It’s going to take more than a good plan and discipline to cope with the financial impact of this lockdown. Some of us are lucky to retain all or some of our income, but for many of us this period is a financial catastrophe. There is no good news, no upside, no silver lining. We are in crisis mode and the goal is survival.

In this week’s episode we think through some lesser-of-two-evils scenarios. Should you take a loan repayment holiday? Should you sell an investment or take on debt? Should you borrow money from the bank or your family?

I wish we could offer some hope or some solutions, but for the moment all we can offer is how to make the best of a bad situation.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Pieter

I have all my cash in my access bond, with the exclusion of about a week's worth of expenses. I realized with ABSA, every time there is a rate adjustment they recalculate the payment to the same term. That’s the outstanding balance, including the money you stored in your access bond.

I’ve been calculating what I should have been paying all along. I pay that over to an investment account. The idea is once that’s enough to clear the bond, we’ll do that. In the meantime we’ll see when that happens if we'll do it or continue to grow the investment.

- When a debt collection agency purchases all your debt from the original company at a few cents to the rand. And at that stage you sometimes can get up to 90% off your debt depending on the type and how close it is to prescription.

- From your first default, your interest and costs may not be more than the amount at default. If you defaulted at R2,000, the max debt may be R4,000. If you pay back say R500 they are still not allowed to add additional cost and interest.

Celma

I have a little flat that I rent out. I declare that and I claim a portion of my electricity, services etc and give SARS what is due to SARS.

I also have a few investments and pay fees on the administration thereof. This is a substantial amount of money. Just as me paying for electricity, water, providing wi-fi enables me to make the money on the little flat, paying the admin fees on the investment enables me to grow my savings. I want to deduct the fees as a taxable expense and I am hitting a concrete wall. I really don't see the difference in the expenses as it both has the same result.

Will really appreciate it if you could assist by explaining this to me or tell me who I need to contact to try and rectify what I view as double standards.

Henk

My parents (64 & 72) have been advised that they shouldn't open a TFSA because they are too old and it won't help them. Is this correct?

Combined they have a portfolio of property, share portfolios with various finance houses and trusts which they obviously don't want to donate to the tax man.

- Could they each contribute to a TFSA for the next 15 years, and when they are no longer with us, will that investment become part of their estate and therefore be liable for estate duties or will the accounts just cede to whoever they decide to leave them to, and continue being TFSAs? We kinda want to know before the end of Feb so we can open one this year.

- How best can they distribute their wealth before they die so that their estate doesn't take forever to be wound up and pay a huge amount in estate duties?

Isn’t it fascinating how quickly we adapt? When the market first started its epic nose dive, we were all ready to jump with it. However, over the past month or so we’ve become so accustomed to a crisis environment that we can almost forget about our investment accounts.

The last lockdown challenge was initially scheduled for the last week of lockdown. The lockdown extension happened after I recorded the podcast. To be honest, I don’t have the emotional energy to engage with the extension at the moment. As a result, we’re looking at our investments this week.

Like our previous two challenges, we are using this time to go through our investments with a fine-tooth comb. Aside from padding your emergency fund, this challenge is not about taking action. It’s about reviewing the choices you made now that you can compare your portfolio before the crash to your portfolio after the crash. You’ve really earned your stripes this month. How did you do?

Win of the week: Nomusa

I bought a car in 2014 without a deposit. I never read the fine print or informed myself about the process. Never again! The car almost got repossessed when I was living hand to mouth. I am back on track now.

In process to get back my peace, I opted for a debt review. I soon discovered this was a rip off 3 months into the trap. There was no agreement with my creditor as they had agreed to do. She ended up cancelling this. We talk about debt review in our Debt series, which you can find at justonelap.com/debt

I have applied the snowball method to pay off debt and its working, I should be off the hook in December 2020. You pay the smallest amount first, add that to the second-smallest. Also find our article on the DIY debt repayment plan.

I opened a Tyme Bank account for an emergency fund. I want this amount to not just sit but grow —even if it’s just by 1%.

I looove rewards programmes., I know I need to heal from the financial trauma I suffered back in the years. I used to get R200 worth of UCount when it started, which I would be getting because I was using my credit card a lot, and I would then buy lunch and food from fresh stop and KFC when I ran out of money mid-month.

I have since stopped using the credit card (because I was handed over really, for non-payment). I am not planning to carry on with standard bank because their fees are ridiculous—R105 cheque card and let alone debits and all extras. I have since opened a Capitec account which is reasonable (R30-35) as I have moved some debits orders to them for insurance, funeral, tracker and the likes.

I have these reward programs

-Ucount

-Freshstop

-Clicks

-PnP smart shopper

-My School days

-ThankU

-All garage outlets reward trust me and use associated stores for others as I travel a lot.

I have noted all further useful hints on credit cards like having a virgin money one because of fewer fees, but my ucount rewards make me wanna go back and this time, use my credit to my benefit, deposit to spend in it, etc,

I know rewards are just there to keep us loyal and I am the culprit. Are they really worth it, do you and Chuckles even care about them? I also love the affiliation things and referring people on stash, easy equities and all?

Will this really buy me bubbles later? Sorry for the long email am just excited.

Guillym

With regards to people saving for their kids, time in the market is the best, right? So why put money into the market for your kids if you are going to take it out?

Rather save more for yourself now, and lower your saving rate when the kid comes to needing money age.

As an example, my wife and I have disposable income that all goes into paying off the bond. When that is done in about 5 years, it will go into something else for us.

When any monthly expense comes along (for Sadie) we can save less, rather than draw from savings, to cover school fees or whatnot.

If Sadie becomes more expsensive, we can give ourselves a raise.

We are super lucky to be able to put away more than 40%. We certainly don't take this for granted. This won't work for everyone, but I feel it's a better option than saving for children just to take it out of the market later.

Joy

I listened to your podcast about first investments. You recommended Ashburton 1200. Because this is a foreign product investing in foreign stocks, surely it is not tax free in the real sense of the word?

I will still be paying taxes and fees into that product? Considering the 40+ years that I hope this account will be running the small 0.1% fees/taxes here and there do need to be considered in light of compounding.

Is it not best to do TSFA into SA products and then discretionary into foreign like the Ashburton 1200? I hope to use my annual tax free donations allowance of R100,000 split between my two children so I would do R33,000 TFSA each and R17,000 discretionary each.

Last week we challenged you to take a closer look at your insurance cover. The challenge was an eye-opener for me. I wrote an article about it here.

Last week we challenged you to take a closer look at your insurance cover. The challenge was an eye-opener for me. I wrote an article about it here.

This week it’s time to look at your medical aid. Since many of our incomes are affected by the lockdown, you might be looking at a cheaper medical aid plan. You might be wondering if the one you have is any good. Perhaps a global health crisis finally scared you into getting medical aid if you don’t already have one.

The trouble with making choices about medical aid is the medical aid industry. If you’ve ever tried to compare two medical schemes or even two plans within the same medical scheme, you know what we mean.

This week, we hope to help you make sense of this mess. Here’s a summary of the big things you need to pay attention to:

- The percentage rate cover.

- Exclusions and sub-limits.

- Whether your particular chronic condition is covered.

- Cover for non-prescribed minimum benefits, like oncology, dialysis and HIV.

Let us know if you have any mind-bending insights of your own, and remember to catch our live interviews with our community members on the Fat Wallet community group.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Jennifer

I just want to let you know that Sunday night is the highlight of my weekend because that's when I receive the phone notification that the latest Fat Wallet episode is available. Thank you for continuing to provide a calm perspective and practical advice during these chaotic times.

I hope you and your families are staying safe and healthy. My wife and I are fine, but we have family, friends, and coworkers who are very sick. We have not left our tiny Manhattan apartment since March 13. Fortunately, many restaurants and grocery stores are making deliveries. I count ourselves lucky that we have the option to get food without leaving the safety of our apartment. I have a fear that the next time we go outside, perhaps months from now, the blocks around me will be unrecognizable because so many shops and restaurants will have closed. At night, I look out my windows and see other pondering New Yorkers in high-rises staring out of their windows trying to figure this all out. Sometimes I feel like we make eye contact, but we're so far away that I can't be sure.

