It’s a nutty time to be alive, isn’t it? A market crash is bad enough. Adding a national lockdown to the mix is bound to provoke some anxiety. Our strategy in this time is not dissimilar from our usual strategy: focus on what you can control.

To that end, our podcast this week is the first of three money challenges. We are starting with wills and estates and then moving on to short-term and long-term insurance. We all know what a drag it is to wade through the fine print of these documents when there are more exciting things to do. Unluckily for the insurance industry, we are all now confined to our homes with nothing but time on our hands. We might as well save some money in the process.

We also think this is a fine time to speak to your family members about your will and segue to money in general. If you’ve been wondering how to broach the topic, the madness in the world has solved this problem for you.

We’ll be doing some live video interviews with members of the Just One Lap community over the next three weeks to get you through the lockdown. These will be broadcast live on our Fat Wallet Community Group. If you’re not a member yet, now’s the time.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Cyril Ramaphosa for being epic at his job.

Today we’re only going to deal with your estate and your insurance.

Will and Estate

- Review your will and make sure it’s still relevant to your life.

- Make a spreadsheet of documents and passwords your family need to have if something happens to you.

- When you die, normally everything goes to your spouse. There’s no taxes payable if that happens.

- If you don’t have a spouse, estate duty is 20%, and you have to pay and executor’s fee. Sometimes, to pay this, they have to liquidate some of your assets. If you don’t want this to happen, you can look at a baby life insurance policy that pays out to your estate to cover these fees and the cost of your funeral. Think about whether you want to do that.

Insurance:

- Short-term

- Start a spreadsheet of all the insurance policies you have, including what is covered, your excesses, as well as when the policy was taken out. You can use this as a starting point every year when you renegotiate your insurance.

- Check what is covered and ensure that you have proof of ownership for specified items. Make a list of things you no longer have or can self-insure.

- Create a spreadsheet of previous claims, including dates and settlement amounts. When you lodge a claim or take out new cover, you have to disclose this as it affects your premiums. If you claim and they find out there’s something you haven’t declared, they can reject your claim on that basis. This is going to save you a lot of time in the future.

- Long-term

- Look at the terms of your dread disease and disability cover. You can decide if you want to reduce cover because your asset base can take care of you if something should happen, or increase cover if your family situation has changed.

- Make a spreadsheet of the terms of your cover in terms that you can understand. You don’t want to be wading through an insurance document if you should need this.

- See if you’re covered if you can’t work because you contracted corona.

- Make sure that you are covered for your own occupation, not own or similar.

- If you have life insurance, make sure you still need it. Be careful of hanging on to these policies just because you contributed a lot to them over the years.

- Similarly, if you don’t have life insurance but you have dependents, make sure they are covered if you pass away. Life insurance pays out directly to the beneficiaries in cash. These policies don’t form part of the estate and aren’t taxed. To know how much you need, look at what your dependents would need to survive for about a year until your estate wraps up and cover any shortfall you might have in your current circumstances.

Mike has decided to go for five regional ETFs instead of one world-wide ETF in his portfolio.

He buys Sygnia S&P 500, Sygnia FTSE100, Sygnia Eurostoxx 50, Sygnia Japan, Satrix Emerging Markets.

He’s comparing his 5 ETF strategy to the single, global ETF strategy across seven areas: Currency spread, dividends, emerging market access, regional exposure, sector exposure, rebalancing and TER.

Currency spread:

Regional Amounts other than USD are first converted to USD for the underlying index and then converted again to ZAR for the Tracking index.Do we lose twice on currency spread every time we buy, sell or receive distributions?

Dividends

Sygnia MSCI World Gross Dividend

Yield = 1.11%

Ashburton 12 Gross Dividend yield =

1.51%

JP + US + UK + EU Average Gross

Dividend Yield = 1.81%

(I didn't include Emerging Markets (Satrix automatically re-invest)

Emerging market access

Since he’s buying the EM ETF, he can control how much exposure he has.

Regional exposure

+-60% of the global index is exposed to US (which also has the highest foreign

dividend witholding tax of 30% compared to Japan/Britain 20%, Europe 26%).

