Timing is everything in investing. If you could get the timing right on every single investment, you’d be rich before anyone else. What we want, in theory, is to put the money in when it costs the least and take it out when it costs the most. That’s it, really.

Unfortunately it’s impossible to know for sure when that is. We guess, we try. Sometimes we get lucky, but most of the time we aim for the ballpark. In this episode, we help Nicole work out when is a good time to take her money out of the country.

What we come up with is really simple: don’t do it when people are panicking.

Nicole

I’m on board with Patrick's thinking. I’d like to move the majority of my discretionary money offshore.

I've been waiting until I'd saved my first million so that I can use interactive brokers without large fees.

I'm finally there, but I'm concerned about the exchange rate. I don't want to end up like the person Simon mentioned who waited 13 years for it to get back to the amount at which they took it offshore. If we assume South Africa will be downgraded in April, do you think the currency will recover at all before then? Is it just a generally bad idea to take it offshore between now and then?

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Why is it so hard to talk to family about money? Shouldn’t the people who love and care about us most be most open to what we have to say? At our live event in Cape Town, someone wanted to know how they can convince their family members to think like them about money. We said it’s impossible, but Ivan disagrees. If this is a problem you’ve been longing to solve, you don’t want to miss this episode.

Ivan

I listen to the Dave Ramsey Show podcast.

On one of the shows someone asked the exact question on how to get his wife on the same page financially.

The response was to talk to him/her about their “WHY” He recommended talking to your loved one about what they want to achieve in life and showing them how saving now and sacrificing in the short term can help him/her achieve that dream.

I thought long and hard about this. With the financial info I had from my father’s affairs made a spreadsheet and powerpoint presentations. I started walking him through the baby steps with a whole comprehensive list of “why’s” he can achieve once he has reached the baby step 7.

I pitched the idea to my father. It gave him hope to change his behaviour since there was a reason and a plan to change his behaviour. It is still early days and it takes effort to remind my father why he is not spending on a credit card anymore, but there has been changed behaviour from his side. This has impacted his finances and his sanity since he has a plan for the future and his life.

Talking about WHY he does things now has changed a lot of elements in his life. I understand that it might not work for everyone but maybe it can work for other people as well.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

If you know you'll be leaving the country for good in the next few years, should you invest your money or keep everything in cash? In the first of five mini Fat Wallet episodes, we help Karlien think through some options.

Karlien

Your show gets me excited to invest, but I'm at a weird place right now.

I'm getting married next year and then we want to immigrate to the Netherlands because I'm a Dutch citizen. We aren't very likely to return to SA permanently. I have no debt and I'm currently saving for the wedding and our big move.

Considering our imminent departure in the next year or two, should I be investing in something like a TFSA or ETFs now, or should I wait until I'm on the other side? If now, how do I make sure I invest smartly considering our move.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

The end of the year is a good time to take stock of how things went financially. At the beginning of 2018, Simon and I discussed our money resolutions for the year. At the end of last year, we revisited some of our financial assumptions.

To wrap up our 2019 Fat Wallet year, we once again discuss our personal finances and which assumptions we’ve come to challenge throughout the year. For me, learning to relax is always a challenge. I spent a lot of money on a holiday and it took me a while to realise that my financial journey is only for me. I don’t need to justify my choices to anyone and if I want to spend a fortune on a holiday, I damn well will.

I’m also starting to be a bit more sceptical of smart beta ETF strategies. After three years of writing the ETF blog, I’ve looked under many hoods and heard many explanations of why a particular investment strategy is simply perfect—on paper. With a market trending sideways for an absurd number of years, these strategies should have come into their own, so why haven’t they? Colour me weary.

We will record a few, short episodes to ensure that you get your Fat Wallet fix throughout the holidays, but this is the last full one for the year. With that, we’d like to thank you so much for your support and participation for another full year. This show is community-driven in every way and wouldn’t exist without you. We appreciate every single download, email, tweet and visit.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Bleeped version is here.

Win of the week: Anna

I finally decided to start investing after listening to your show.

I am starting by maxing out my R33 000 tax free for this year.

While researching tax free accounts I came across an article on Stealthy Wealth "what these 9 experts hold on their TFSAs"

Simon holds Satrix prop 31.8%, Ashburton Global 1200 36.6% and sygnia itrix MSCI world ETF 29.5%.

I then decided to research the fund fact sheets of each one and noticed that the Ashburton 1200 and Sygnia itrix MSCI basically invest in the same companies just at different percentages.

I'm totally new to this so what am I missing? Isn't that then just investing in basically the same product if their holdings are basically the same? What would the reasons be in investing in both these options?