Lady Kabelo

Whenever you and Simon talk about medical aid I feel like it's a high-level overview. But the really difficult thing is the nitty gritty - when looking at plethora of options how do you make sense of it?

Can you and Simon talk about which cover you have and, more importantly, how you landed on that? What did you take into consideration?

At this point, I'm thinking Discovery purely because the brand is familiar. I also have my life insurance with them. And then I'm guessing the more expensive the plan, the more benefits it gives you so pick the most expensive one I can afford. I haven't pulled the trigger yet on this plan because it seems like a very bad way to make the decision.

Save me Kristia - recommend a company and their best plan and put me out of my misery.

Miles

Satrix MSCI and other offshore ETFs and unit trusts are "non accumulating" or "roll-up" funds, so don't pay dividends.

What happens to the dividends?

Am I actually saving on foreign divi tax, but paying more CGT at sale time with these foreign investments? Also, in a TFSA, one pays foreign divi withholding tax.

Hendrik

You caution against ETFs and Investment products with high fees. You mentioned there are living annuity products on the market where the TERs are 0.5% or lower?

Would you care to elaborate on these please,.., which ones they are? 10X for example indicates a fee of 0.86% and OutVest has got those RA’s for 0.40%,.. but no Living Annuity as yet.

10X’s 0.86% TER had been the lowest I could locate thus far…

I am going on Retirement in May of this year at the age of 60. It is crucial to me that I make the right choice of Living Annuity with the best combination of the highest possible return, lowest risk and lowest fees.

Michael

I get offered almost 3x my salary as straight credit on my FNB credit card (which I personally think is nutzzzz!).

I was wondering if I could transfer that full amount to a Tyme bank account and earn 6-9% interest on it for the month and then transfer it back to FNB before the 55 days interest free period is up?

It can't be that simple right? otherwise everyone would be doing it?

Christian

My question is related to a deduction from my SYGWD dividend.

The transaction breakdown is as follows:

- SYGWD Foreign Dividend

- Foreign Dividend Tax

And then the weird one:

- SYGWD - Port Costs

I had a look on the internet but cannot find any reference to this cost, would you be able to shed some light on this? Don't know if it matters, but this was in my Share Builder account with FNB.

Bradley

I have a retirement savings product (that I hate) via my employer. I have investment property (rentals): I’m a property guy (long term debt; short term income; expropriation without compensation risk; what could go wrongJ). I have no TFSA yet.

I want to create a R200k fund for high risk, high return investments projects through share trading: “SASOL” to be specific).

- What do you think of putting funds aside to just invest in riskier things that have a much higher pay out?

- What is the best way to go about buying and selling shares? Will I pay CGT or personal income tax on proceeds?

It’s a nutty time to be alive, isn’t it? A market crash is bad enough. Adding a national lockdown to the mix is bound to provoke some anxiety. Our strategy in this time is not dissimilar from our usual strategy: focus on what you can control.

To that end, our podcast this week is the first of three money challenges. We are starting with wills and estates and then moving on to short-term and long-term insurance. We all know what a drag it is to wade through the fine print of these documents when there are more exciting things to do. Unluckily for the insurance industry, we are all now confined to our homes with nothing but time on our hands. We might as well save some money in the process.

We also think this is a fine time to speak to your family members about your will and segue to money in general. If you’ve been wondering how to broach the topic, the madness in the world has solved this problem for you.

We’ll be doing some live video interviews with members of the Just One Lap community over the next three weeks to get you through the lockdown. These will be broadcast live on our Fat Wallet Community Group. If you’re not a member yet, now’s the time.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Cyril Ramaphosa for being epic at his job.

Today we’re only going to deal with your estate and your insurance.

Will and Estate

- Review your will and make sure it’s still relevant to your life.

- Make a spreadsheet of documents and passwords your family need to have if something happens to you.

- When you die, normally everything goes to your spouse. There’s no taxes payable if that happens.

- If you don’t have a spouse, estate duty is 20%, and you have to pay and executor’s fee. Sometimes, to pay this, they have to liquidate some of your assets. If you don’t want this to happen, you can look at a baby life insurance policy that pays out to your estate to cover these fees and the cost of your funeral. Think about whether you want to do that.

Insurance:

- Short-term

- Start a spreadsheet of all the insurance policies you have, including what is covered, your excesses, as well as when the policy was taken out. You can use this as a starting point every year when you renegotiate your insurance.

- Check what is covered and ensure that you have proof of ownership for specified items. Make a list of things you no longer have or can self-insure.

- Create a spreadsheet of previous claims, including dates and settlement amounts. When you lodge a claim or take out new cover, you have to disclose this as it affects your premiums. If you claim and they find out there’s something you haven’t declared, they can reject your claim on that basis. This is going to save you a lot of time in the future.

- Long-term

- Look at the terms of your dread disease and disability cover. You can decide if you want to reduce cover because your asset base can take care of you if something should happen, or increase cover if your family situation has changed.

- Make a spreadsheet of the terms of your cover in terms that you can understand. You don’t want to be wading through an insurance document if you should need this.

- See if you’re covered if you can’t work because you contracted corona.

- Make sure that you are covered for your own occupation, not own or similar.

- If you have life insurance, make sure you still need it. Be careful of hanging on to these policies just because you contributed a lot to them over the years.

- Similarly, if you don’t have life insurance but you have dependents, make sure they are covered if you pass away. Life insurance pays out directly to the beneficiaries in cash. These policies don’t form part of the estate and aren’t taxed. To know how much you need, look at what your dependents would need to survive for about a year until your estate wraps up and cover any shortfall you might have in your current circumstances.

Mike has decided to go for five regional ETFs instead of one world-wide ETF in his portfolio.

He buys Sygnia S&P 500, Sygnia FTSE100, Sygnia Eurostoxx 50, Sygnia Japan, Satrix Emerging Markets.

He’s comparing his 5 ETF strategy to the single, global ETF strategy across seven areas: Currency spread, dividends, emerging market access, regional exposure, sector exposure, rebalancing and TER.

Currency spread:

Regional Amounts other than USD are first converted to USD for the underlying index and then converted again to ZAR for the Tracking index.Do we lose twice on currency spread every time we buy, sell or receive distributions?

Dividends

Sygnia MSCI World Gross Dividend

Yield = 1.11%

Ashburton 12 Gross Dividend yield =

1.51%

JP + US + UK + EU Average Gross

Dividend Yield = 1.81%

(I didn't include Emerging Markets (Satrix automatically re-invest)

Emerging market access

Since he’s buying the EM ETF, he can control how much exposure he has.

Regional exposure

+-60% of the global index is exposed to US (which also has the highest foreign

dividend witholding tax of 30% compared to Japan/Britain 20%, Europe 26%).

Sector exposure

World: Heavily exposed to IT

Japan's no.1 exposure is to Industrials. FTSE, EUROSTOXX and Emerging Markets no 1 Exposure is Financials. Energy is also no.2 on the FTSE but is only no.7 on the MSCI World.

Rebalancing

World: Done every +-3 months. When you top up account you are topping up both the winners and the losers of all regions

Done every +-3 months though you have the opportunity to top up only the regions doing the worst

TER

Low TER of 0.35% (Satrix MSCI)

Low TER of 0.45% (Ashburton 1200)

Average TER is high at 0.63%.

It’s looking rather scary considering EU & Uk’s big drop! Portfolio is 16.83% down.

I can still contribute R27k for this year (R36k limit) so was thinking of doing +-R6k per month until limit is used up and sticking to strategy as I don’t know if it has already or when it will bottom out.

I do like the idea of Dividend paying ETFs within a TFSA. Once I have reached my lifetime limit I can still use the dividends to purchase new shares without having to sell my current shares. I’m sure better/cheaper ETFs will come out in the future. I also then won’t be forced to sell shares (and pay more fees) should I wish to take a small drawdown in retirement. I can just withdraw the dividends.

Many of us are witnessing a stock market crash for the first time. Like most of you, I’m experiencing a heady mix of excitement and terror. I’m so glad watching my portfolio no longer feels like watching paint dry. Instead, it feels like being dropped off a very high building. It’s not great, but at least it’s not boring.