Sector exposure

World: Heavily exposed to IT

Japan's no.1 exposure is to Industrials. FTSE, EUROSTOXX and Emerging Markets no 1 Exposure is Financials. Energy is also no.2 on the FTSE but is only no.7 on the MSCI World.

Rebalancing

World: Done every +-3 months. When you top up account you are topping up both the winners and the losers of all regions

Done every +-3 months though you have the opportunity to top up only the regions doing the worst

TER

Low TER of 0.35% (Satrix MSCI)

Low TER of 0.45% (Ashburton 1200)

Average TER is high at 0.63%.

It’s looking rather scary considering EU & Uk’s big drop! Portfolio is 16.83% down.

I can still contribute R27k for this year (R36k limit) so was thinking of doing +-R6k per month until limit is used up and sticking to strategy as I don’t know if it has already or when it will bottom out.

I do like the idea of Dividend paying ETFs within a TFSA. Once I have reached my lifetime limit I can still use the dividends to purchase new shares without having to sell my current shares. I’m sure better/cheaper ETFs will come out in the future. I also then won’t be forced to sell shares (and pay more fees) should I wish to take a small drawdown in retirement. I can just withdraw the dividends.

Many of us are witnessing a stock market crash for the first time. Like most of you, I’m experiencing a heady mix of excitement and terror. I’m so glad watching my portfolio no longer feels like watching paint dry. Instead, it feels like being dropped off a very high building. It’s not great, but at least it’s not boring.

Many of us are witnessing a stock market crash for the first time. Like most of you, I’m experiencing a heady mix of excitement and terror. I’m so glad watching my portfolio no longer feels like watching paint dry. Instead, it feels like being dropped off a very high building. It’s not great, but at least it’s not boring.

This week we address nothing but crash questions. Drawing on some of the concerns of The Fat Wallet Community Group, we provide some guidance to get you through this process with your net worth protected.

If you’ve been wondering what you should be doing right now, you’ve come to the right place.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Bronwyn

I know that TFSA are supposed to be long term investments but I cant wonder if it's not right at the time.

I started one with FNB 2 months ago, last year one was with Allan Grey and it did badly so wanted to test a different one plus it helped with the ebucks.

Anyway I lost close to R500 in 2 months.

My children have cash TFSA and it's growing steadily.

What do I do?

I cannot afford to lose R500 in 2 months? Can one pause it?

I know the markets are volatile but I assume they will be getting worse still.

Danielle:

What are great and safe buys while markets are cheap? I’ve been watching the prices hoping to buy low. Any suggestions?

Jacques:

Any views on buying government bonds?

Enesh:

FNB has just taken R3000 out of my share investor account. No record of it in transactions. They state this is a precaution given the volatility of the market. Is this legal? There absolutely not record of the transaction besides the email sent to me. I don’t this is kosher. Any advice?

Sizwe:

Hi everyone, seeing some opportunities for buying. Am seriously considering 75% of my emergency fund to buy more etfs. Note sure of the risk though. What are your thoughts?

Minnaar:

I would love to “buy the dip” now, but the rand weakening has me worried. Those of you who are buying now, what ETFs are you going for?

K:

I just want to enquire on the market share or stock marketing shares...

How do you buy shares of a certain public company

And where do i start?

Shaun:

I have my full TFSA allocation for the year ready to invest. Do I spend it all on ETFs now as they are on discount or does the math say rand cost average it out because the market may go lower?

Sarit:

If we buy our favorite global ETF at a dip, R42 and 16.6 ZAR/USD.

Then the ETF goes up but at the same time the ZAR usually strengthens...

Is it the opposite movement nullifying each other at exactly the same rate?

It seems that the crash always comes with a weaker ZAR, if we are buying at a dip are we really making money when markets go up but ZAR strengthen?

Runyararo

In a crisis like we have there is no well diversified portfolio because systematic risk cannot be diversified away.

The Shamases

The money still sits with us because something has now occurred to us that we hadn't considered before.