Colin

My parents are reaching retirement age. They mostly worked government jobs and have decent government pensions.

They have a portfolio of properties which is supposed to be their retirement income along with the pensions.

They’ve kept the bonds maxed and used the allowable tax deductions through the years really well.

Getting closer to retirement age, larger chunks of the bonds are getting paid up, as they are going to need to start drawing an income from it within the next five years. They are finding it more and more difficult to find enough deductions on the property alone to cover the profit.

Should they take the money out of the access bonds and put it into a fixed savings? At Tyme bank they’ll get 9.75% for 100k and the remainder with African bank where you get 9.2% on a two-year fixed deposit. (5 year fixed at 10.75%, but wouldn’t want their money tied up for that long this close to retirement).

By doing this they’ll minimising the profit made on the properties as the interest paid will be much higher with the bonds still being maxed.

To wipe out the remaining profit made, calculate what’s needed in RA contributions to have enough deductions to get as close to making a loss as possible annually.

If they're moving R2m out of the bonds/mortgages they're going to be paying tax on the interest earned in any case. So they could then just take 200k odd out each into fixed savings, 30k each into TFSA, they left with R1.5m sitting in bonds/mortgages. Come retirement they could just take the money out of the TFSA and fixed accounts to pay off the bond. Should they put a lump sum into a RA to offset the profit made? What would be the best way to mitigate the tax payable?

Emmanuel

My wife and I have maxed out our TFSAs (ASHEQ and Satrix MSCI) and we are looking for the next best thing to do with the extra income.

- What is your ideal framework for extra income investment after TFSA?

Normal/discretionary long term investments (ideally for withdrawal between 40-55, if it is favourable) and RA

- Did you ever find the answer to the tax efficient way to invest in RAs? Is the 27.5% the best option assuming emergency fund and other needs are in place.

He’s currently building his DIY RA on Sygnia. Here’s what he has:

Kyle

We systematically worked through our expenses and 30 minutes later, viola!!! A revised budget, with greens all around. The next step was putting the plan into action and one month later, most of the plan have been executed... which included amongst other things:

- Cutting back on food budget (we don’t eat less, just buying more efficiently – Yes, 50% off Checkers meals is our thing now)

- Changing bank account to Capitec – Full time (changing debit orders wasn’t as cumbersome as I thought)

- Reducing airtime allocation

- Reducing internet speeds

- Paying up and cancelling ALL retails accounts

- Changing to a cheaper gym

- Driving less, reducing fuel allocation

- Consolidating and changing insurance

- Retirement savings remained the same (RA and TFSA for both of us)

- Short term savings reduced by 80% (but we are still trying to save as much as we can, even with one income)

While the process is ongoing and it hasn't been easy, what I’m most grateful for is that bloody complex-as-all-hell budget spreadsheet.

If you lectured Budgeting 101 to the masses, how would that lecture go down? What do your budgets look like? How is it structured? Excel? Paper? What are the must have categories or line items and do you do your allocations down to the R1 like I do or is it a little more of an estimate. Would love to hear your take on this one.

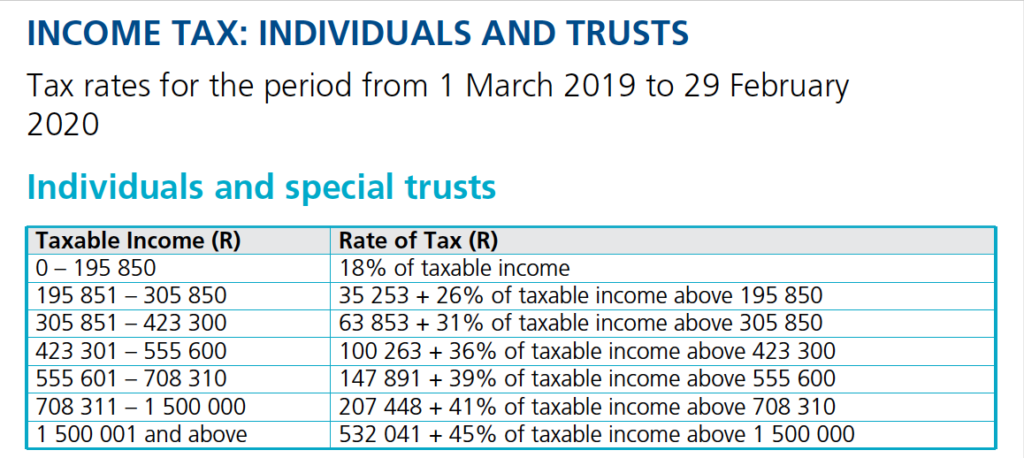

For the longest time I thought a progressive tax system referred to how we spend our tax money. Poor, naive me. It turns out that a progressive tax system means there’s not one tax rate. How much tax you pay depends on how much money you make. Your tax rate gets progressively higher as you earn more income. In a way, you pay less tax on the money you make first.

