - 1.67% growth above what I put in) pay out and pay off my most expensive debt first. That's R700 that can go to the next card/account and then the next and so on.

Is this the right strategy or should I rather look for somewhere else to invest that money, eg. TFSA, ETF and slowly pay off the debt over time?

The way I understand from what I have learned from you guys so far is get rid of debt, then create an emergency fund while simultaneously slowly starting to save/invest and increasing the savings/investing part as the emergency fund gets closer to 3 months salary.

TFSAs

SARS gives us R23,800 tax free interest already. Is it still beneficial to contribute to an TFSA at possibly lower returns if we are still far from reaching that limit? Saving the R500,000 cap for when one day we pass the R23,000 limit? Reaching the R500,000 limit would take about 15 years if you contribute the max of R33,000. As I am 34, I still have 31 years left if I am unable to retire early.

PENSION

My employer requires 22.5% pension contribution monthly, deducted from my salary (me=7.5% company=15%). At the moment its split between Allan Gray and the company fund.

I plan on increasing the percentage towards retirement to max as soon as I can get the rest in order, or at least a little better.

Stefan responded to Frank, who wanted to know where to keep his Lazy system cash while he waited for entries.

I have four EasyEquities accounts and I get interest on all cash in my accounts. There’s a cash management fee, so it's not the best cash account, but it's not like I'm getting nothing.

Fred has an interesting question about TERs. He is invested in an Allan Gray Balanced Fund through a financial planner. The TER of the fund is 1.44%. In addition to that, he pays an admin fee of 0.40, an advisor fee of 0.50% and a management company fee of 0.79%. Just for the privilege of buying the fund he’s paying 1.69%.

I looked up the fund costs on the Allan Gray website, and I have some bad news. The TER is 1.45%, but excludes “other expenses” of 0.02%, VAT of 0.15%, and transaction costs of 0.07%.

3.38% total cost.

The problem is, you don’t see the TER. It costs you money, but you don’t see the money.

Pieter is putting his emergency fund to work. He banks with FNB, and he’s really made the most of that infrastructure.

- I have a cheque account that my salary gets paid in. I have a bit of extra money to cover the "shit I did not budget for". I move most of my expense money to my credit card so it is positive. This earns me a tiny bit of interest and I win back quite a lot in ebucks.

- I have a linked savings pocket with 1 months expenses in it. It earns interest, has no account fee and money is available immediately.

- I am building up 3 months living expenses in a 32 day notice account that also earns interest and has no account fee.

So the plan is: for small unplanned things, you just use money in your account. If the paw paw hits the fan I can live a month with my savings pocket money. When I start touching that money I can request "next months salary" from the 32 day notice account without incurring costs.

If I can build up > 3 months in my notice deposit, I will move that to bond ETF or something that gives better return.

This way I have no fees and costs, acceptable interest and money available now.

Gerhard needs help with life insurance.

I love your war on fees. It’s helped me a lot in making my decisions around investing.

Is there a similar type of thing in the life insurance side of the world?

My life insurance is with Liberty, and it is fully a grudge purchase, but I do have 100s of children so kind of have to have something.

Are there new style life insurance companies that you guys are aware of, like a 10X but for life insurance?

I asked the 10X team and they didn’t know of anyone.

However, I did get some suggestions.

Have a look at brightrock.co.za. It looks like a new school type of business, but it’s majority shareholder is Sanlam.

The other suggestion was FMI. They’re a division of Bidvest Life.

Craig Gradidge from Gradidge-Mahura investments said:

The insurers who are "traditional" and reasonably transparent are Sanlam, Old Mutual, Hollard, PPS. The 2 that integrate are Discovery and Momentum.

With Brightrock benefits structure is still something they need to work on...as always, the answer of which is best is usually determined by client requirements, their lifestyle and health conditions, etc etc

Poor Josh is stuck between a rock and a hard place with his RA.

I recently started working at a Big Four bank

I come from a company that used 10X as a provider. I didn't know how lucky I was back then. I am 26, so I need an aggressive portfolio.

The fund options we have are somehow administered/managed by Old Mutual and the options are:

- Allan Gray global balanced portfolio - 51% equity allocation, 1% fee on SA based assets, and performance related fees of between 0,5 and 2,5% for foreign assets. I'm staying fucking far away from this one. Assholes.

- Coronation global houseview portfolio - 49% equity allocation, looks like a fund of funds so fees on fees will apply here, but doesn't look that bad. Still shitty though.

- Investec balanced fund - 41% equity allocation, 23% bonds allocation. Fees are reasonable at 0.54% for local assets and 0.75% for international assets. I ended up choosing this one due to the lower fees, but it's so conservative, so shitty.

- Nedgroup core diversified fund - 50% equity allocation, 7% bonds. Fees are good at 0,58%. But again, lower equity exposure. Actually looking at this now, this option looks the best out of a shit bunch.

The rest are so shit they aren’t worth mentioning. Think old mutual, Tanquanta cash pooled fund (yes, seriously).

So, my question is - do I bite the bullet and just throw as much as I can at the Investec/Nedgroup funds, or maybe lower contributions to the least I can and then open a portfolio with a better RA provider like a Sygnia/10x etc in my personal capacity?

I'm leaning towards the latter. But this would probably mean some complications come tax return time? I don't suppose I can go to a massive corporate’s benefits department and tell them that my options are terrible, give me better ones?

Jorge wants to invest in a living and guaranteed annuity, but he wants to know how to make that decision.

What are the practical implications and values considerations should be taken into account when opting for both a guaranteed and living annuity?

We have an excellent article on justonelap.com/retire about the difference between these products.

Entries to win Manage your money like a fucking grownup by Sam Beckbessinger.

We asked you for the one fact that changed the way you thought about your finances.

Christoff’s point is about health.

When you realise that you need to save up for a potentially very long retirement (30+ years these days!), we do all this planning to ensure that we’re “taken care of” financially, but what about our physical health?

If we’re going to live for another 30+ years after retirement, we’d be enjoying those years a lot more if we’re fit and healthy, right up to nearly the end.

I’m 43 and take good care of myself, but I look around at my peers (school friends, cousins, colleagues, etc of the same age-group) and a LOT of them already suffer from heart problems, hypertension, cholesterol, various forms of cancer, diabetes, and what have you! It’s very depressing to think of having the benefit of living in the 21st century, with enough technology to keep us alive for so many more years, when most of those years are going to suck!

Just as compounding works for/against your finances, it does the same with our health. Poor daily habits will eventually catch up with you, so we need to keep our attention on this very important factor if we’re going to enjoy our hard-earned and cleverly-invested wealth.

Phemelo found The Fat Wallet Show in January and has made massive strides in his financial life.

I’m not all over the show.

I have a financial plan and taking on the challenge of keeping the lifestyle cost the same to avoid lifestyle creep.