We were going to just open a brokerage account and let time do its magic. But what if we make a poor selection when putting together a basket of ETFs? If we get a retirement annuity or a managed tax free fund, that concern is removed from us. However it would come with the expense of fees, which eat into growth.

How do we select between managed and unmanaged? And how do we select a good basket?

While the rest of the world is getting in supermarket fights over toilet paper, life at Just One Lap carries on. Lesego, who is only 24, is ready to start their investment journey. This week we hold their hand through their first tax-free purchase. We explain what tax-free accounts are, what ETFs are and why we like to go for a diverse, global investment.

If the investment world is new to you, you don’t want to miss this episode. The video below is a deep-dive into tax-free investments, presented by Chuckles himself.

If you’re buying ETFs at the moment, enjoy the sale.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Lesego

I am completely clueless regarding tax free savings accounts.

I went onto the easy equities app but I have no idea which ETF so even select or how everything actually works because I would like to invest before the end of the financial year.

I listened to the podcast and they mentioned it won’t be enough having just a tax free account so I would like to open a retirement annuity fund as well but have no cooking clue how to even delete a company for that.

Jaco

Let's assume you are 35, earning R240,000 and have R33,000 pa to contribute to a TFSA or RA.

Assuming fees and growth are the same, there’s no difference between the two, since both funds grow tax-free until withdrawal.

If you reinvest the tax saving from the RA back into the RA, the RA value will naturally be higher at the end of the term due to the additional contributions. The higher amount will give you a bigger savings pot to draw an income from.

Is the higher savings amount available at retirement offset by the income tax payable in retirement on income?

You need to look at the tax saving on the contributions and the tax payable on the income.

Tax saving on contributions:

A 35-year-old earning R240 000 pa will have a marginal tax rate of 26%. The tax saving/deduction on the R33 000 contribution is R8 580 (tax saving = contribution*marginal tax rate). The tax saving is 26%, which is equal to the marginal tax rate of 26%. So on contributions, your return on the saving of R33 000 is R8 580 (26%)

Income tax payable:

At retirement age 60, if you keep your income at R240 000, your marginal tax rate will still be 26%. But the tax you pay on your retirement income will be taxed at your effective tax rate. A marginal tax rate of 26% is equal to an effective tax rate of 13.55% (the rate at which you pay tax). The effective tax rate is lower than the marginal tax rate due to the rebates and sliding tax scales. So the "cost" on your retirement income of R240 000 is R32 512 or 13.55% (R32 512/R240000).

Based on the above, the tax saving on RA contributions is 26% or R41 580 (R33000+R8 580), and the tax payable on retirement income is 13.55% or R32 512. Because the tax saving is > the tax payable, contributing to an RA is net-net positive.

I recommend if your marginal tax rate is above the tax-free threshold, and you are happy with Regulation 28 to first contribute to an RA.

The higher your marginal tax rate, the bigger the tax-saving, the bigger the benefit of contributing to an RA. If you have liquidity problems, earning an income below the tax-free threshold or want to increase your offshore/equity exposure, the TFSA is the better option.

Joshua

What is the practical difference in taking money offshore using Interactive Brokers vs using EasyEquities USD Platform?

Do you suggest opening an offshore bank account and is this possible? The issue with the local banks offerings, for example FNB’s linked Global account, is that interest is only earned at around 0.5%.

Ollie

In episode #178 you considered the options for a listener who was planning to move to the Netherlands. One of the options canvassed was the potential of leaving money in a TFSA in the event of a market decline prior to emigration.

One element of this approach not considered, is that the overseas jurisdiction may consider the account taxable, meaning that the tax-free benefit of saving through a TFSA will be negated from the moment that the person migrates to the new jurisdiction. This varies on a country by country basis but should probably be considered by anyone before planning on leaving money in a South African investment vehicle whilst living abroad.

Innes

Since I am a little risk averse given how high developed markets are - I decided to buy some of this NFGovi ETF in my TFSA (about 25%) to give it some more diversification and less risk (and to hopefully receive a better return than cash/interest due to it being linked to bonds).