The table below shows how your income is taxed. Unless you’re in the lowest tax bracket, you’ll notice a rand amount before the percentage you pay on your salary. When you multiply the highest amount in the tax bracket above by the corresponding tax bracket, you get to that rand amount. In other words, all the money you earned before you got to your current bracket is taxed at a lower rate.

A good way to think about this is by allocating a lower rate to the money you earn first. Let’s say you earn R423,000 per year. This puts you at the upper end of the 31% tax bracket. However, since tax is progressive, you actually only pay 31% on everything above R305,850. In other words, you only pay a rate of 31% on R117,150, not on the full R423,000.

A good way to think about this is by allocating a lower rate to the money you earn first. Let’s say you earn R423,000 per year. This puts you at the upper end of the 31% tax bracket. However, since tax is progressive, you actually only pay 31% on everything above R305,850. In other words, you only pay a rate of 31% on R117,150, not on the full R423,000.

If you earn R423,000 per year, you earn R1,185 for every day of the year. Your first R195,850 is taxed at 18%. For the first 165 days of the year, your tax rate is therefore 18%. We got there by dividing the upper end of the first bracket by your daily income. For the next 92 days, your tax rate is 26%. The last 96 days of the year brings your tax rate is 31%.

At this point you might notice there are 12 missing days in your year. Those are the 12 days the government gives you for free. Neat, eh?

It’s good to know the upper limits of your income tax rate, because income from interest or rental income gets added to all your other income and taxed accordingly. This affects your investment choices. If you notice that income from your investments might push you into a higher tax bracket, you can start making choices that might be more tax-efficient in the long run.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Chris

Please tell fellow SA’ns traveling abroad, that the Revolut App is amazing.

You can transfer money into a wallet for 1.6% flat rate and from then on you pay zero fees.

You can also order a card for around R80 , but if you have Apple Pay it’s not necessary as you can just link it.

You pay zero fees per transaction and get really decent conversion rates. It’s much cheaper than any SA bank I’ve ever used.

Martina

I have resigned from my job and October was my last month. I have been offered a scholarship to study overseas in Italy for six months. I have a small side hustle but will not be earning a stable income whilst I am abroad. I have no guaranteed job to come back to. However, I don’t plan on going back to a corporate environment again.

My work will pay out my pension fund which is through Momentum Funds At Work (which has not performed well in the last 2 years). Is it best to put my pension in a preservation fund or an RA?

My understanding is that preservation umbrella funds should carry lower costs / fees than preservation funds and retirement annuities available to individuals, but the Momentum preservation fund fees are 0.76%. and Sygnia Skeleton Retirement Annuity fees are only 0.65%.

I’m not sure if there are hidden fees and what the advantages are of putting it in a preservation fund vs a RA, besides being able to draw from a preservation fund before 55 as opposed to after 55 for an RA.

Charmaine

I heard that you can transfer your annuity from one provider to another for a fee of R650 or something.

I don’t know if this is for living annuities only. If one has a RA with those money grabbers, there are high penalty fees.

What are the options? Shall one turn it into a living annuity and then transfer it?. Shall one draw 17.5% just to get the money out. I think if the value is less than R247,000 you can take all the cash, with obvious tax implications

What are one’s options if you are stuck in an expensive retirement annuity?

Frank

I too have been looking for an offshore investment broker and was looking at Degiro as well. I just wanted to share that unfortunately there have been recent changes in regulations in the EU which resulted in Degiro now requiring its clients to have both an EU bank account and be resident in the EU. That said all existing non-resident clients can remain clients. So it looks like the door on EU based brokers is solidly closed and I'll have to start looking at US investment brokers instead.

Marco

We're currently putting at least R10 000 extra into our bond access facility. This is also essentially our emergency fund. At current projections, we should get the house paid off by late 2023.

My plan is to essentially arbitrage the interest on my house debt (8.9%) to fund a Tyme bank account that earns up to 10% interest.

The plan would essentially be to stop paying R10 000 extra into the bond, but put it into 10 day notice Tyme bank account. If we started with what we have currently saved up, and put in 10K a month from now, we should reach 220K around early-mid 2021 with monthly compounding, and then it should start paying ~23K a year in interest.

Once this is achieved, resume paying the 10K into the bond as before, except now we have 23K a year extra to put into the bond, or an emergency fund that pays for 2/3rds of a TFSA every year (hopefully they increase this amount). If we put the 23K extra a year into the bond, we'll pay off the house by mid 2025(July 2025 ish), around 18 months after if we had just put the 10K a month into the bond.