Many of us are witnessing a stock market crash for the first time. Like most of you, I’m experiencing a heady mix of excitement and terror. I’m so glad watching my portfolio no longer feels like watching paint dry. Instead, it feels like being dropped off a very high building. It’s not great, but at least it’s not boring.

This week we address nothing but crash questions. Drawing on some of the concerns of The Fat Wallet Community Group, we provide some guidance to get you through this process with your net worth protected.

If you’ve been wondering what you should be doing right now, you’ve come to the right place.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Bronwyn

I know that TFSA are supposed to be long term investments but I cant wonder if it's not right at the time.

I started one with FNB 2 months ago, last year one was with Allan Grey and it did badly so wanted to test a different one plus it helped with the ebucks.

Anyway I lost close to R500 in 2 months.

My children have cash TFSA and it's growing steadily.

What do I do?

I cannot afford to lose R500 in 2 months? Can one pause it?

I know the markets are volatile but I assume they will be getting worse still.

Danielle:

What are great and safe buys while markets are cheap? I’ve been watching the prices hoping to buy low. Any suggestions?

Jacques:

Any views on buying government bonds?

Enesh:

FNB has just taken R3000 out of my share investor account. No record of it in transactions. They state this is a precaution given the volatility of the market. Is this legal? There absolutely not record of the transaction besides the email sent to me. I don’t this is kosher. Any advice?

Sizwe:

Hi everyone, seeing some opportunities for buying. Am seriously considering 75% of my emergency fund to buy more etfs. Note sure of the risk though. What are your thoughts?

Minnaar:

I would love to “buy the dip” now, but the rand weakening has me worried. Those of you who are buying now, what ETFs are you going for?

K:

I just want to enquire on the market share or stock marketing shares...

How do you buy shares of a certain public company

And where do i start?

Shaun:

I have my full TFSA allocation for the year ready to invest. Do I spend it all on ETFs now as they are on discount or does the math say rand cost average it out because the market may go lower?

Sarit:

If we buy our favorite global ETF at a dip, R42 and 16.6 ZAR/USD.

Then the ETF goes up but at the same time the ZAR usually strengthens...

Is it the opposite movement nullifying each other at exactly the same rate?

It seems that the crash always comes with a weaker ZAR, if we are buying at a dip are we really making money when markets go up but ZAR strengthen?

Runyararo

In a crisis like we have there is no well diversified portfolio because systematic risk cannot be diversified away.

The Shamases

The money still sits with us because something has now occurred to us that we hadn't considered before.

We were going to just open a brokerage account and let time do its magic. But what if we make a poor selection when putting together a basket of ETFs? If we get a retirement annuity or a managed tax free fund, that concern is removed from us. However it would come with the expense of fees, which eat into growth.

How do we select between managed and unmanaged? And how do we select a good basket?

While the rest of the world is getting in supermarket fights over toilet paper, life at Just One Lap carries on. Lesego, who is only 24, is ready to start their investment journey. This week we hold their hand through their first tax-free purchase. We explain what tax-free accounts are, what ETFs are and why we like to go for a diverse, global investment.

If the investment world is new to you, you don’t want to miss this episode. The video below is a deep-dive into tax-free investments, presented by Chuckles himself.

If you’re buying ETFs at the moment, enjoy the sale.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Lesego

I am completely clueless regarding tax free savings accounts.

I went onto the easy equities app but I have no idea which ETF so even select or how everything actually works because I would like to invest before the end of the financial year.

I listened to the podcast and they mentioned it won’t be enough having just a tax free account so I would like to open a retirement annuity fund as well but have no cooking clue how to even delete a company for that.

Jaco

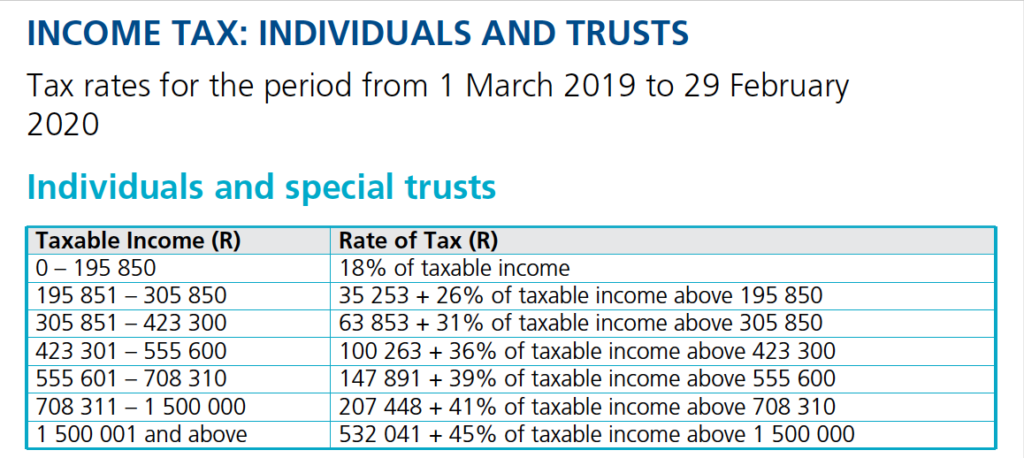

Let's assume you are 35, earning R240,000 and have R33,000 pa to contribute to a TFSA or RA.

Assuming fees and growth are the same, there’s no difference between the two, since both funds grow tax-free until withdrawal.

If you reinvest the tax saving from the RA back into the RA, the RA value will naturally be higher at the end of the term due to the additional contributions. The higher amount will give you a bigger savings pot to draw an income from.

Is the higher savings amount available at retirement offset by the income tax payable in retirement on income?

You need to look at the tax saving on the contributions and the tax payable on the income.

Tax saving on contributions:

A 35-year-old earning R240 000 pa will have a marginal tax rate of 26%. The tax saving/deduction on the R33 000 contribution is R8 580 (tax saving = contribution*marginal tax rate). The tax saving is 26%, which is equal to the marginal tax rate of 26%. So on contributions, your return on the saving of R33 000 is R8 580 (26%)

Income tax payable:

At retirement age 60, if you keep your income at R240 000, your marginal tax rate will still be 26%. But the tax you pay on your retirement income will be taxed at your effective tax rate. A marginal tax rate of 26% is equal to an effective tax rate of 13.55% (the rate at which you pay tax). The effective tax rate is lower than the marginal tax rate due to the rebates and sliding tax scales. So the "cost" on your retirement income of R240 000 is R32 512 or 13.55% (R32 512/R240000).

Based on the above, the tax saving on RA contributions is 26% or R41 580 (R33000+R8 580), and the tax payable on retirement income is 13.55% or R32 512. Because the tax saving is > the tax payable, contributing to an RA is net-net positive.

I recommend if your marginal tax rate is above the tax-free threshold, and you are happy with Regulation 28 to first contribute to an RA.

The higher your marginal tax rate, the bigger the tax-saving, the bigger the benefit of contributing to an RA. If you have liquidity problems, earning an income below the tax-free threshold or want to increase your offshore/equity exposure, the TFSA is the better option.

Joshua

What is the practical difference in taking money offshore using Interactive Brokers vs using EasyEquities USD Platform?

Do you suggest opening an offshore bank account and is this possible? The issue with the local banks offerings, for example FNB’s linked Global account, is that interest is only earned at around 0.5%.

Ollie

In episode #178 you considered the options for a listener who was planning to move to the Netherlands. One of the options canvassed was the potential of leaving money in a TFSA in the event of a market decline prior to emigration.

One element of this approach not considered, is that the overseas jurisdiction may consider the account taxable, meaning that the tax-free benefit of saving through a TFSA will be negated from the moment that the person migrates to the new jurisdiction. This varies on a country by country basis but should probably be considered by anyone before planning on leaving money in a South African investment vehicle whilst living abroad.

Innes

Since I am a little risk averse given how high developed markets are - I decided to buy some of this NFGovi ETF in my TFSA (about 25%) to give it some more diversification and less risk (and to hopefully receive a better return than cash/interest due to it being linked to bonds).