My huge eye-opener was there are no shortcuts to this thing - baby steps.

I’ve closed my overdraft, I’m starting to slowly chow the credit card debt, and I started paying my student debt.

The next step is starting to slowly build the emergency fund.

Ronel had an a-ha moment about fees

If I can lower my fees on my Retirement Annuity, I can have sooo much more money.

It blew my mind that if I get 10% growth, and inflation is 6%, there is only 4% left for growth (compounding) and if I pay 3% of 4% in fees, I will only get back what I put in (adjusted for inflation). That is not my idea of a comfortable retirement ....

So I moved my Retirement Annuities from Sanlam and Old Mutual to 10X.

I am now on a fee witch hunt to cut ALL fees to the bare minimum :)

John Morrison (our retired unicorn) submitted a vote for Khuliso, I think.

When people speak about money I have realized that I must first determine their anchor point and their biases. Then I can adapt this information to my anchor point and confront my biases. Someone investing for future retirement is at a different point to another living off investments in retirement.

I am truly inspired by Khuliso and their kota. Such an understanding of compound interest, time and lowering the cost of living. Really amazing!

You can't help it if your parents were poor and you start poor, but with compound interest in a single generation everything can change. Well done Khuliso!

With ABSA's WTF new minimum brokerage fees in ETF accounts (which is by the way more than a kota) we need to get behind EasyEquities and give them huge support. Is EE the only company that understands not to rip off the poor?

Links to be included in show notes:

Adam sent a link about the three biggest lies about passive investments.

They are:

- People can’t make their own decisions about which products to buy

-

- Very few investors have the time, knowledge or skill to invest their own money.

-

- The fees aren’t as low as they claim

-

- Passive products available to retail investors in South Africa are still relatively expensive and not that much lower than actively managed funds.

-

- You don’t get market return

- It is easy to compare the JSE/FTSE All Share Index returns with active manager returns and conclude that active managers are not worth their fees. The comparison is flawed. It does not consider risk and it also does not take into account that most of the growth from that index has come from one share – Naspers.

I’m not going to tell you what to think about this. If you understand how these products work, you can make up your own mind.

If you secretly hate us but haven’t been able to find a different source of financial information, I have some great news! I found a Freakonomics Radio episode that summed up exactly the principles we champion on this show.

In this episode, Simon and I take the financial literacy survey. It’s only three questions, but understanding their answers will enable you to make great financial decisions. If this sounds vaguely familiar, you might be thinking of this podcast we did last year.

Here are the questions:

- Suppose you have R100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

- More than R102

- Exactly R102

- Less than R102

- Imagine that the interest rate on your savings account was 5% per year and inflation was 6% per year. After one year, how much would you be able to buy with the money in this account?

- More than today.

- Exactly the same as today.

- Less than today.

- Do you think the following statement is true or false: buying a single company stock usually provides a safer return than a collective investment scheme like an ETF or unit trust.

Win of the week: Rob has been coming to our events for ages. He has some ETF investments, but he’s been wanting to trade since the day I met him. This week, he sent this email:

Yes I have done my first trade and bought my first bunch of shares (7 shares in total - some bits and bobs) (as oppose to ETFs)

I am not sure how I am supposed to feel!

Its bit like sex for the first time - did not know what to expect!

Frederick

My world has been turned upside down! I started listening to your podcast a week or so ago, and fok... my google is broken!! From googling sport all day I now spend endless nights and have sleepless nights on where to put my money and avoid tax as much as possible!

I use to think money is money and my RA is perfect and that life is sorted! I was wrong!

I have an RA (diversified wealth builder) with Sanlam. Any thoughts here please? My FEES (to my knowledge) is 0.65%.

It says “management fee at benchmark %”.

I put some money in monthly with a 10% annual increase. By retirement I should be paid out R11,5m.

Let’s say you live another lifetime after your working life, how much will you need? It’s possible to retire at 60 and live to 100.

https://justonelap.com/podcast-much-money-need/

Frank is trading Simon's Lazy system and wants to know if he can park his money somewhere while he waits for entries. He’s not earning interest on the money that he’s allocated for this trade.

Shamona wants to know if timeshare is worth it.

What are the pros and cons? What should I look out for when buying?

Entries to win Manage Your Money Like a Fucking Grownup. We want you to share the financial fact that blew your mind. We’ll be running this competition for one more week.

I asked author Sam Beckbessinger hers and she said on R10k per month, you’ll earn R19m in your working life. Mine is that a low cost of living is basically the answer to all your problems.

Lesigisha wrote back after we sent him a shout-out last week.

Thank you so much for the great affirmation I received from the submission of my email, it really really went a long way in validating what I’m doing.

It’s hard to start on this journey, but after doing it for a while one does sometimes get despondent and wonder if this is worth it. Your affirmation has helped reinvigorate me and I go back to it every time someone says they’re waiting until they have a bigger shoe size before they can start making “real money decisions”.

Khuliso’s mind-blowing fact is that you don’t need huge amounts of money to invest. As a result of his mail I spent a lot of time thinking about kotas this morning.

The most mind-blowing fact was finding out that if I can afford to buy a kota (R23.00) or street wise 2 I can afford to invest in the JSE and create wealth.

Even though it's little money, over the long term it makes a difference. In my case the problem was lack of information rather than a lack of money to invest.

I am now very conscious about my spending habits. Whenever I buy takeaways in the back of my mind I keep on thinking of ETFs that I could be buying. When I look back, I see missed opportunities where I could have invested and build wealth.

It’s becoming increasingly clear that access to money isn’t always the best thing. In last week’s episode, Pieter explained how access to a free house and investments didn’t make him great at money. Fat Wallet bestie and newly appointed spy, Wilhelm, sent us news from the front line this week.

Wilhelm started sorting out his money and sharing his journey with us when he was still a student. It’s been such a pleasure witnessing his pre-income journey. If you can figure out your money situation before you actually have any, how much you earn becomes irrelevant. You’ll be a financial success.

Sadly, the opposite is also true. I certainly learned that the hard way getting into mountains of debt in my 20s. The difference between me and Wilhelm’s new colleagues is that I earned a junior journalist’s salary (basically just enough to make my engineering friends feel sorry for me). The amount of damage I could do to my financial life was artificially limited by the amount of money I earned. Thank goodness.

This week we talk about the dangers lurking behind the piles of money of high-income earners. If you’re a low-income earner, this is good news for you too. These are the traps to watch out for before the dineros start rolling in.

We are giving away a prize for the first time ever. Sam Beckbessinger is the author of Manage Your Money Like a Fucking Grownup. She donated a copy of her book to one lucky Fat Wallet listener. Find out how to win it in this week’s show. You can find out more about the book here.

Kris

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Wilhelm writes:

The government takes really good care of its young doctors. We get a good salary, but the lack of financial education means that a lot of that money simply gets wasted.

