Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

When you leave a company’s pension or provident fund because you leave the company, you have three options when transferring those funds:

- You can move it to your new company’s pension or provident fund.

- You can buy a retirement annuity (RA) in your private capacity.

- You can put that money into a pension preservation or provident preservation fund.

Both pension and provident funds are Regulation 28-compliant products offered by employers. They differ in one important way: with a provident fund, you can withdraw the full amount in cash at retirement. If you hold a pension fund at retirement, you can only withdraw one-third in cash. The rest has to be reinvested in a living or life annuity.

A pension preservation or provident preservation fund is designed to hold on to the money you saved when you were employed with your company. It’s also a Regulation 28-compliant product, but once you move your retirement money into a preservation fund, you can no longer contribute to that fund.

If you have a pension preservation fund and your new company has a pension fund, you can move that preservation fund to your new company’s pension fund. If you have a provident preservation fund and your new company has a provident fund, you can move your preservation fund to your new company.

All this complicated moving around of money makes one wonder why you wouldn’t just transfer your money into a retirement annuity (RA), right?

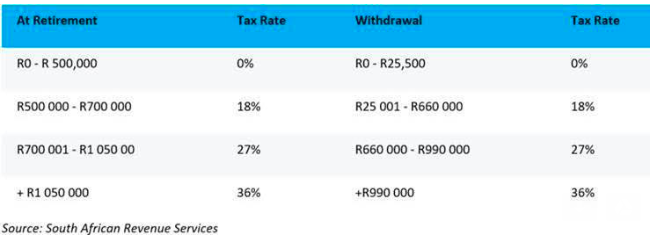

It turns out, by law you can make one full or partial withdrawal from your preservation fund before retirement. The first R25,000 is tax-free. After that you are taxed according to the table below.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

In this idea he is right and wrong. If he got a new job, contributed to his new employer’s pension or provident fund and got retrenched, he would be able to retire out of the new fund upon retrenchment using the R500,000 tax-free withdrawal he would have received upon retirement.

He can only withdraw from the fund to which he was contributing with his new employer, so if he didn’t transfer his preservation fund to his new employer, he’d be taxed on that withdrawal. The other snag is that it affects the tax-free amount he can take upon retirement. If he withdrew R100,000 tax-free upon retrenchment, he’d only have R400,000 tax-free money left when he retired.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Alexis

When you financially emigrate SARS makes you pay CGT on all your investments worldwide as if you had sold them on that day. Ok, fine, but I haven't actually sold them, and one day, when living in my new country I will want to sell them.

But then the new country is going to want tax on the profits, presumably calculated from the actual base cost. I'm not sure how to avoid paying tax twice in this situation. Unless I actually sell the investment when financially emigrating, and buy it again at a new base cost after this process is done, which seems like a waste because of fees, spread and spending some time out of the market.

We asked our Head Elf De Wet about this. He has good news.

Typically the country to which you are emigrating has legislation (if their tax system is advanced enough as is the case with South Africa) that will deem the base cost in the new country to be the re-acquired base cost (not the original) and it should therefore not result in double taxation. It can in very few circumstances result in double taxation, but the chances are very slim.

AJ

After I resigned from my previous employer, I moved my Provident Fund money to a Sygnia Preservation Fund.

I chose this option to follow the ‘’Tax rules’’. I no longer save additional money, as I have moved abroad. I’ve gone quite aggressive with my allocation on Sygnia (Top40, Property, Offshore, Rhodium & Palladium and no cash, no bonds) minimum fees 0.62%.

On my return to SA and if I find employment where there is an umbrella fund available, I can transfer my preservation fund to their Fund. This means I start at my new company with a lump sum available from day one.

I’m not a big RA, regulation 28 type of guy. My main benefit would be if I am retrenched and my retirement value is close to R500,000 at retrenchment I could benefit and effectively take this tax free.

Secondly, I could take this money with a huge tax implication if I am in some sort of emergency where I need cash all before the age of 55.

I am putting myself in the position that at worst case, if a retrenchment happens I at least benefit in some way. The maximum benefit would be around R500,000 in retirement money.

This tax free withdrawal can only be done once per person. If you have used your R25,000 tax-free portion, the max benefit you would be able to take is R500,000 less R25,000 (R475,000).

Francois

I am 28 and recently started to take control of my financial life.