However, looking at the price graph over the last 6 months - the return has been the flattest thing I’ve ever seen. And the 5 year historical return looked so promising and consistent when I was deciding to invest! I thought that bonds (and bond ETFs) were supposed to be “more certain/safer” than equities and have a better return than cash.

Why do you think the return for the govi has been so flat of late? Do you think this would continue to be flat if SA is downgraded to junk status?

I know you referred to the Ashburton 1200 as one of your favourite ETFs - would there be a certain bond or bond etf you would recommend and why? Are bonds or bond ETFs maybe a waste of time given their low (and not so certain) returns? Maybe I should be buying bonds and not bond ETFs? What platform would you recommend using to buy bonds? (If you would recommend them at all).

Hugo

I love the innovation behind the product, one which will hopefully create a revolution in the investment domain.

I am a bit underwhelmed though with the fee structure of the product during the initial build-up phase of the portfolio.

There are current providers who can offer RAs with fees less than 1.5%, (10X and Sygnia come to mind) from the first rand invested.

Sygnia does there Skeleton 70 product for example at 0.55% all in.

Why not invest with a cheaper provider until you reach an amount where Outvest become cheaper, then make the switch?

For example:

R1 – R 818 000 at Sygnia = 0.55% / annum

R818 000 @ 0.55% = R4500 (Outvest cap)

R 818 000 to infinity at Outvest = 0.55% (decreasing to 0.2%)

We have to assume that the funds invested in are of course all the same – and I think we can argue that Reg28 investments, whether aggressive or moderate or low risk, will all more or less perform the same.

Am I missing something?

Eleanore

I would like to transfer my RA from Allan Gray to Sygnia. Both Ag & Sygnia's forms ask about a unit transfer. I'm not sure what to select. Assuming a unit transfer is possible in this case (for a transfer from AG Balanced Fund to Sygnia Skeleton Balanced 70 Fund), should I select this? Which is best, a cash or unit transfer? I don't want to make a mistake and diminish my Retirement savings at this point due to a transfer mishap.

Robin

I received an Insurance payout which I have placed in an Investec Fixed deposit, drawing a compound interest of around 7.5%.

We’ve bought two apartments off-plan in Cape Town, which will only be ready for handover towards the end of 2022. I’ve made upfront payments of 25% and 50% respectively on the apartments. These funds are sitting in the Conveyancers Trust Account drawing a 7.8% compounded interest per year. I am unable to touch this.

Would it be better to move the money that is sitting in my Investec account into one ETF or a group of ETFs for three years. Or should I hold these funds where they are at the moment?

My feeling was to keep it in a secure environment so I will be in a position to pay off the properties completely, and then draw rental income.

However, the income derived from the Investec investment will be taxable, which will be lumped together with my other SA rental based income. Together the total income will be around R320K for the year.

Should I put the R320K into my RA? When the time comes to settle the payment on the apartments at the end of 2022 I’ll draw from my Unit Trust Investment to settle the difference, or repatriate funds from my overseas investment. If I keep it in the Investec fixed deposit I will end up paying around R63,853.00 in tax.

One of your listeners from China (Podcast #169) was inquiring about where he can invest using Euros or USD. As an expat I use Internaxx - based in Luxembourg - https://en.internaxx.com where I buy my international ETFs and stocks. I trust this will help your listener (sorry I don't recall his name I was listening while walking).

Steven noticed we prefer ETFs to unit trusts and wants to know why.

Eugene is keen on opening a TFSA for his spouse. He’s not keen on using EE, so he wants to know who else we can recommend.

We’re not prone to panic, but at this point staying calm requires a level of stoicism we haven’t quite mastered. You may have forgotten this in the diseased fog of the Coronavirus, but a mere two months ago it seemed as though the US was going to war with Iran.

Part of what makes it so hard to keep calm is that the rest of the world is in a flat panic. When even the Federal Reserve starts behaving erratically, you may be forgiven for wanting to turn your ETFs into Kruger Rands*.

In this week’s episode, Simon and I discuss some of the fallouts we’re seeing in world markets and in our portfolios. We try to understand some of the more alarming news headlines, explain why the US rate cut is by no means a good sign and talk through some of what we can expect as local investors.

If you take one thing from this episode, I hope it’s this: wash your hands!

*Don’t do that.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Ursula

Transferring my Liberty RA to Sygnia, I stumbled across the 'Sygnia Life Berkshire Hathaway Fund' on their website. What are your thoughts on this product? It is touted as a 'linked Life Endowment Policy' that invests 100% in BRK shares. While not being targeted at 'major offshore players who are already set up to trade independently and can easily buy BRK’s Class A or B shares. Rather, the SLBF has been designed to offer a hassle-free option to invest offshore with Buffett without the complexity'. I phoned Sygnia in the hopes of getting some more information with regards to the TIC etc. but was informed that because the fund is so new, this information is not yet available.

I am at the point where I would like to start investing in addition to the funds currently directed my TFSA and my RA and was curious about this. Why would one opt for an investment like this as opposed to directly investing in Berkshire Hathaway and what benefits, if any, does a Life Endowment have?

Barry

I was sent a video that basically states that the US is bankrupt and has two options.

- The US government stops influencing the market and allows the business model to play out, the effect of which they compared to a 1930’s type depression. Take the pain in one big hit.

- The US government allows massive inflation, bypasses the banking system (which provides loans), and provides an MMT style (I had to google that) of providing “helicopter” money to consumers and maintaining debt demand, resulting in rising inflation or hyperinflation as more money chases limited goods and services.

It certainly seems logical that this could happen from a layman’s perspective. If you spend more than you earn for long enough, you end up in a world of trouble.

Is this just some more scaremongering or possibly some realism in there?

Secondly, if either of the above scenarios were to play out and one was invested in a ‘buy-for-life’ Total World ETF like the Vanguard VWRD or even the Ashburton 1200 or MSCI World, what would the effect of either of these scenarios playing out be on the ETF?

Currently the US market cap is weighted at about 55% of the ETF, if the this scenario were to play out and the US market-cap dropped as they rebalanced, would the ETF over a period of time rebalance accordingly too, chuck out the US holdings and increase those from other geographical regions as the non-US regions capitalized on the market-cap that the US had lost? So, a (relatively, a few years) short-term drop-in ETF unit price followed by a gradual recovery again? Similar to how Steinhoff is/ has been worked out of the Top 40 by the ETF?

What would the effect be on the value of the USD?

Javid

I have recently come across your gem of a podcast and have been trawling through as many of your previous podcasts as possible.

My question is:

- With tensions amongst the US and Iran at an all time high it seems imminent that it may escalate into another protracted war that could even turn nuclear. With this in mind what preparations should South African investors embark on to protect/rebalance our financial assets in the interim as this plays out. Some of my thoughts:

- If you’re holding onto ZAR cash should this be rather converted to USD or Gold which could be seen as a safe haven (bearing in mind the US could enter hyperinflation as they print more USD to fund another war).

- I suspect Oil in the region would surge, holding an oil index in the interim?

- Are there any stocks to consider - perhaps in the defence industry?

- I guess one could also have a list of fundamentally sound stocks on a watchlist and purchase them when they are a deep discount?

Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

Boy, did AJ open a can of worms this week! We fall down a preservation fund rabbit hole that’s perhaps long overdue. Here are some of the key things you should know.

When you leave a company’s pension or provident fund because you leave the company, you have three options when transferring those funds:

- You can move it to your new company’s pension or provident fund.

- You can buy a retirement annuity (RA) in your private capacity.

- You can put that money into a pension preservation or provident preservation fund.

Both pension and provident funds are Regulation 28-compliant products offered by employers. They differ in one important way: with a provident fund, you can withdraw the full amount in cash at retirement. If you hold a pension fund at retirement, you can only withdraw one-third in cash. The rest has to be reinvested in a living or life annuity.

A pension preservation or provident preservation fund is designed to hold on to the money you saved when you were employed with your company. It’s also a Regulation 28-compliant product, but once you move your retirement money into a preservation fund, you can no longer contribute to that fund.

If you have a pension preservation fund and your new company has a pension fund, you can move that preservation fund to your new company’s pension fund. If you have a provident preservation fund and your new company has a provident fund, you can move your preservation fund to your new company.