I know of three doctors living in my building who purchased expensive brand new cars (Mercedes Benz A class AMG, Audi RS3) before receiving their first salary (and without receiving any help from their parents). They bought cars on credit using only a contract from the department as collateral, where it has often happened that people do not get paid the first month due to the poor admin/payroll/HR abilities of the DoH. One is paying an interest of 13% over seven years.

In PE we get the opportunity to live in the doctors’ quarters. It’s an old apartment building in an old and rather dodgy part of town, but it is centrally located with adequate security, a brilliant sea view. We get to live here for R1100 per month. My flatmate and I pay R2200 for a three-bedroom apartment.

Many of the new doctors don’t want to live in the flats. They are old, the outside looks a little dilapidated and the first two floors had a history of cockroach problems (which has been sorted out). They justify their choice with, “I’m only here for two years, I’d rather live close to the beach.” They pay between R6,000 and R8,000 per month for two- or three-bedroom apartments. This often excludes water and prepaid electricity or 24-hour security. That is 300-400% more than we are paying.

The last thing I noticed is the absolute ignorance towards savings and investments. Of the 52 interns who started at Livingstone hospital, I’ve chatted to more than 40 of them and only two of us have TFSAs.

One of them even said his financial advisor told him that TFSAs are “only for poor people”. People blindly follow the advice from advisors from companies like Sanlam (which gets sold to us under the Abacon brand), Old Mutual and Liberty with very few people even knowing that 10X, Sygnia and EasyEquities exist.

People have private financial advisors that have them investing in Funds with TER > 3% with many hidden costs. When they asked them about TFSAs, they said “oh yes we can talk about those when you want to get serious about saving!”

From a financial point of view I’m on target to have my TFSA topped up for 2018 within four months. My emergency fund is also growing nicely, already up to three months of living expenses.

I’ve also done a bit of research and found that you can save quite a few rand every month on insurance if you increase your excess payments when you claim. You should only do this if your emergency fund is able to cover the amount of excess that you are taking on (maybe even two or three times over so that one single claim does not consume your entire emergency fund).

Mary-Ann wants to know if her emergency fund can do better.

I am currently keeping my emergency cash funds of about R100k in my OST account which currently earns me 5.638% - better than a Savings account.

I’ve been trying to figure out if it is worth putting that cash into something like the Newfunds GOVI ETF or Newfunds or Satrix ILBI ETFs.

It seems to me like I could earn closer to 8% there although would need to deduct the TER from that return.

I realise that the capital could fluctuate slightly, but is there significant capital risk to make it not worthwhile? It could get liquidated if required in a few days. I would probably continue to keep a portion as cash for immediate emergencies that could not wait a few days.

What are your thoughts on pros and cons of this strategy? Where might I do better? I hate having money laying around not earning its keep!

Milan has an answer for Georgie regarding her bond insurance. I think he’s going to save many of you a lot of money.

Georgie mentioned having trouble trying to reduce her credit insurance premium. There's an easy way around this issue.

The new credit life regulations state the credit provider must allow the bond holder to substitute the insurance cover as long as it provides the same level of benefits.

In other words Georgie can look to other credit life insurance providers for insurance on her bond and get a quotation based on the outstanding balance of the loan.

Antoine (who shared their thoughts on RA penalties being like debt) has another pearl of wisdom. They say, regarding when to spend and when to save

I heard a good explanation for this on “Money Management Skills”, from the Great Courses series:

Think of your past, current and future self.

If you borrow money, your current self is taking from your future self.

When it comes to a home or study loan, you can argue that future self will also benefit from the house or degree, so it is not that bad.

When you save money, you are sending some money to future self. In this instance, it doesn’t make sense that your 30-or 40 year-old current self can’t do anything fun while you’re still young and active and your future 90-year-old self lies in bed with millions in the bank.

I recently bought a new bike. I am able to buy a very fancy bike cash, but at a certain price the marginal gains are not worth the money you spend at my level of cycling.

Instead of spending thousands extra on a bike that’s a bit lighter, I decided to get a good enough bike and shoot some of that cash to my future 70-year-old self, so that he can use that cash to go on a nice overseas trip.

Last week Keith Mclachlan took issue with ETFs on Twitter. We gave him an opportunity to share his views on our website. Paul reckons he hit the nail on the head:

Because we all wish to improve our knowledge and understanding of investments we should welcome Keith’s view.

I just don’t see any misunderstanding;

He uses ETFs when/if he doesn’t know/understand a market and doesn’t have the time to study/follow it. That’s what we all do. That’s the reason ETFs exist.

Glad to see my investment strategy mirrors his.

Denzel just discovered fees. He’s not happy. He has questions.

I’m sorry to get back onto RAs again but the fees these f*ckers have been charging me is absurd. Now I know why my FA drives the car he does!!

I have two RAs:

One is with 10X (very happy, even though returns to date are average, market not great)

The other is with Liberty through a FA. They invest in Allan Gray and Coronation.

The fees are just crazy.

See below image of the EAC I have just come across. I’m so angry I didn’t look at this before.

I’ve been with them for two years after moving from Discovery (another mess).

Would it be best if i cancel the Liberty/ AG/ Coronation F*ck up and put it all into 10X? I know it seems obvious, but I have to ask!

I have a Liberty Evolve investment with them too

Again, crazy fees (like 8% it seems!)

I’m thinking of cancelling this and placing this straight into Easy Equities, spread over a year or two of course.

I have an emergency fund of just under three months that i'm building up to be six months where i'd be comfortable

Would it be best to use the evolve investment to get this to six months worth and then put the rest into my Easy Equities TFSA/ Equities?

The only debt I have is my wife's car, Still owe about R200k on this - Pay off first?

Pieter wants to know how to find a cheap car.

In one of your earlier shows Simon mentioned how he figured out the year price (or something) to help him to buy an underpriced second hand car.

I can't remember which episode and I am having trouble figuring it out. Could you please be so kind as to give the formula again?

Subtract the current milage from 150,000 (or whatever you suspect the Death Mileage is for a car). Divide your expected annual milage into the remaining milage for number years until you suspect the car might have no real economic value. Divide that number of years into the price. That gives you a ballpark of cost per year. Now you can compare cars!

Flipi is living in Japan at the moment. They wrote us about RAs a while back, but this week sent pictures of the cherry trees in bloom. Since this show comes out on a public holiday, I’m including them in the show notes. Seeing the Japanese cherry blossoms are a bucket list item for me. Thanks for sending them, Flipi!

[gallery ids="7483,7484,7485,7486"]

So many Fat Wallet listeners are diligently setting money aside for their kids. We often field questions about investments and suitable investment vehicles for children. Being able to send your child into adult life with enough money is a noble aspiration.