So far:

- I started a budget via 22Seven

- Paid off my car loan

- Maxed my TFSA (100% Satrix global MSCI- Single ETF lowest cost- great article by Stealthy Wealthy comparing global ETF's. Single ETF strategy for the win)

- In the process of moving my RA from "Unnamed Life insurance company" (My EAC was 6.61%) to Sygnia skeleton balanced 70 fund

I am currently stuck.

I am looking to increase my global portfolio.

I currently earn in USD and receive this money in a USD call account. Would it be better investing in USD directly in an ETF (example Vanguard S&P 500) or use ZAR to invest in a global ETF (example Satrix MSCI global/Ashburton 1200)?

I will only be earning USD for the next two years and will then have to convert rand to USD to continue my dollar cost averaging amount monthly if I have a USD-based account. What is the benefit of having a USD account vs investing in Rands via a global ETFs.

Yakoob

Can a South African citizen buy shares in Aramco? It’s a Saudi Arabian oil company that listed in November on their local stock exchange.

Mbasa

When buying property the bank will show how much interest you would pay over 20 or 30 year home loan period.

When you rent the property out the deficit will be reduced and eventually become a surplus that can be used to quickly pay off the loan.

Example:

A R 850k mortgage will amount to R 2 000 000 in total instalments over 20 years

(R8369 * 240 months).

Baring in mind that this is paid for by the bank and the tenant. Is it advisable to then save (ETF, shares, unit trust ) to reach that R 2m goal or borrow from the bank and rent out.

I did a quick calc and about R2.5k per month at 10% pa over 20 years reaches the R 2m goal.

Sam

I am 34, I have a 9 month old daughter and would like to save for her education.

Time horizon is 13-14 years. We hope to cover primary school from salaries or a separate investment.

I don't want to do a TFSA in her name as we will withdraw it all and then "rob" her of some or all of her Tax Free lifetime allocation.

Would TFSAs split between my wife and I be a good idea considering we would draw down on a large chunk of our lifetime allocation long before retirement?

If not then what would you suggest?

(Regardless of the vehicle, ETFs will likely be the underlying investment, thanks to you guys)

Boitumelo

In 2019 I tightened my budget a bit, moved my Pension Preservation to a low-cost provider and fully funded my emergency fund for 6-8 months. Because of my work in Botswana I do not pay tax and can thus not get the tax benefit from the RA. I am now channelling those contributions and excess into my discretionary investments after maxing the TFSA.

I receive my salary in USD into a dollar account in Botswana.

I transfer some cash for basic living expenses here and some to my expenses in SA (i.e. bond, donations, investments etc..).

I then leave some USD inside this account at 0% interest. Should I perhaps build up some USD in my account here transfer every few thousand dollars to a USD Account to buy some Vanguard US Total Stock? Would that be a good idea and better use of the USDs instead of keeping it in this normal cheque account?

In my TFSA I buy the Satrix World and the CS Prop. In my discretionary account, I buy the Ashburton 1200 and The Satrix Top 40. Given that I am already buying the 'World' in both accounts, will buying the US Total Stock in USD mean I will be too US concentrated and therefore at risk? I am just looking for better value and better use of the USDs while I am able to.

Lusani

In 2014 I bought a house, paid extra monthly and when I was left with 13% to go I opted for a second property as an investment. The worst move I made was applying for a re-advance on my residential bond and then paying for the rental property cash. The whole transaction incurred transfer and bond registration fees.

Things were looking rosey until tax time. My tax consultant told me I could not deduct the bond interest since the property address on the bond statement does not correspond with the address of the rented apartment.

I missed out on that deduction and as a result my income is higher. My worry is that when we get our annual increase (6%) in April, this rental income will to push me to the next bracket.

I have decided to register a bond on the investment property. Based on my calculations, I will not pay any tax from the rent for at least 3-4 years. I will be deducting a whole chunk of interest, levies and rates, still taking in consideration the yearly increase of at least 5%. I want to retain my tenant and not scare them away with 10%.

Must the bond be on that property? Some people say it is possible to deduct the bond interest even if property B is not bonded, but as long as you can prove where the money comes from.

If I use this money towards buying stocks on EE, I will still pay tax. Registering my bond now seems dumb or was it a clever move?

I only joined recently. Must I move it elsewhere, or cancel it? The thought of paying those fees kills me. Until my RA issues fees issues are sorted out I will not increase my contribution to the allowable 27.5% using this money.

Tafadzwa

What are the risks of trading in ETFs in an illiquid market to a retail investor?

Also, how can one use small and mid cap ETFs to enhance returns?