All this complicated moving around of money makes one wonder why you wouldn’t just transfer your money into a retirement annuity (RA), right?

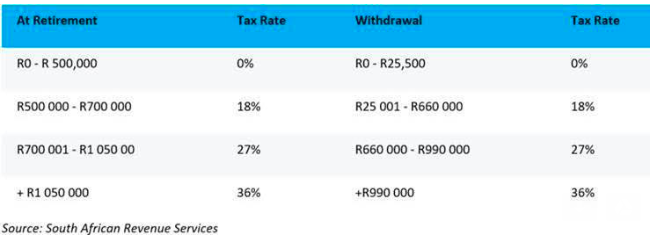

It turns out, by law you can make one full or partial withdrawal from your preservation fund before retirement. The first R25,000 is tax-free. After that you are taxed according to the table below.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

At this point you might be wondering why AJ is under the impression that his first R500,000 would be tax-free when he is retrenched.

In this idea he is right and wrong. If he got a new job, contributed to his new employer’s pension or provident fund and got retrenched, he would be able to retire out of the new fund upon retrenchment using the R500,000 tax-free withdrawal he would have received upon retirement.

He can only withdraw from the fund to which he was contributing with his new employer, so if he didn’t transfer his preservation fund to his new employer, he’d be taxed on that withdrawal. The other snag is that it affects the tax-free amount he can take upon retirement. If he withdrew R100,000 tax-free upon retrenchment, he’d only have R400,000 tax-free money left when he retired.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Alexis

When you financially emigrate SARS makes you pay CGT on all your investments worldwide as if you had sold them on that day. Ok, fine, but I haven't actually sold them, and one day, when living in my new country I will want to sell them.

But then the new country is going to want tax on the profits, presumably calculated from the actual base cost. I'm not sure how to avoid paying tax twice in this situation. Unless I actually sell the investment when financially emigrating, and buy it again at a new base cost after this process is done, which seems like a waste because of fees, spread and spending some time out of the market.

We asked our Head Elf De Wet about this. He has good news.

Typically the country to which you are emigrating has legislation (if their tax system is advanced enough as is the case with South Africa) that will deem the base cost in the new country to be the re-acquired base cost (not the original) and it should therefore not result in double taxation. It can in very few circumstances result in double taxation, but the chances are very slim.

AJ

After I resigned from my previous employer, I moved my Provident Fund money to a Sygnia Preservation Fund.

I chose this option to follow the ‘’Tax rules’’. I no longer save additional money, as I have moved abroad. I’ve gone quite aggressive with my allocation on Sygnia (Top40, Property, Offshore, Rhodium & Palladium and no cash, no bonds) minimum fees 0.62%.

On my return to SA and if I find employment where there is an umbrella fund available, I can transfer my preservation fund to their Fund. This means I start at my new company with a lump sum available from day one.

I’m not a big RA, regulation 28 type of guy. My main benefit would be if I am retrenched and my retirement value is close to R500,000 at retrenchment I could benefit and effectively take this tax free.

Secondly, I could take this money with a huge tax implication if I am in some sort of emergency where I need cash all before the age of 55.

I am putting myself in the position that at worst case, if a retrenchment happens I at least benefit in some way. The maximum benefit would be around R500,000 in retirement money.

This tax free withdrawal can only be done once per person. If you have used your R25,000 tax-free portion, the max benefit you would be able to take is R500,000 less R25,000 (R475,000).

Francois

I am 28 and recently started to take control of my financial life.

So far:

- I started a budget via 22Seven

- Paid off my car loan

- Maxed my TFSA (100% Satrix global MSCI- Single ETF lowest cost- great article by Stealthy Wealthy comparing global ETF's. Single ETF strategy for the win)

- In the process of moving my RA from "Unnamed Life insurance company" (My EAC was 6.61%) to Sygnia skeleton balanced 70 fund

I am currently stuck.

I am looking to increase my global portfolio.

I currently earn in USD and receive this money in a USD call account. Would it be better investing in USD directly in an ETF (example Vanguard S&P 500) or use ZAR to invest in a global ETF (example Satrix MSCI global/Ashburton 1200)?

I will only be earning USD for the next two years and will then have to convert rand to USD to continue my dollar cost averaging amount monthly if I have a USD-based account. What is the benefit of having a USD account vs investing in Rands via a global ETFs.

Yakoob

Can a South African citizen buy shares in Aramco? It’s a Saudi Arabian oil company that listed in November on their local stock exchange.

Mbasa

When buying property the bank will show how much interest you would pay over 20 or 30 year home loan period.

When you rent the property out the deficit will be reduced and eventually become a surplus that can be used to quickly pay off the loan.

Example:

A R 850k mortgage will amount to R 2 000 000 in total instalments over 20 years

(R8369 * 240 months).

Baring in mind that this is paid for by the bank and the tenant. Is it advisable to then save (ETF, shares, unit trust ) to reach that R 2m goal or borrow from the bank and rent out.

I did a quick calc and about R2.5k per month at 10% pa over 20 years reaches the R 2m goal.

Sam

I am 34, I have a 9 month old daughter and would like to save for her education.

Time horizon is 13-14 years. We hope to cover primary school from salaries or a separate investment.

I don't want to do a TFSA in her name as we will withdraw it all and then "rob" her of some or all of her Tax Free lifetime allocation.

Would TFSAs split between my wife and I be a good idea considering we would draw down on a large chunk of our lifetime allocation long before retirement?

If not then what would you suggest?

(Regardless of the vehicle, ETFs will likely be the underlying investment, thanks to you guys)

Boitumelo

In 2019 I tightened my budget a bit, moved my Pension Preservation to a low-cost provider and fully funded my emergency fund for 6-8 months. Because of my work in Botswana I do not pay tax and can thus not get the tax benefit from the RA. I am now channelling those contributions and excess into my discretionary investments after maxing the TFSA.

I receive my salary in USD into a dollar account in Botswana.

I transfer some cash for basic living expenses here and some to my expenses in SA (i.e. bond, donations, investments etc..).

I then leave some USD inside this account at 0% interest. Should I perhaps build up some USD in my account here transfer every few thousand dollars to a USD Account to buy some Vanguard US Total Stock? Would that be a good idea and better use of the USDs instead of keeping it in this normal cheque account?

In my TFSA I buy the Satrix World and the CS Prop. In my discretionary account, I buy the Ashburton 1200 and The Satrix Top 40. Given that I am already buying the 'World' in both accounts, will buying the US Total Stock in USD mean I will be too US concentrated and therefore at risk? I am just looking for better value and better use of the USDs while I am able to.

Lusani

In 2014 I bought a house, paid extra monthly and when I was left with 13% to go I opted for a second property as an investment. The worst move I made was applying for a re-advance on my residential bond and then paying for the rental property cash. The whole transaction incurred transfer and bond registration fees.

Things were looking rosey until tax time. My tax consultant told me I could not deduct the bond interest since the property address on the bond statement does not correspond with the address of the rented apartment.

I missed out on that deduction and as a result my income is higher. My worry is that when we get our annual increase (6%) in April, this rental income will to push me to the next bracket.

I have decided to register a bond on the investment property. Based on my calculations, I will not pay any tax from the rent for at least 3-4 years. I will be deducting a whole chunk of interest, levies and rates, still taking in consideration the yearly increase of at least 5%. I want to retain my tenant and not scare them away with 10%.

Must the bond be on that property? Some people say it is possible to deduct the bond interest even if property B is not bonded, but as long as you can prove where the money comes from.

If I use this money towards buying stocks on EE, I will still pay tax. Registering my bond now seems dumb or was it a clever move?

I only joined recently. Must I move it elsewhere, or cancel it? The thought of paying those fees kills me. Until my RA issues fees issues are sorted out I will not increase my contribution to the allowable 27.5% using this money.

Tafadzwa

What are the risks of trading in ETFs in an illiquid market to a retail investor?

Also, how can one use small and mid cap ETFs to enhance returns?

This time of year is like Christmas for money nerds (or maybe it’s just me). Everyone’s tax situation is unique and there are so many variables to tweak. It’s truly magical.