We don’t often encounter people who benefited from this type of financial leg-up, making it difficult to guess at the impact it has. This week, listener Pieter let us in on his experience as the beneficiary of this sort of parenting. He also tells us why he doesn’t think it helped as much as it could have.

He writes:

The biggest financial issue for my dad has always been paying off their house. He used to say that he would have done much more with us as younger kids if he didn’t have that debt. He took it upon himself to make sure my sister and myself get a good, debt-free start to adult life. We are very fortunate that he helped us buy our first house cash, and had some money left to invest. For this I am truly grateful.

BUT!

My financial education was as follows:

At age 10 my dad gave me a little book and a pen and told me I need to write down my allowance and spending. It took all of 20 seconds and I think I wrote one line in that book. I never saw him do it and he never asked me about it again.

More than decade was wasted simply because I was not financially literate. Worst of all, it lead to the mismanagement of the assets with which we were entrusted. If I knew at 18 what I knew at 33, I would have been much closer to retirement.

To save oodles of money for your kids is a nice gesture, but teaching them about that money makes the biggest impact.

Both my kids have TFSA ETF accounts at Absa and that is all fine and well. But I am making an effort even at their young age to educate them about money. Once they’re older they will be included in budget talks and planning, know about salaries and about their investments. I want them to work with money and make mistakes while I am still there to catch them.

You also mentioned in the podcast that talking to your kids about finance means you should fix yours. I also feel that you should include them in your failures. Learning comes from failure so go at it :D

We live on a farm and pay the kids allowance for chores using poker chips. It’s a mission to have a bunch of 1 rands everywhere.

We soon realized that we we’re running out of poker chips and had to make a plan.

I built a small "bank" for them where they can deposit their poker chips. I added some budget functionality and my plan is to add some interest dynamics when they are older. I put it online for some friends to use and figured you can point other parents to if you want. (I gain nothing from people using it. I just like to share).

Shane wins second prize, for putting his money where fees aren’t.

Thanks for the great on TFSA Transfers!

I've decided to be a guinea pig, and initiate my transfer out of those super high fee people (Old Mutual), and into the safety of my EasyEquities account.

It's been fairly painless so far, all I did was call each provider, told them what I want to do, and they mailed through the forms.

Now the 10 day waiting game begins.

Kris

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Richard Watson reckons the time for silver investing has come and gone.

The listener who wanted to put all his cash into silver might want to move half into vanilla!

Dirk is looking for a place to invest for his little girls.

Seems as if Sygnia has quite a reputable TFSA with lowest costs I have seen in the market thus far.

I am thinking about opening a TFSA for each of my little girls in the near future.

We’d like to commiserate with our friend Petrus for paying a rental management firm 10% commission every month for no good reason.

Been paying these fuckers 10% commission for more than a year for nothing!! Anyway, just another point for NEVER buying!! I have a good tenant (well, I hope as I'm sitting in Germany), so I will be dealing directly with him until I get to sell the piece of shit property.

He also has an excellent point regarding emergency funds.

Just a quick sanity check. Why should I not use my credit card as an emergency fund? It seems wasteful to have say three months worth of living expenses sitting in cash not earning anything. Surely with the 58 days (I think) interest free you get with your credit card this gives you enough time to draw money from your investment (of course not your TFSA) before you have to pay interest.

I guess there is a good reason you keep this in cash, but I am not sure what this is.

- Fees

- If you use your credit card because you lost your job, how will you pay it back?

Perwez wants to help his wife find an index-tracking RA

My wife recently resigned from her job and now has her retirement funds available to invest.

I’ve told her the best option would be to open an RA with what she has rather than converting it to a provident or preservation fund.

I’m a firm believer in passive funds and I have been doing some research in what is available within RA wrappers. Other than the usual suspects (below), do you know of any other passive RA products/wrappers?

Thus far, Im leaning towards a 50/40 split between the Prescient balanced fund and the Nedgroup Core Accelerated funds, both of which are available on Momentum Wealth's RA LISP (the only platform I know of that has both funds available) and adding the remaining 10% to an index tracker focusing on property.

- Prescient balanced fund

- Nedgroup Core funds

- Satrix balanced fund

- Sygnia Skeleton funds

- 10X

- Easy Equities RA funds

- ETFSA funds

- ABSA core RA passive fund (although latest factsheet is from Sep 2016)

Hannes has literally sold the farm - or part of it, at least.

I‘ve sold part of the farm and must now invest the money wisely.

Everybody tells you to see a certified financial adviser - I am still to meet such a creature.

The inputs I have had creates more confusion than clarity and I get the distinct feeling that a corporate overseer is involved and that fees are not realistic.

Can you give me some pointers?

Is there anybody that is knowledgeable about trusts since the property is in a trust?

In the podcast we recommend that Hannes get in touch with Craig Gradidge. You can contact him here.

Miles compared a bunch of balanced funds and found that the NewFunds MAPPS Growth ETF outperformed the others by a huge amount.

Although it’s overweight Naspers, at a TER of 0.20% - great.

Even a medium risk TFSA blend would probably battle to beat this growth!

I seriously think, for a TFSA portfolio of ETFs, MAPPS could have about 20% allocation.

To remind you, this ETF has:

Cash (4.56%)

Equity (75.65%)

Inflation-Linked Government Bonds (9.11%)

Nominal Government Bonds (10.68%)

Marlene has a financial responsibility vs lifestyle balance issue.

I am saving a lot for retirement and not so much for the things I want to do, which is travel. I feel like my brain is in save mode.

All of a sudden I am anxious to save for everything. From a deposit for my next car, to a deposit for country house (when I retire) or nice-to-have item.

How can I balance the two as I grow older, seeing as I am 31? I want to retire comfortably but also travel. I feel like I cannot just focus solely on my retirement portfolio and medical expenses, but want to travel and enjoy life whilst in my 30s. I opened the ETF accounts to utilize when I retire. Hopefully they will grow as I reinvest dividends, and the market doesn't collapse like 2008.

Should I resume my investment strategy as is, or should I look at other ways of growing my portfolio? Please also advise if I am saving too much for retirement/ future medical expenses as opposed to doing things I want (travel).

A few weeks ago I attended a 10X event in Johannesburg. Being a low-cost retirement annuity (RA) provider, obviously much of the discussion centred around fees. Steven Nathan, who runs 10X, did an analysis of a statement sent by an old-school retirement product provider. He used the real example to illustrate how impossible it can be to figure out what we’re actually paying for our investments.

Listener Jenny Pigeon (a nom de plume, if you will) had the same experience this month. She’s been investing with Allan Gray for 16 years but never thought to check her fees until she discovered The Fat Wallet Show.

She sent her statements on to me, hoping I could help her figure them out. Since I’m of the new school (0% platform fee, 0.25% brokerage, 0.1% TER), I couldn’t. Simon had brushed up against these sort of products and still has an Allan Gray product. He couldn’t do it either.