The argument could be made that we can pay the bond off earlier (end of 2023), but then we're left with no emergency fund at the end of 2023, and have to essentially build it up. The 10K plus the extra money freed up by not having bond payments would build it up faster, and assuming Tyme has the same 10% account, to build up the emergency fund to 220K(probably higher with 6 years of inflation to add to living costs) would take around 12 months.

Also, since my partner and I are married, double interest exemption can be gained per year eventually for the emergency fund. Although we really only would need around 220K for a 12 month emergency fund, so not enough to attract interest and dividends tax--we have no other interest earning amounts.

I know the adage, "time in the market is better than timing the market" holds true, and this plan would limit our RA contributions and TFSA allocations for a year or two, but the payout would be a chunky enough emergency fund that pays 10% p/a and would contribute 2/3rds of one of our TFSAs--not bad for an emergency fund.

Pieter

Do I need exposure to local equity?

Assuming a 100% equity ETF portfolio, are there benefits to holding South African stocks in addition to global index ETFs? I know that the JSE has historically outperformed world indexes, but there is no guarantee this will always be the case.

I am not pessimistic about SA, but I want to be optimally diversified. I am already invested in SA by virtue of the fact that I earn and save Rands. Is there a reason to put those Rands into South African stocks, other than to bet that the JSE will outperform the rest of the world?

Marvin

I am a bit stumped and need some guidance.

My dad has finally reached retirement age 65, however, does not have sufficient funds to sustain my mom and himself through their life. He does do the odd job by this is not regular and cannot plan based on this income.

I’ve assisted them in paying off their flat (Current Value R 750,000) so all they need to cover is lights, water, rates and levies (R2,500.00). We have gotten their total living expenses down to R8,000 pm.

My dad’s RA is worth R 175,000.

His pension is worth around R600,000. When my dad lost his job 8 years ago, we stopped contributing to it as the odd private jobs he did went to living expenses and I felt it would be better they pay off their flat.

My dad is expecting an inheritance of ±R100,000.

They are both currently receiving a pension grant from the government.

Thankfully they are both still healthy and as kids, we have them on a very basic medical aid.

I really need guidance as to what I should do now without putting their pot at financial risk.

My plan is as follows:

- The flat is a large part of their retirement source and needs work done to the place. If we were to sell it in the future or rent it out, we would need upgrades. The plan is to use half the inheritance to upgrade and invest the balance. (At this point, I have no intention of selling the place, as they still need to live somewhere).

- Regarding the RA and pensions, my dad is keen to take the 3rd, but will this still be tax effective or even worthwhile?

- If we take the 3rd, we would then take a living annuity out for the balance, and invest the 3rd and balance of the inheritance (50k) in The SATRIX World ETF and only use this when the living annuity runs out. Else I saw Africa Bank is offering 10.75% on a R100k deposit for 6 years. This works out to an effective interest rate of 13.33% due to compounding.

- Do I invest the 3rd and inheritance in a TFSA?

Tim

I have a query based on being penalized 40% by Sars for transferring equities and money from SGB to easy equities within the TSFA ring fence environment.

I was under the impression account transfers were tax free (we didn't withdraw the money and re-deposit)

Has anyone else suffered this injustice?

We have disputed it with SARS and have asked easy for help in the interim.

Would be nice to know if we are a first or if the community has had similar issues.

Lungi

I started listening to the podcasts two weeks ago and I pretty much listen to you guys all day, every day: at work, at home and while I'm jogging :)

One thing you have brought to my attention that wasn't even on my radar was the fees issue on my investment products. And boy did I get the shock of my life!

I'm currently contributing to an RA with Liberty and I have one with Old Mutual which I don't contribute to anymore.

I also have a Pension Fund Preserver Policy with Liberty (which is currently invested over 4 investment products each with its own management fee).

This afternoon I decided to look through my statements and found that I was being ripped off in fees for the current RA that I am contributing to.

I currently contribute R535 premium and according to my calculations for September 2019, after the monthly fees of R321.20 (over 2 investment products), only R213.80 actually goes into the RA. So basically, 60% of my premium goes to paying management fees. This is a very poor investment.

- Will I be able to consolidate all my RAs and Pension Fund Preserver into one product so I can pay one management fee. Or is it better to diversify?

- I can only currently contribute R500 to an RA - looking at the fees charged by the companies, am I better off putting that money elsewhere till I can afford to contribute more? like in my Easy Equities Investment Account? Will other RA companies be able to get me a better deal than the one I currently have?