However, looking at the price graph over the last 6 months - the return has been the flattest thing I’ve ever seen. And the 5 year historical return looked so promising and consistent when I was deciding to invest! I thought that bonds (and bond ETFs) were supposed to be “more certain/safer” than equities and have a better return than cash.

Why do you think the return for the govi has been so flat of late? Do you think this would continue to be flat if SA is downgraded to junk status?

I know you referred to the Ashburton 1200 as one of your favourite ETFs - would there be a certain bond or bond etf you would recommend and why? Are bonds or bond ETFs maybe a waste of time given their low (and not so certain) returns? Maybe I should be buying bonds and not bond ETFs? What platform would you recommend using to buy bonds? (If you would recommend them at all).

Hugo

I love the innovation behind the product, one which will hopefully create a revolution in the investment domain.

I am a bit underwhelmed though with the fee structure of the product during the initial build-up phase of the portfolio.

There are current providers who can offer RAs with fees less than 1.5%, (10X and Sygnia come to mind) from the first rand invested.

Sygnia does there Skeleton 70 product for example at 0.55% all in.

Why not invest with a cheaper provider until you reach an amount where Outvest become cheaper, then make the switch?

For example:

R1 – R 818 000 at Sygnia = 0.55% / annum

R818 000 @ 0.55% = R4500 (Outvest cap)

R 818 000 to infinity at Outvest = 0.55% (decreasing to 0.2%)

We have to assume that the funds invested in are of course all the same – and I think we can argue that Reg28 investments, whether aggressive or moderate or low risk, will all more or less perform the same.

Am I missing something?

Eleanore

I would like to transfer my RA from Allan Gray to Sygnia. Both Ag & Sygnia's forms ask about a unit transfer. I'm not sure what to select. Assuming a unit transfer is possible in this case (for a transfer from AG Balanced Fund to Sygnia Skeleton Balanced 70 Fund), should I select this? Which is best, a cash or unit transfer? I don't want to make a mistake and diminish my Retirement savings at this point due to a transfer mishap.

Robin

I received an Insurance payout which I have placed in an Investec Fixed deposit, drawing a compound interest of around 7.5%.

We’ve bought two apartments off-plan in Cape Town, which will only be ready for handover towards the end of 2022. I’ve made upfront payments of 25% and 50% respectively on the apartments. These funds are sitting in the Conveyancers Trust Account drawing a 7.8% compounded interest per year. I am unable to touch this.

Would it be better to move the money that is sitting in my Investec account into one ETF or a group of ETFs for three years. Or should I hold these funds where they are at the moment?

My feeling was to keep it in a secure environment so I will be in a position to pay off the properties completely, and then draw rental income.

However, the income derived from the Investec investment will be taxable, which will be lumped together with my other SA rental based income. Together the total income will be around R320K for the year.

Should I put the R320K into my RA? When the time comes to settle the payment on the apartments at the end of 2022 I’ll draw from my Unit Trust Investment to settle the difference, or repatriate funds from my overseas investment. If I keep it in the Investec fixed deposit I will end up paying around R63,853.00 in tax.

One of your listeners from China (Podcast #169) was inquiring about where he can invest using Euros or USD. As an expat I use Internaxx - based in Luxembourg - https://en.internaxx.com where I buy my international ETFs and stocks. I trust this will help your listener (sorry I don't recall his name I was listening while walking).

Steven noticed we prefer ETFs to unit trusts and wants to know why.

Eugene is keen on opening a TFSA for his spouse. He’s not keen on using EE, so he wants to know who else we can recommend.

We’re not prone to panic, but at this point staying calm requires a level of stoicism we haven’t quite mastered. You may have forgotten this in the diseased fog of the Coronavirus, but a mere two months ago it seemed as though the US was going to war with Iran.

Part of what makes it so hard to keep calm is that the rest of the world is in a flat panic. When even the Federal Reserve starts behaving erratically, you may be forgiven for wanting to turn your ETFs into Kruger Rands*.