It took two weeks before Jenny, Simon and I got to some sort of answer, which wasn’t too bad, actually. In this episode we talk about the process, why successful investing means you’ll inevitably pay more than you contribute and how little we like the percentage of assets business model.

We also decided to include my preparation notes to try to make the topics more searchable. It’s not as great a solution as a transcription. However, it’s a free solution. And some (us, mostly) would say that’s the best solution.

Christoff Gouws sent a link about the P/E Ratio of the S&P 500. http://www.multpl.com/shiller-pe/

It is a great way to guage the “value” within the whole S&P500 (for example when planning on buying some more ETFs tracking this index). As you know, when evaluating single stocks, any P/E ratio above 20 is considered “overvalued” or “expensive”. To this, an interesting thought is the current “overvalued price” of the whole S&P500, since the Shiller P/E Ratio currently stands at 32.38! More market-correction (as was seen in the last few weeks) is needed I guess!

Win of the week:

Me, for figuring out this thing about total return ETFs.

A total return ETF reinvests dividends instead of paying them out to you. The idea is that you save on the brokerage, because there’s no charge. This only works if you want to use your dividends to buy the same ETF.

However, you do get taxed on the dividends before they’re reinvested.

What I learned:

Once you get taxed, they don’t actually buy more ETF units. They simply add the value of the dividends to the NAV of the ETF. When you sell the ETF at a profit, your CGT is calculated based on the sell price minus the buy price. But your sell price now includes dividends you already paid tax on.

We need a spreadsheet ninja to work out when your CGT becomes more than your brokerage. We also need to work out if this applies to bond ETFs.

I also wanted to send a shout-out to Warren. He says:

Today is both a happy and a sad day. Happy/ relieved that I have FINALLY finished listening to ALL the fat wallet show podcasts, including all bonus episodes, Christmas and the like and a sad day as now I have to wait for the new ones to come out (I don't even know when these are released as I would download them as I go, on free office WiFi of course).

I would just like to say thank you both for putting this together. I am a 26yr old Investment Analyst (so not as cool as your engineer or doctor friends haha) and currently also studying towards my CFA charter. Its refreshing listening to this podcast as its takes all the complicated things I deal with on a daily basis and states them in a nicer simpler way. The links to the IG and other webinars are also great.

We inspired Jenny Pigeon to confront her investment fees for the first time.

I am in my early 60’s and would like to retire fairly soon. I am self-employed and instead of taking out a retirement annuity I have "paid my self first” and paid regularly into Allan Gray.

Since my new addiction of listening to you and Simon on The Fat Wallet Show, I have decided, for the first time ever, to read my Allan Gray Quarterly Statement.

There are about 20+ different funds on my platform. I have asked Allan Gray to send me the total fees for the quarter in rands, as I find the maths a bit complicated with so many different funds with different fees.

My fear is that my annual contribution (R240,000) could in fact be less than my annual management fees.

I would love to make significant changes to reduce costs and therefore improve my investment performance.

She does have another problem. She’s become friends with her advisor, so I want to try to help her understand and simplify her fees without burning bridges.

She sent a statement. And then some more statements with the rand amount for the period. Then there was a Twitter storm. In the end, I managed to work out:

She pays more in fees than their monthly contribution of R20,000. Based on the latest info, fee is 0.78%.

Paying more than your contribution in fees isn’t impossible. If you contributed R1500 to an ETF and ended up with R1m, at a TER of 0.15% your contribution would match your fees.

In one account she’s invested in nearly 30 different funds, including one that "reduced the minimum fee from 0.70% to 0.60%, the maximum fee from 2.10% to 2.00% and the fee at benchmark from 0.85% to 0.75%."

Only 8 have an investment management fee under 1%. 11 have investment management fees over 1.5%. Average investment management fee cost over funds, 1.5%. Excludes platform admin of 0.23%.

This fee excludes Annual Administration Fees, Annual Financial adviser fees and

Initial financial adviser fees.

She also has a second account, which includes five more Allan Gray funds - some of them feeder funds, some UTs. The investment management fee for all of those comes to 1.98%.

“Some annual administration fees are deducted within the unit trust and are included in the investment management fee.”

Some feedback that I got from Twitter.

Let’s start with, when was the investment made or moved to the AG LISP? Looks like you are trying to stir up some attention here. 😉

- She set up the fund in the early 2000s.

Doesn't sound right...Allan Gray caps the annual fee at 1%. An initial fee can only be charged once.

- All the statements she sent included an initial advisor fee as well as an annual advisor fee

Passive? Which index is the UT tracking?

- Turns out, she has some passive like the Satrix ALSI and the MSCI World, but in the smaller account all of her funds are actively managed.

Two people said the advisor is the one to blame:

More of an advisor problem than AG. You can get Nedgroup Core Diversified and Core accelerated trackers for a exactly 1 percent (inclusive) on AGs platform.

This is a function of the advisor screwing the client. Important not to bad mouth the platform, active management or underlying funds.

Kris

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Georgie wants to save on bond insurance.

18 months ago I took out a home loan for R1 million.

I managed to pay off R400 000 in the first year.

Now I am paying the remaining R600 000 in monthly instalments, with no adjustments to the interest.

To qualify for the home loan, I was required to take out full bond insurance.

I’m paying a monthly amount of just under R500 to insure the R1m bond, only 60% of which I would actually use if the situation arose that I was unable to pay.

I have asked the bank for my "principal amount" of R1m to be re-evaluated, with no joy, just a convoluted answer about having to take out another home loan, which I would then need another Offer To Purchase for, which seems ridiculous.

How can I work this situation so that I'm not overpaying for home loan interest and insurance?

Madelyne says we’re wrong about the Satrix 0.1% TER.

Currently on etfsa, it is listed at 0.31%.

That makes the Ashburton top 40 with a TER of 0.16% more attractive.

Wealth needs help making choices about their tax-free account.

I have previously invested in the tax-free Allan Gray balanced fund, and although it is a good fund the fees are far too high (TER of higher than 1%).

I am glad I can move from this year, but I am not sure what to take and what to do with the new allowance.

I like the ETF options as discussed in you one ETF to rule them all show but are looking at REITs as well.

Reason being that the dividends from REITs are taxed as normal income outside of a TFSA. This makes the TFSA a bit of a hack for a good future passive income in retirement.

I am just not sure what good options there are, I know ABSA’s property equity fund is very good but again fees are a stumble.

Edwin wants to diversify his property portfolio.

I have three investment properties and would like to diversify my wealth.

Two of these are paid up and the last one will be in about two years’ time.

Is there a way I can use my paid up properties to get a lump sum of cash that I can use to put into ETFs without selling the properties? The rentals already go towards paying off the 3rd property. I’m trying to diversify by stealth.

Lawrence says we’ve been giving him sleepless nights following our single ETF strategy show.