This time of year is like Christmas for money nerds (or maybe it’s just me). Everyone’s tax situation is unique and there are so many variables to tweak. It’s truly magical.

In this episode, we take you through some tax basics. We explain why the end of the tax year is significant, even if you don’t file a provisional return. We help you work out why tax-free savings are so important and discuss some of the similarities between tax-free investment products and retirement products like annuities and pension funds.

If you don’t find tax exciting yet, it’s only because you don’t know enough about it. Let us change your mind in this episode.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Janesh

In 2016 I moved to CPT and started renting. I was busy with my Masters and working at the same time. I went from a fairly decent Department of Health salary through 2017 with poor cash flow. I still managed to get by, even after getting married in the year.

In 2018 - cash flow improved and I could start thinking of buying a house, which we did in April 2019.

I started a new medical practice in July 2019, so cash flow came to a screeching halt and my emergency fund dried up due to the purchase of the house.

I'm also sitting with a hefty tax liability as the people previously doing my tax hashed it a little bit.

I was just listening to the episode on financial planning. My plan is to pay off some of my debt and at the same time build an emergency fund again.

I think i just need somebody to say, it’s okay - these situations are part of starting your own business.

Pascal

Since I asked my question referencing TD Ameritrade there has been an escalating fee war between major US brokerages. Most of them now offer no account minimums, no maintenance fees and zero commissions. What a time to be alive!

Why wouldn't you want to invest directly through a US brokerage that allows it, now that they're so damn cheap? I'm still new to this game. Is there something I'm missing? Obviously foreign exchange fees and international wire transfer fees are unavoidable.

I want to support local companies as much as possible, but when it comes to offshore investing, how can you say no to zero commissions?

TD Ameritrade seems to be the only one that welcomes South African investors. They even provide a digital "Ben10" form on your profile to reduce your dividend withholding tax through the platform without using a third party company (Interactive Brokers does this too).

The funny thing is, I personally can't even use them, because my Standard Bank offshore account happens to be in the UK channel islands which is on TD's list of restricted countries. Something you can only learn by going through the process of opening an account and trying to fund it. What fun. I now invest my USDs with Interactive Brokers. It's not free, but still cheap! Thanks Patrick!

If it interests you at all, after MONTHS of intense reading and research, I've settled on this simple equity-only offshore portfolio:

- 80% VTI - Vanguard total US Stock Market

- 20% VXUS - Vanguard Total World Excluding US

Together these 2 ETFs make up your well-mentioned VT - Vanguard Total World, but I've weighted more towards the US Market for now for a number of reasons, most importantly because it's the economy I'm most comfortable with, and not least of which, in your own words: If the US is fucked, then we're all fucked :)

Vivesh

I opened a TFSA with Standard Bank this month. I bought a third each of PREFTRAX, NEWFTRACI and NEWFNGOVI after watching Simon’s webinar on TFSA on OST platform.

I understood that the distributions are reinvested in the TRACI and GOVI. The TRACI price chart goes up annually by 7.1% due the reinvestments, but I don’t see this with the GOVI.

I thought maybe the quantity of the GOVI ETF held would be adjusted upwards but that did not happen at last distribution.

I can see the money received and reinvested in my cash balance history. How and when do you actually realize the growth/yield from this bond ETF if there is no capital gain from price appreciation due to distributions. The GOVI MDD puts the yield at about 8.65% ish, higher than TRACI.

Secondly, the PREFTRAX for example pays out quarterly dividends which could be used to supplement income, but how would one use the TRACI/GOVI for income purposes? Do you keep investing in TFSA to R500K limit and then when you need the income you sell the ETFs that reinvest distributions and go to cash or ETF that pays distributions?

Guillym

I stopped investing when I lost my life savings in 2012, when I was 25.

I had close to R200k in my current account. I knew I should do something with it, so invested it all into a single scheme, and lost every cent. Simon may remember when the owner of RVAF Trust Shares shot his partner and then himself.

As you can imagine I was rather jaded after that, even though I was mainly burnt due to being an idiot. So I started on properties.

Actually, first for about three months I spent every cent I earned and partied like a rock star. I was used to saving two thirds of what I earned. All of a sudden I could afford to go to the pub/club every night.

After that I saved for a while and bought my first flat in Cape Town in Jan of 2014. Now I own three flats (the bank owns like one and a half) in Cape Town.

Since finding your podcast, I have started diversifying away from property. I put some money into a trading account and then took it out to see that it wasn't gone.

Have like 6k in there now, all over the place. Will probably move R33k in before the end of the financial year for TFSA. I hear all the merits you guys mention on investments over properties, and have done a lot of the math. I am not sure how much better off we would be if I hadn't gone the property route, but I understand it is now time for ETFs and the like.

Marius

My parents just sold a property to finance a badly planned retirement.

They have R1.4 million to invest and can take care of their monthly expenses, but they cannot do anything more. What would you recommend?

Candice

When you speak of being over-diversified, what difference does it make if I put R10 into the Ash1200 or R5 into the Ash1200 and R5 into the Satrix MsCi World?

I know they are very similar but one will outperform the other one day and is it not better to dabble a little in both?

Conventional wisdom has it that a budget is at the heart of any successful financial strategy. My wisdom has it that a budget is an excellent tool for self-deception. Nobody was better than drawing up a theoretical map of how money should be spent than me not spending money that way.

Conventional wisdom has it that a budget is at the heart of any successful financial strategy. My wisdom has it that a budget is an excellent tool for self-deception. Nobody was better than drawing up a theoretical map of how money should be spent than me not spending money that way.

In this episode we discuss where budgets fall short. We each share our own approaches to budgeting and offer some more useful alternatives.

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Ken from the Fat Wallet Community Group on Facebook.

I've looked for a post on STXWDM + STXEMG vs ASHGEQ in various places, including this group but I can't find one.

In episode #85 ASHGEQ was voted by Kristia and Simon as the one ETF to rule them all.

Stealthy Wealth voted for STXWDM as the one ETF to rule the world.

The argument for ASHGEQ is more diversification + emerging market exposure.

The argument for STXWDM is lower fees.

DOES STXWDM + STXEMG GIVE THE BEST OF BOTH?

The argument against STXEMG could be too much Tencent exposure. In episode #72 Simon did some math and determined that there was less Tencent than in a JSE top40 index, so that seems ok.

Does it cost more to hold two EFFs than it does one?

STXWDM has a TER of 0.35%

STXEMG has a TER of 0.40%

For the sake of simplicity, I'll assume they both have a TER of 0.4% and R100 is bought in a 50/50 ratio.

Holding only one ETF = 0.4% of R100 = R0.40

Holding two ETFs = (0.4% of R50) + (0.4% of R50) = R0.40 i.e. same same but different.

ASHGEQ has a TER of 0.6%

Does this mean that the combined cost of STXWDM + STXEMG is less than ASHGEQ?

I presume there would be the cost of an additional trade? Two trades vs one. I don't know what that cost would be.

Using EasyEquitites to purchase the ETFs, would buying both still work out cheaper than ASHGEQ after considering both transaction costs and TER?

Assuming that the cost does in fact make it cheaper to buy STXWDM + STXEMG over ASHGEQ, and assuming those are the only two ETFs one buys, I'm interested to hear in what proportion you guys would suggest buying them, assuming a time horizon of 20+ years?

In Stealthy's article he says, "I estimate the Emerging Market component of the Ashburton 1200 to be 3.5%, but let’s be generous and call it 5%."

Following that, one might buy 95% STXWDM + 5% STXEMG to emulate to the 'one ETF to rule them all'.

But just because that's the ratio of the ASHGEQ, doesn't necessarily make it the best ratio, and so I'm interested to hear what ratio others would suggest?

Mariette

I've had one for a few years now, and there are the stupid things that they do for me which I can live without. They do help a lot with emails getting lost in the big ship. There have been a few times where I've requested cession documents, interest rate adjustments, etc. where it would take very long to sort out, and if I put my private banker on the matter, it's sorted within a day. I'm busy moving my tax free shares account over to EasyEquities, and I'm battling, this is where he will come in very handy.