In this week’s episode, Simon and I discuss some of the fallouts we’re seeing in world markets and in our portfolios. We try to understand some of the more alarming news headlines, explain why the US rate cut is by no means a good sign and talk through some of what we can expect as local investors.

If you take one thing from this episode, I hope it’s this: wash your hands!

*Don’t do that.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Ursula

Transferring my Liberty RA to Sygnia, I stumbled across the 'Sygnia Life Berkshire Hathaway Fund' on their website. What are your thoughts on this product? It is touted as a 'linked Life Endowment Policy' that invests 100% in BRK shares. While not being targeted at 'major offshore players who are already set up to trade independently and can easily buy BRK’s Class A or B shares. Rather, the SLBF has been designed to offer a hassle-free option to invest offshore with Buffett without the complexity'. I phoned Sygnia in the hopes of getting some more information with regards to the TIC etc. but was informed that because the fund is so new, this information is not yet available.

I am at the point where I would like to start investing in addition to the funds currently directed my TFSA and my RA and was curious about this. Why would one opt for an investment like this as opposed to directly investing in Berkshire Hathaway and what benefits, if any, does a Life Endowment have?

Barry

I was sent a video that basically states that the US is bankrupt and has two options.

- The US government stops influencing the market and allows the business model to play out, the effect of which they compared to a 1930’s type depression. Take the pain in one big hit.

- The US government allows massive inflation, bypasses the banking system (which provides loans), and provides an MMT style (I had to google that) of providing “helicopter” money to consumers and maintaining debt demand, resulting in rising inflation or hyperinflation as more money chases limited goods and services.

It certainly seems logical that this could happen from a layman’s perspective. If you spend more than you earn for long enough, you end up in a world of trouble.

Is this just some more scaremongering or possibly some realism in there?

Secondly, if either of the above scenarios were to play out and one was invested in a ‘buy-for-life’ Total World ETF like the Vanguard VWRD or even the Ashburton 1200 or MSCI World, what would the effect of either of these scenarios playing out be on the ETF?

Currently the US market cap is weighted at about 55% of the ETF, if the this scenario were to play out and the US market-cap dropped as they rebalanced, would the ETF over a period of time rebalance accordingly too, chuck out the US holdings and increase those from other geographical regions as the non-US regions capitalized on the market-cap that the US had lost? So, a (relatively, a few years) short-term drop-in ETF unit price followed by a gradual recovery again? Similar to how Steinhoff is/ has been worked out of the Top 40 by the ETF?

What would the effect be on the value of the USD?

Javid

I have recently come across your gem of a podcast and have been trawling through as many of your previous podcasts as possible.

My question is:

- With tensions amongst the US and Iran at an all time high it seems imminent that it may escalate into another protracted war that could even turn nuclear. With this in mind what preparations should South African investors embark on to protect/rebalance our financial assets in the interim as this plays out. Some of my thoughts:

- If you’re holding onto ZAR cash should this be rather converted to USD or Gold which could be seen as a safe haven (bearing in mind the US could enter hyperinflation as they print more USD to fund another war).

- I suspect Oil in the region would surge, holding an oil index in the interim?

- Are there any stocks to consider - perhaps in the defence industry?

- I guess one could also have a list of fundamentally sound stocks on a watchlist and purchase them when they are a deep discount?

Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

When you leave a company’s pension or provident fund because you leave the company, you have three options when transferring those funds:

- You can move it to your new company’s pension or provident fund.

- You can buy a retirement annuity (RA) in your private capacity.

- You can put that money into a pension preservation or provident preservation fund.

Both pension and provident funds are Regulation 28-compliant products offered by employers. They differ in one important way: with a provident fund, you can withdraw the full amount in cash at retirement. If you hold a pension fund at retirement, you can only withdraw one-third in cash. The rest has to be reinvested in a living or life annuity.

A pension preservation or provident preservation fund is designed to hold on to the money you saved when you were employed with your company. It’s also a Regulation 28-compliant product, but once you move your retirement money into a preservation fund, you can no longer contribute to that fund.