He has some shorter-term objectives in his TFSA, but thinks that he can afford to be slightly more risk tolerant. He’s thinking about:

a combination of 2 ETFs - one high risk with the majority of my holding per year and one low risk for when I reach a level I feel I should sell out and trade into the more stable ETF.

An example could be something with high exposure into Emerging Market or a Resource ETF and a Top 40 ETF as a combo.

Normal ETF Account

Then on my normal ETF profile, just to keep it plain and simple with something to keep putting money into over time and not looking for any special returns.

Mbasa wants to know if RAs and provident funds can really be counted towards your net worth.

On disposal of ETFs and Unit Trusts, do you pay CGT?

Colin’s friend is being threatened with fees.

I sent a copy of this week's newsletter to a mate who seems to be stuck with a 'policy'

He replied to me that he cannot cancel the policy until he is 55 and that the broker has threatened to charge all admin fees until the end of the policy. Or words to that effect.

Is this type of stuff legal, and who is the best person to give some advice?

Shaunton wants an RA without an advisor.

Simon mentioned that he has an RA that don't have any financial adviser involved?

What is a good platform that one can use to invest in your RA without using financial advisers?

What is good DIY RA options to investigate, which products to use?

Nehal took his TFSA situation into his own hands like a boss.

It took just one secure message while on the share trading platform and they moved my portfolio from the internet banking site with a R10 monthly fee to the share trading platform at zero monthly or annual fee and just the trading fee.

However since we can now transfer or TFSAs can you please make a mini podcast just with what Simon said about ABSA being the cheapest and that we can now transfer.

Last week I was lucky enough to join my ETF inspiration Nerina Visser on ETF Investor on Business Day TV. We attempt to answer the ETF questions of a beginner investor who invested in an Easy Equities basket.

This week’s Fat Wallet is the audio of that programme. You can watch the videos below.

Kris

123

- Listen / download here.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

We can finally move our tax-free accounts - in theory. In this week’s episode, we consider the curious case of Rama, who is getting properly shafted in their tax-free account. We use their misfortune to help you work out whether you should be moving your tax-free account. We also issue some warnings about being on the front line.

We have very unflattering things to say about Old Mutual. By sheer fluke, three listeners wrote us about three different ludicrously expensive Old Mutual products. Aside from the actual fees you pay on these products, you are also robbed of your peace of mind. Even people who made all the right choices to provide for retirement have come out behind because they were sold products that didn’t have the investor’s best interests at heart.

If you suspect you are holding a product that isn’t 100% geared to benefiting you, do something about it today. How do you know? Check your fees. There are very few financial products these days that cost more than 1% per year. Just to be clear, that’s a percentage of your total investment.

We also offer some ideas to a listener who feels out of control of his retirement savings. We explain how understanding your regional exposure, sectoral exposure, fees and asset allocation can help you plot a way forward for your investment lifetime.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Your first investment will scare you half to death. Don’t let anyone tell you different. We’ve all felt that terror (some of us more than once). We all came out the other end secure in the knowledge that we are now among the select few who Invest in the Market.

Hannes, a Just One Lap user, has been following Simon since before Just One Lap existed. He’s paid for a share trading account every month for the better part of a decade, and yet never managed to pull the trigger on that first investment.

In this episode we discuss the things we’re afraid of when we start investing and how to overcome those fears. Like Lesigisha pointed out last week, effective compounding depends more on time than money. This excellent Stealthy Wealth article illustrates that point very effectively.

Links

Frank was perplexed by this quote from a Moneyweb article, “Taxpayers may even include any capital gains that they are liable for in a particular year of assessment as part of the 27.5% tax deduction."

In this episode we explain how that works.

Chris is concerned about spreads in ETF products. As we explain in this episode, spread is the difference between the price people are willing to pay for a share and the price at which people are willing to sell. ETF prices are determined by market makers, not buyers and sellers like ordinary shares. Why then are the spreads so large?

His email is below.

I was intrigued by the discussions around the Lars Kroijer videos and your post "ETF: The whole world in your portfolio". This got me thinking about implementation of such a strategy and I started looking at TERs and spreads of local top 40 ETFs and the global ETFs as I will most likely opt for the cheapest products.

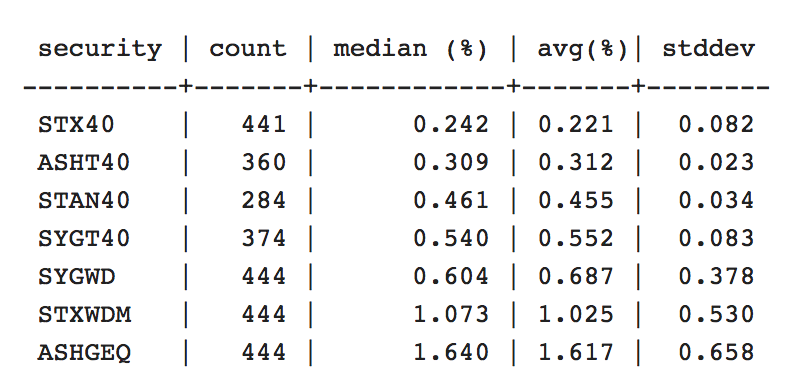

TERs are easily available and published by the product providers and some third party sites such as etfSA.co.za. But nobody ever talks about the spreads. I wrote a script to poll bid/ask prices every 5 minutes throughout the trading day and computed some statistics on them:

The count column is the number of samples taken, median is the median of unfiltered data, avg is the arithmetic mean after filtering for outliers and stddev is the standard deviation from the mean.

Because ETFs trade fairly infrequently compared to normal stocks, I think it is safe to assume the market makers participate in the majority of orders. Thus, the figures above should be a fairly accurate view of the spreads the market makers maintain.

Now I understand the spread is a once off "cost" that I pay, but look at those numbers. 1.6% on the Ashburton global and 1% on the Satrix world!

Kristia

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

For many South Africans, saving simply isn’t an option. Either they don’t earn enough to be able to save, or they have too many familial obligations to do so. In this episode we offer some tips on things you can start doing on a very low income to put yourself in a better financial position in the future. We also talk about some common traps high income earners fall into.

If you’re already too scared to listen, here’s what we talk about:

- Why insurance might be a better idea than an emergency fund.

- Why a low income is the best place to start preparing for a bright financial future.

- Why debt is not your friend.

- How cost per use or cost per unit can help you make better financial decisions.

- Why you shouldn’t avoid paying tax.

Our win of the week is Lesegisha, who is foregoing sushi in favour of education. As you’ll hear, his letter blows my mind in this episode. For that reason, I’m republishing it in full here.

I am a pious listener of The Fat Wallet Show and the proud contributor to Lewis dragging down our Fat Wallet Index. When I heard the topic of this week’s show I knew you guys were still sticking to what it says on the label and giving advice to the little guy on the street.