I'm soon not going to have one anymore, I'm downgrading my account to save on fees. Slightly ironic that I need this paid service when I want to invest better.

Mariana

What salary is referred to when people talk about % of salary going to savings. Is it:

- Cost to company, which Includes employer’s contribution to: Pension/Provident fund (to which her employer contributes 10%) and 60% of medical aid, UIF

- Gross salary (Cash salary excl employer’s contributions as above)

- Take-home salary (Deductions: Tax, pension fund contribution (7% of cash salary) , 40% of medical aid, UIF, Group Insurance)

When they ask about “after tax salary”, is that cash salary minus tax but still including my other deductions like PF and Medical aid?

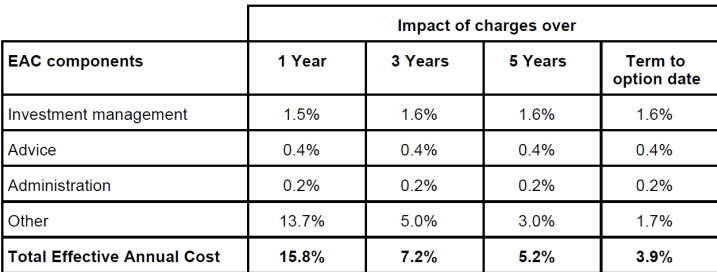

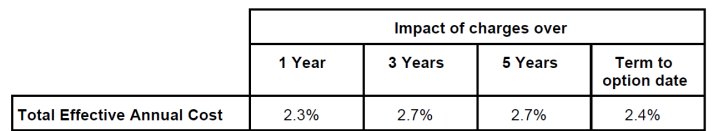

They (her pension fund provider) have a normal one indicating what my annual costs would be if I continue with the policy. Then they say I should use an alternative table if I’m considering moving the RA to compare with the new provider’s costs.

Are they trying to make themselves look better (still horribly expensive) or why would the second table apply?

At the moment I compare the current fund value plus the ongoing fees (table 1) against the termination value (> R50000 penalty) and the new provider’s fees for the remainder of the term 8-11 years( 55-58 age), am I missing some point with this 2nd table?

Column two:

EAC if you are considering replacing your investment

The table below shows the EAC calculation assuming that you terminate your existing investment immediately. The EAC table of the alternative product needs to be compared with

the information below in order to determine whether or not the replacement may be in your best interest from an impact of charges comparison perspective.

Minnaar

With the upcoming elections in the US, there is lots of talk of certain technology companies having to be split up (either by congress or public pressure) (these include Amazon, Facebook etc). What happens to these companies that are major constituents in an ETF?

If Amazon (which is now around 9% of the NASDAQ 100) decides to spin off Amazon Web Services into a different company, what happens to something like the Satrix NASDAQ 100 ETF? Do those new shares simply land up in the constituents immediately, or will it only benefit at the next rebalancing date?

Essentially - do ETFs actually benefit from these occurrences?

Javier

An important advantage for new investors in using ETFsa would be the advisory service combined with the no fee on moving products to different providers in the future. It allows new investors to grow and get advice and if in the future with what they have learned they think their money is better off in a different RA product or TFSA then they can move it at no cost. I think this would help avoiding many rookie mistakes. Plus at the beginning the fees of a smallish portfolio will not have a huge effect in the future.

And the one thing that made me the happiest is that they will manage the transfer of existing products my wife had in Old mutual, so we will not have to do any admin! just for that it’s worth it!

Chris

The 1nvest product tracks the the MSCI World Index. It has a total investment charge of 0.5%, with a total expense ratio of 0.4%. It’s almost identical to the Satrix product, except it pays dividends, while the Satrix MSCI product is a total return ETF.

Where can I see where, when and how much my dividends in Asburton will be?

Olyn

I’ve resigned. I am not sure if I should split my fund into 50/50 between RA and preserve preservation fund. I am 43 and starting a new job in Feb. Which preservation fund and pension is better?

Louwrens

I only discovered your show about a month ago and have been binge listening ever since. I am a scientist with the government. I don’t know if you collect scientists in bottles as well, or is it only engineers? I have a great pension plan and 100% of my expenses will be covered once I retire. My other investments are just bubbles money!

Currently 85% of my discretionary investments are in a RA with shitty returns due to me paying for Old Mutual’s Christmas party every year. I am in the process of fixing this. The other 15% is in the MSCI World ETF.

I created a spreadsheet with sector distribution for each and then calculated the total % for each.

I want to have at least 15% in Technology,10% in industrials and 15% real estate. This is personal preference only and not based on anything.

To do this I have calculated that I need to invest the following

31.5% in an Industrial fund (like Sygnia ITRIX 4th industrial revolution global fund)

8.5% in REIT

This will leave me with the following: MSCI World 8.7%

RA 51.1%

Industrial fund 31.5%

REIT 8.7%

What do you think about this kind of approach? does it make sense, or am I going to over expose myself?

“Return” is one of those words that Finances Bros simply love to throw around. Good luck trying to have a conversation about investments without hearing all about it. This week, we discuss why return is something you can basically forget about, if your Finance Bro will let you.

“Return” is one of those words that Finances Bros simply love to throw around. Good luck trying to have a conversation about investments without hearing all about it. This week, we discuss why return is something you can basically forget about, if your Finance Bro will let you.

We explain what the word “return” could mean, depending on the circumstances. We help you figure out how to know whether a return is good or bad. This is important, because a positive return can be a bad return. It’s one of those, “how long is a piece of string” things that we so love. As always, you can rely on inflation to just ruin things for everybody. We also explain how you can work out the return on your own portfolio.

Win of the week: Boitumelo. Jorge has some feedback for her.

Our Church recommends that we keep an “Admin File”. In this file we keep a copy of all the different accounts, investments, bank statements, credit card statements, Last will and testament, RAs, car papers, water & rates, telephone, funeral policies, copy of ID’s, passports, pay slips etc. for both spouses. We then advise the family members where we keep this file.

In the event of death, the person handling the estate will have a copy of everything they need to finalise the estate.

When an account closes or and investment pays out., the item is removed and replaced with the new one.

We don’t file the documents on a monthly basis as this would defeat the object of the admin file which is purely for information purposes.

It is a very traumatic time for the surviving spouse in the event of a death and this enables the person helping the family on this sad occasion, from the info in the admin file, to contact all those institutions to get things going without having to bother the surviving spouse.

Gerhard

You guys understand investments and are quick to point out how we get ripped off. You sadly don’t have the same understanding in medical aid. I wonder if a lot of the same thinking can’t be applied, since there’s lots of complexity, lots of fear, lots of fees.

Why in the world is it so complex that one can’t understand and compare the different options.

I have a family of 5 (well 4 + me) and I’m currently on a hospital plan at Bestmed for R4059 per month. It’s the best and cheapest medical aid I can get my hands on - probably increasing again in Jan.

I can get medical insurance for hospital-related stuff from Affinity for around R2,500 per month - much more palatable. However there are annual limits.

The thing is, I don't know what this means. I don't know what amount of insurance you need to feel kind of covered. Also it seems in the States you get options with an excess payment that bring down your premiums, is there something like that in SA?

It feels to me that if one had some clear insight you could potentially make better decisions.

Maryn

I've been recently diagnosed with a chronic illness. I am paying an unforeseen R4000 to R8000 per month for medical bills (a third of my salary). I have a Classic Saver with Discovery (I get a discount for Discovery through my job) of which the day-to-day savings have been exhausted soon after the diagnosis.

I need your expert opinion (or just some cutting through the medical aid bullshit). Do I continue to carry my expensive medical bills month-to-month? Is it maybe worth it to register as a PMB patient, and upgrade my plan with Discovery? Do I look for a different medical scheme? Do I invest my monthly R4000 and run fast (real fast) away from the doctor after each appointment?

I'm 24 and still have a long time for my investments to grow through the magic that is compound interest. I'm very proud that I still manage to invest my monthly R2750 into my tax-free (thanks again fat wallet), despite the increased medical burden.

Do you perhaps have someone in mind? I'll pay a once-off consultation fee, but no monthly fees on top of fees (learned this trick from fat wallet ;) ). Please, can you share your wisdom?