If you have a pension preservation fund and your new company has a pension fund, you can move that preservation fund to your new company’s pension fund. If you have a provident preservation fund and your new company has a provident fund, you can move your preservation fund to your new company.

All this complicated moving around of money makes one wonder why you wouldn’t just transfer your money into a retirement annuity (RA), right?

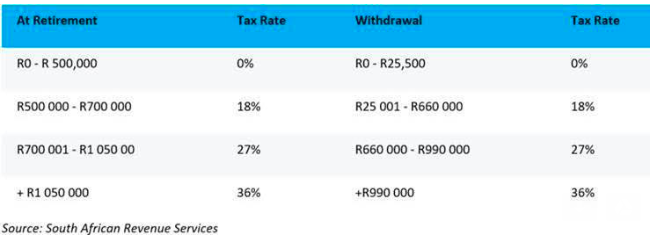

It turns out, by law you can make one full or partial withdrawal from your preservation fund before retirement. The first R25,000 is tax-free. After that you are taxed according to the table below.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

In this idea he is right and wrong. If he got a new job, contributed to his new employer’s pension or provident fund and got retrenched, he would be able to retire out of the new fund upon retrenchment using the R500,000 tax-free withdrawal he would have received upon retirement.

He can only withdraw from the fund to which he was contributing with his new employer, so if he didn’t transfer his preservation fund to his new employer, he’d be taxed on that withdrawal. The other snag is that it affects the tax-free amount he can take upon retirement. If he withdrew R100,000 tax-free upon retrenchment, he’d only have R400,000 tax-free money left when he retired.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Alexis

When you financially emigrate SARS makes you pay CGT on all your investments worldwide as if you had sold them on that day. Ok, fine, but I haven't actually sold them, and one day, when living in my new country I will want to sell them.

But then the new country is going to want tax on the profits, presumably calculated from the actual base cost. I'm not sure how to avoid paying tax twice in this situation. Unless I actually sell the investment when financially emigrating, and buy it again at a new base cost after this process is done, which seems like a waste because of fees, spread and spending some time out of the market.

We asked our Head Elf De Wet about this. He has good news.

Typically the country to which you are emigrating has legislation (if their tax system is advanced enough as is the case with South Africa) that will deem the base cost in the new country to be the re-acquired base cost (not the original) and it should therefore not result in double taxation. It can in very few circumstances result in double taxation, but the chances are very slim.

AJ

After I resigned from my previous employer, I moved my Provident Fund money to a Sygnia Preservation Fund.

I chose this option to follow the ‘’Tax rules’’. I no longer save additional money, as I have moved abroad. I’ve gone quite aggressive with my allocation on Sygnia (Top40, Property, Offshore, Rhodium & Palladium and no cash, no bonds) minimum fees 0.62%.

On my return to SA and if I find employment where there is an umbrella fund available, I can transfer my preservation fund to their Fund. This means I start at my new company with a lump sum available from day one.

I’m not a big RA, regulation 28 type of guy. My main benefit would be if I am retrenched and my retirement value is close to R500,000 at retrenchment I could benefit and effectively take this tax free.

Secondly, I could take this money with a huge tax implication if I am in some sort of emergency where I need cash all before the age of 55.

I am putting myself in the position that at worst case, if a retrenchment happens I at least benefit in some way. The maximum benefit would be around R500,000 in retirement money.

This tax free withdrawal can only be done once per person. If you have used your R25,000 tax-free portion, the max benefit you would be able to take is R500,000 less R25,000 (R475,000).

Francois

I am 28 and recently started to take control of my financial life.

So far:

- I started a budget via 22Seven

- Paid off my car loan

- Maxed my TFSA (100% Satrix global MSCI- Single ETF lowest cost- great article by Stealthy Wealthy comparing global ETF's. Single ETF strategy for the win)

- In the process of moving my RA from "Unnamed Life insurance company" (My EAC was 6.61%) to Sygnia skeleton balanced 70 fund

I am currently stuck.

I am looking to increase my global portfolio.