Thank you for that and it’ll pay dividends in future if not cheap wine.

I am a 26-year-old full-time postgraduate student (I’m lucky I know but here me out) living on R6000 a month.

This may sound like a lot for a student but bear in mind I have previously held a full time paying auditing job with plenty of travel perks and whatever bells and whistles that come with the occupation. So I have tasted the fruits of freedom and R6,000 in that context is worse than my life before I knew what sushi tastes like.

I've been studying the topic of investing, business and leadership since I was 15, reading Rich Dad Poor Dad and can say the easiest and biggest investments that one can make on a small paycheque is in their financial literacy.

The concept of pay yourself first cannot be overemphasised.

In my budget the first R300 goes towards everything finance and investing related. I split it R120 for my active share portfolio, R120 for my tax-free savings portfolio and R80 into a rolling emergency fund which I draw down to R80 after three months to invest the excess in my active portfolio and my tax-free savings. I’ve been with EasyEquities from the very beginning.

“Lost money” that I find in my jeans, birthday presents etc I take in cash or direct my friends and relatives to make deposits to these accounts.

I make sure that at least once a year the R300 buys me a decent book that can help me stay on course. My Best Buy and read so far was Fooled by Randomness by Nicolas Taleb and Security Analysis by Ben Graham (which costs the equivalent of six months' investing capital).

The reason I do this is to entrench the habits of having my money work for me while it’s in triple digits so that when I eventually break my glass ceiling the pressure isn’t there to learn habits that I had the opportunity to learn before lifestyle creep.

My biggest belief is that the size of my return will be materially disproportionate to my input not because I’m gambling, but because I take the time to learn as much as I can about the basics of money that you guys mention. I always look to put my money hard at work where it’ll earn me the biggest most predictable returns.

The law of compounding interest says, start early not start big.

The rest of the R5700 I survive on with the piece of mind of knowing that I have used the best part well and that there will always be someone who is surviving on waaaay less and not complaining.

But my key takeaway is that on a small paycheque education is your biggest investment and then pay your future self first. The rest is survival as we know it.

Kristia

For a moment there I got excited. I blame Peter Hood, who dangled the capital gains avoidance carrot dangerously close. Peter’s theory is elegant:

Use your capital gains allowance each year to offload your cheap ETF units at a profit and then buy them back at a higher price. Your cost per unit goes up over time, allowing you to pay less capital gains tax when you eventually cash in for real.

Unfortunately, traders ruin it for everyone. Regular (read, annual or more) transactions in your trading account lands your squarely in the investing-for-income category. Income, as in “income tax.” Yeah.

You may be able to hack it by having three different ETFs that you sell and rebuy on a rolling three-year period. That sounds like a lot of admin, but the tax saving might just make it worth it. I’m not often grateful that I have a growing portfolio (I was going to say “small”, but I like the more hopeful term), but this time it works in my favour. Unless my portfolio doubles twice over, I’m not even close to the profit exemption. I have time to figure this out.*

Links

Thanks to Christoff and Mukhtaar for sharing this link to the financial independence calculator. This tool will help you work out the most tax efficient way to invest your money. They sent this following the discussion we had about tax on a retirement annuity. Play around and share your insights with us.

Francois Louw shared this ShareNet article on Top 40 offshore earnings. It’s an awesome tool. ShareNet will publish an updated version this Thursday - this data is about a year old. Keep an eye out for that.

When we had the discussion on renting vs owning last year, many of you shared this Rolling Alpha calculator. Johan Uys discovered it last week and shared it with us. I’d forgotten how much fun it is.

Lastly, next week we’re doing an episode for people who earn very little. If you consider yourself a low income earner, send your concerns to ask@justonelap.com.

*Unless my ship comes in. I expect it any day now.

Following last week’s investment crisis episode, indices seem to be on everyone’s mind. We decided to dedicate this episode to all things index. Navi wanted to know which ETFs we’ll be investing in this year. The Ashburton 1200 looks very appealing for us both. Nobody saw this coming - least of all us.

Frank Denys made a case for ETNs that practically had us throwing our money at him. It’s a product I intend to learn more about. In the meantime, I strongly suggest you direct your ETN questions to our friend Nerina Visser from etfSA.co.za.

Tim is so into ETFs he’s been reading SENS announcements. He realised that he doesn’t know how the delisting and listing of additional securities work with ETF providers. He was worried that it might be an ominous sign, but we reassure him.

What is the best thing to do with your tax-free account when you are already retired? Jim is 76 and not sure if he should be keeping his allocation in cash or ETFs. We help him think through his decision.

Fernando thought he found a workaround for our single ETF strategy by investing in a passively-managed unit trust. We have some bad news for him that might land us in trouble.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

Did Dale Towert ruin our lives, our business and possibly the ETF industry? Turns out Dale is a powerful guy. He sent a link to the “Investing Demystified” video series by Lars Kroijer and immediately changed the way I think about ETFs.

In the videos, Kroijer makes an argument for a single world-wide ETF combined with bonds as a complete investment strategy. Over the years my ETFs expectations changed. Instead of hoping for market return, as it says on the sticker, I’ve been trying to use my ETFs to outperform the market. In douche parlance, it’s called “seeking Alpha”. In the real world, it’s called “a fool’s errand”.

We didn’t think it was possible to simplify our investment strategy more than our existing ETF portfolios, but in this episode we do. By the end of the conversation, I land on holding the Satrix MSCI World (Developed Markets) and the old school Satrix Top40.

We also discuss a Finweek article sent by Christoff Gouws. The article advises structuring your retirement savings in a more tax efficient way. It inspired me to work out how much tax I would pay on the one third of my annuity I’m allowed to cash out in retirement. The answer horrified me. At my current savings rate, I’ll pay 34.6% tax on the lump sum. This excludes the income tax I’ll pay from the money I earn from my annuity. I used the rates on this page.

At first glance, I’ll be paying more tax I’m currently saving on the lump sum. On the other hand, the 27.5% tax break I’m currently getting is pushing me into a lower tax bracket. That means I pay less capital gains tax - largely irrelevant because I have no intention of cashing in my investments.

The tax I’ll pay on the annuity income is what is going to resolve this issue for me. Currently, the first R117 300 per year received after age 65 and R131 150 after age 75 is tax-free. Presumably I’ll withdraw the tax-free amount every year and supplement my income from other investments. My tax-free savings account will come in handy here, as well as my R40 000 capital gains allowance.

It’s also worth considering the opportunity cost of not making the most of the tax rebate. Can the money I save in the lower tax bracket earn more money than I’ll be paying in tax once I retire?

My head hurts.

If the article inspires you to go through this process and you have more success than I’ve had, please share your calculations with me.

Lastly, Simon talks about an index methodology mailing list in this episode. Subscribe to that list here.

Remember to send your questions to ask@justonelap.com.