Life has this dreadful habit of happening. Almost always these goings on require money to solve. The financial foundation we advocate is designed to help you cope with financial crises when they happen. When you have no debt, sufficient short-term insurance, an emergency fund, medical aid and dread and disability cover, you have some tools in your time of need.

Life has this dreadful habit of happening. Almost always these goings on require money to solve. The financial foundation we advocate is designed to help you cope with financial crises when they happen. When you have no debt, sufficient short-term insurance, an emergency fund, medical aid and dread and disability cover, you have some tools in your time of need.

Unfortunately life doesn’t sit around waiting for us to have our ducks in a row before causing drama. Sometimes you have to do the best with what you’ve got. In this episode we offer some ideas about what to do when life happens before you’re ready to cope with it. We talk about dealing with emergencies when you have debt and no emergency fund.

We have no elegant solutions, but hopefully a few of the strategies can help you navigate a tricky time with grace.

Good luck!

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Keith

According to the national credit act (NCA), debt should be repayable at any moment by a borrower without any penalties. If a loan at the outset has a, say, 16% interest rate over its life, then the lender is not allowed to capitalize the entire life of interest over the life of loan so that early repayment penalizes you.

As far as I can tell, that is illegal.

NCA gives the borrower the power to ask for the full and final settlement account at any moment. Hence, if you are 2 years into a 10 year loan, they cannot go and add 8 years of interest into the loan’s capital amount. This would, surely, be illegal.

Gregg

I was listening to a program on TV where the panelist said we need to be aware when buying equities through Easy Equities, they are on the balance sheet of the brokerage. If the brokerage goes under, you are not guaranteed of getting all your funds back.

Can you explain what this means? Perhaps explain using an example. If I buy Satrix 40 ETF – does it mean if I sell them that EasyEquities may not give me my money and that I have no direct claim from Satrix itself because the ETFs I bought are lying on EasyEquities balance sheet?

This sounds like a risk. Is it one worth being nervous about? I would assume that as an Easy Equities user yourself, you’ve done your homework?

I am considering buying through them directly onto the US Market, which is one of their offerings. I want to make sure that I can quite comfortably do this at almost zero risk.

Dario

Could you guys please talk about how EasyEquities functions as a platform i.e how they are able to provide fractional shares and are there any other good alternatives?

I am asking this because I bought some STXNDQ without looking at the buying price. before logging off I decided to have a look and quickly cancelled the order as there was a 9% difference between the delayed price and buying price.

Mariette

My parents are 78 and 72 years old. My dad gets R14,500 pm from pension, so a lot of the extras fall on myself and one of my 4 sisters.

I took out life cover on my dad's life (after not such great advice from a 'financial advisor') which costs me a pretty penny every month. The idea is that if something should happen to him, my mom can use that amount (R500k) to offset the 50% loss in income from my dad's pension fund.

My dad had all his investments with Old Mutual and after all those years had a measly 2% growth.

He immediately took that money (about R450k) and put it in a 7-day notice account with FNB (6.3% repo related interest). He is dependent on the interest from that investment to cover expenses that are not covered by his pension. He doesn’t want to take any risks, especially with big institutions.

My mom has a buy-to-let property she bought with some inheritance money and try to save R1000 pm from the income. This can be done in a TFSA, but not sure if it will make such a big difference at their age.

What would you suggest they do to stretch their savings a bit?

My first suggestion was to move from FNB to Capitec, take R370k and put it in a fixed deposit (8.55% interest) and the rest as an emergency fund with Thyme Bank (10% interest).

Also to try and reinvest as much as he can and not make use of the full R1000 extra from the increased interest rate. I'm not sure if my dad will go for an income-generating ETF, it's too unknown and too big a risk for him.

Paul

Here’s a list of his spreadsheets: The spreadsheets list my investments; their TER; their individual holdings (i.e. Naspers, BHP, Apple, etc.); how much (%) each investment is of my total value; to tracking what they have been doing on a monthly basis; my monthly expenses; SA inflation, my monthly savings (+-40%); retirement target and how far I am away from it; the amounts from every formal salary slip I have ever received (I can tell how much money I have made over my 14 year working career and my subsequent retirement contributions); to a breakdown of individual index funds for comparison purposes; to the monthly updating Rule of 300; as well as all the graphs in between.

My company retirement fund (which I contribute 27.5% to each year) has increased by about 18% this year, which is great, after the bloodbath of last year.

Should I get an RA or just leave my money in investments?

My understanding is that an RA is just tax delayed, but with having investments at least you have an accurate representation of what you should get out of your investments as the tax is taken constantly. An additional benefit (or negative depending on how you look at it) to the RA is that the money cannot be touched by anyone until it matures. What is your opinion?

Stephen

I had a legacy Sanlam RA which, after listening to your podcast, I started investigating the charges. To cut a long story short I decided to take the penalty and move it to 10X.

The problem I have with 10X though is the lack of visibility into what sectors they are investing. I think this is important to know so that you don't over-invest in certain sectors in your TFSA and Taxed portfolios.

I then moved the RA from 10X to Easy Equities.

My reasons were:

- Strategy visibility

- Everything under a single solution

Hopefully future functionality to build my own Reg 28 compliant portfolio.

However, my question is why do these products all tend to overlap equities?

Personally I'd prefer purely Satrix 40 for local instead of the overlap in the different sectors.

For international I'd prefer Satrix World with an element of Satrix Emerging to capture the entire market.

My EE RA is a small portion of my retirement as my main funds are within my work fund (Sanlam) and I'm maxing that out at 27.5% (any contributions above the standard 15% does not incur costs). I'm more prone to go aggressive on my RA and also simplify the approach.

I'd prefer to stick with EE and have a custom Reg 28 RA based on Satrix products without penalties for not using Sygnia products. I'm hoping they release the functionality in the near future.

Do you have any connections at EE to find out if this is on their roadmap and by when?

Eric

I have a TFSA that I max out yearly. The only ETF that I have is the Sygnia S&P500. Although I've had some great growth over the last 2 years, I'm concerned that due to the market being at record highs, growth may start to stall & taper off in 2020.

To counter this, would it be a good idea to keep the initial S&P500 investment and start investing any new money into something like the Ashburton 1200? Maybe contribute toward a 50-50 split between the funds or contribute until a 50-50 split is reached? I'm very aware that there may be duplication of the same companies / regions if I choose these funds so is there maybe another fund to counter the exposure to the US market?

The financial world is filled with dreadful products. Avoiding them all is a tempting strategy, but not feasible for most people. In our first full episode of the year, Simon and I dedicate some time to help you spot a bad product.

The financial world is filled with dreadful products. Avoiding them all is a tempting strategy, but not feasible for most people. In our first full episode of the year, Simon and I dedicate some time to help you spot a bad product.

Below is a checklist of red flags you should watch out for before investing in these products/

Debt

- Interest

- Balloon payments

- Revolving loans

- Fees

Savings

- TFSA in cash

- Disclosure - 13% compound vs simple

- Fees

- Products that are tied to other products

Insurance and medical aid

- Requirements

- Complexity

Investments

- Promises of above-market reruns

- Non-diversified/concentration risk

- Fees

- Lock-ins

- Is it tied to an insurance product

- Derivative products

- Subscribe to our RSS feed here.

- Subscribe or rate us in iTunes.

Win of the week: Tafadzwa

I stay in Namibia. Last month I discovered your show. I’ve been teaching myself FI by reading various blogs for 3 to 4 years. I recently turned 41 and your podcast was just the kick up the behind I needed to DO something about my finances.

I am restructuring my life from top to bottom (or vice versa). I reduced my bank charges from 450 to 213 just because I went and raised hell. Guess what, there was a bundled package which suited me to a t. Thanks guys for the proverbial butt kick.

I am working on reducing my debt. Bye-bye to my clothing account in 5 months. Good riddance.

My car loan is much more difficult. The prime rate was reduced from 10.75% +1 to 10.25%+1 in April this year. My installment was not reduced appropriately as was implied in the contract with the bank. I have 18 months left to clear the loan. Is the debt set in stone or can it be reduced through setting early? I need a hack please.