I currently earn in USD and receive this money in a USD call account. Would it be better investing in USD directly in an ETF (example Vanguard S&P 500) or use ZAR to invest in a global ETF (example Satrix MSCI global/Ashburton 1200)?

I will only be earning USD for the next two years and will then have to convert rand to USD to continue my dollar cost averaging amount monthly if I have a USD-based account. What is the benefit of having a USD account vs investing in Rands via a global ETFs.

Yakoob

Can a South African citizen buy shares in Aramco? It’s a Saudi Arabian oil company that listed in November on their local stock exchange.

Mbasa

When buying property the bank will show how much interest you would pay over 20 or 30 year home loan period.

When you rent the property out the deficit will be reduced and eventually become a surplus that can be used to quickly pay off the loan.

Example:

A R 850k mortgage will amount to R 2 000 000 in total instalments over 20 years

(R8369 * 240 months).

Baring in mind that this is paid for by the bank and the tenant. Is it advisable to then save (ETF, shares, unit trust ) to reach that R 2m goal or borrow from the bank and rent out.

I did a quick calc and about R2.5k per month at 10% pa over 20 years reaches the R 2m goal.

Sam

I am 34, I have a 9 month old daughter and would like to save for her education.

Time horizon is 13-14 years. We hope to cover primary school from salaries or a separate investment.

I don't want to do a TFSA in her name as we will withdraw it all and then "rob" her of some or all of her Tax Free lifetime allocation.

Would TFSAs split between my wife and I be a good idea considering we would draw down on a large chunk of our lifetime allocation long before retirement?

If not then what would you suggest?

(Regardless of the vehicle, ETFs will likely be the underlying investment, thanks to you guys)

Boitumelo

In 2019 I tightened my budget a bit, moved my Pension Preservation to a low-cost provider and fully funded my emergency fund for 6-8 months. Because of my work in Botswana I do not pay tax and can thus not get the tax benefit from the RA. I am now channelling those contributions and excess into my discretionary investments after maxing the TFSA.

I receive my salary in USD into a dollar account in Botswana.

I transfer some cash for basic living expenses here and some to my expenses in SA (i.e. bond, donations, investments etc..).

I then leave some USD inside this account at 0% interest. Should I perhaps build up some USD in my account here transfer every few thousand dollars to a USD Account to buy some Vanguard US Total Stock? Would that be a good idea and better use of the USDs instead of keeping it in this normal cheque account?

In my TFSA I buy the Satrix World and the CS Prop. In my discretionary account, I buy the Ashburton 1200 and The Satrix Top 40. Given that I am already buying the 'World' in both accounts, will buying the US Total Stock in USD mean I will be too US concentrated and therefore at risk? I am just looking for better value and better use of the USDs while I am able to.

Lusani

In 2014 I bought a house, paid extra monthly and when I was left with 13% to go I opted for a second property as an investment. The worst move I made was applying for a re-advance on my residential bond and then paying for the rental property cash. The whole transaction incurred transfer and bond registration fees.

Things were looking rosey until tax time. My tax consultant told me I could not deduct the bond interest since the property address on the bond statement does not correspond with the address of the rented apartment.

I missed out on that deduction and as a result my income is higher. My worry is that when we get our annual increase (6%) in April, this rental income will to push me to the next bracket.

I have decided to register a bond on the investment property. Based on my calculations, I will not pay any tax from the rent for at least 3-4 years. I will be deducting a whole chunk of interest, levies and rates, still taking in consideration the yearly increase of at least 5%. I want to retain my tenant and not scare them away with 10%.

Must the bond be on that property? Some people say it is possible to deduct the bond interest even if property B is not bonded, but as long as you can prove where the money comes from.

If I use this money towards buying stocks on EE, I will still pay tax. Registering my bond now seems dumb or was it a clever move?

I only joined recently. Must I move it elsewhere, or cancel it? The thought of paying those fees kills me. Until my RA issues fees issues are sorted out I will not increase my contribution to the allowable 27.5% using this money.

Tafadzwa

What are the risks of trading in ETFs in an illiquid market to a retail investor?

Also, how can one use small and mid cap ETFs to enhance returns?