Kristia

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

The below letter from one of our listeners stopped us in our tracks. So often we have no control over the course our lives would take. The challenge is to ensure our finances are in a position to sustain crises. In this episode, we talk about how to spot our own financial weaknesses and how to recover from a financial disaster.

I have always been a HUGE fan of property.

About eight years ago I was doing, I thought, pretty well. I had a high-paying freelance gig (very much the norm in my line of work).

I bought four investment properties and was comfortably funding the shortfall between the rent and the bonds, levies, maintenance and other expenses. That was my road to financial freedom, or so I thought.Then, just like that, the high life ended. I was called into the head honcho's office one afternoon and told they were changing direction and not to worry about coming in the next day. After 10 years, I was given 24 hours’ notice.

Back then I had never heard of income protection and I ended up losing everything. The investment properties, our cars, the house my wife, kids and I lived in. Everything. It was so dire that we had to move back into my parent's house. You have no idea how humiliating that time in my life was. I felt like the biggest loser and failure on the planet.

We slowly started picking up the pieces. We found a small flat to rent, we managed to buy a small, old second-hand car cash. It's been a very long road and we are nowhere near where I want to be financially, but I am pretty proud of what we have been able to achieve over the last year.

For the first time ever, I am going into a new year with a small, but growing, emergency fund. I also now have income protection in place. Another first, I have paid one of my kids’ school fees upfront for the year, thanks to you guys mentioning it on the podcast. That decision will save me 8% on his fees this year. It's been a slog but I finally feel like I am starting to get my head above water.

I also managed to invest a fair amount over the last year for what I planned to be a deposit on a home for my family. We have been desperate to own our own home again and it has been burning my ass 'paying off someone else's bond’ as is often said. It's the one thing about this whole process that has been eating away at me.

I started listening to your podcast late in 2016, so just missed the property one. Thanks to that specific podcast, I've changed the way I look at it and now I'm ok with not owning. I also realise I'm probably better off as there is no way we could afford to own a similar house in the area we're in if we were to buy. We would have to downscale significantly and move quite a distance from the schools our kids are in.

Thanks so much for sharing your experience with the Fat Wallet community. I think we can all learn a lot from your situation. Massive kudos for picking up the pieces smarter and better!

Kris

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

- Sign up here to receive an email every time a new show goes live.

We received an excellent email from Jason Herron, who has found a way to make Discovery Vitality work hard for him.

I have a little love affair for Discovery miles and thought now that you are using Vitality, it could be useful to you and the listeners.

There is a bit of admin in getting the best Miles collection rate. You will need the following:

- Discovery Credit Card

- Discovery Vitality

- Achieve gold status in vitality and eventually Diamond after 3 years of gold.

I know having a credit card goes against the teaching of your podcast, but have a minimal limit and pay it back in full every month.

When spending on the card you earn 1 mile for every R15 spent.

The key is to get to gold and spend at partner stores. You get 5x miles ie. 5 miles for every R15 spent. Then eventually Diamond

status you get 10x miles so for every R15 you spend you get 10 miles.

The partner stores are very common stores that we all spend at anyway.

- Dis-chem/Clicks

- PicknPay/PicknPay liquor (wine for Simon)

- Shell/BP

- Computicket, Takealot, Ticketpro

- Nando’s

- Exclusive Books

- iStore/Incredible Connection

- Hirsch’s/Coricraft

- BabiesRus, ToysRus, Hamleys, Reggies

- Golfers Club/Pro Shop

- Vida e Cafe (I know you love coffee*)

The best thing about Discovery miles is they can easily be spent at most of these partners. For me, the key is to use them exclusively on travel.

When you book on Kulula with Discovery and are on Diamond status, you get 35% off the flight plus an additional 10% if you pay with your Discovery card. You can also use miles to offset the

balance of the flight. There have been many a time when I’ve had to pay a few cents on the credit card (free flight) as you can use miles in multiples of 10 only. 10 discovery miles is worth R1.00 with Kulula.

If you’d like to go international, Discovery miles can easily be converted to British Airways Avios or SAA Voyager miles on the Discovery site. Avios 1 to 1. Voyager 1.2 discovery miles per voyager mile. Also nice for upgrades.

*I really, really do.

There’s nothing Wolf of Wall Street about long-term wealth creation, especially for us index investors. You diligently put away what you can and wait for the market to do its thing. If you’re not fond of watching paint dry, you probably won’t get your kicks from this investment strategy.

It’s not surprising, therefore, than we often receive questions about alternative asset classes. If you’ve been bored out of your mind with your investment strategy, you are ready for some action. Like everyone else, I’d love to tell the story of the one investment decision that made me rich. It’s investment lore at its best.

In this podcast, Simon and I discuss the alternative asset classes we get asked about and why we never have a satisfying answer for thrill-seekers or artists.

Happy New Year! We hope to make this your (and our) most successful financial year ever.

Sticking to the theme, we talk about our financial resolutions for 2018. Last year I made the same financial mistake twice. In trying to avoid cost, I incurred unnecessary cost and aggravating effort. This year, I hope to develop mental models so I can stop making the same irritating mistake.

Simon shares his financial goals for 2018, as well as why he doesn’t believe in goal setting. Since 2017 proved me an excellent goal setter, we disagree on this point.

While every question we receive on this podcast pertains to a completely unique financial situation, some themes recur. More often than not, the questions we receive pertain to property investments, tax efficiency and foreign investing.

In this mini podcast, Simon and I discuss the answers we give most often to these questions. If you’re a regular listener, a lot of this might sound familiar to you. Perhaps hearing us talk about them again inspires you to revisit these areas to ensure you’ve got the right mix for your financial situation.

We are so happy that you’re taking a break from your merriment to share a few minutes of your holiday with us. We hope it’s a pleasant day, however you choose to celebrate it.

If you have a pressing question, sleep on it for a few more weeks. We’re back to our inboxes on 15 January 2018.

It’s safe to say that I think about money slightly more than the average person. Once bitten, twice shy and all that. Weirdly, though, my financial hyper-vigilance sometimes results in exactly what I try to avoid. 2017 felt the need to teach me that lesson more than once.

In the second of our mini podcasts, Simon and I talk about the financial mistakes we made this year. Mine cost a little, Simon’s a lot. Even so, I’d like to do better next year.

We are now officially on holiday, which means I won’t get to your questions until January. I hope you enjoy your festive season as fully as I intend to enjoy mine.

Fat Wallet listener Hugo Schuitemaker and his trusty Excel spreadsheet made a startling discovery. An amount invested at the beginning of the year would have to earn a 19.5% return to catch up to a 10% discount on his child’s school fees.

“Sometimes schools offer a discount for paying the full annual amount upfront. In my case its 10% if I pay the full annual amount of school fees by 1 January. So this naturally called for an Excel spreadsheet. Upfront payment vs Monthly payment.